Creating the Media and Entertainment Industry’s Most Comprehensive Global Localization Services Company LOS ANGELES, Jan. 22, 2021 — Iyuno Media Group, a market leader in localization services to the media and entertainment industry, announced today that it has entered into an agreement with Imagica…

Ribbon Selects Switch Connect as its First Universal Partner in Australia New Zealand

WESTFORD, Mass., Jan. 8, 2021 — Ribbon Communications Inc. (Nasdaq: RBBN), a global provider of real time communications software and network solutions to service providers, enterprises, and critical infrastructure sectors, today announced that it has appointed Switch Connect, one of Australia’s premier IP-centric…

BC Technology Group Enters Into Agreement to Raise HKD697 Million in Share Placement, with Morgan Stanley Appointed as Sole Placing Agent

HONG KONG, Jan. 6, 2021 — BC Technology Group (stock code: 863 HK), Asia’s leading public technology and digital asset company, is pleased to announce that it has entered into an agreement to raise HKD697 million (approximately USD90 million) in a top-up share placement,…

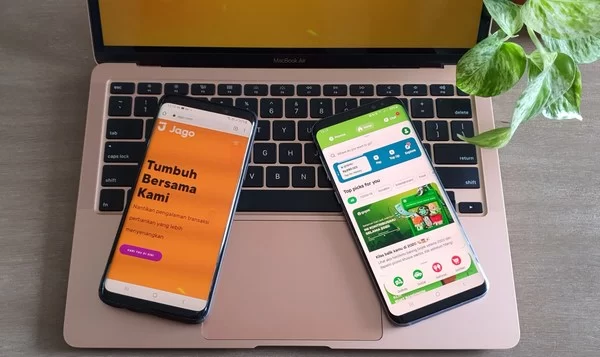

Gojek invests in Bank Jago to accelerate financial inclusion in Indonesia

Investment made through Gojek’s payments and financial services arm, with ambition to provide millions of users with greater access to digital banking services JAKARTA, Indonesia, Dec. 22, 2020 — Gojek, Southeast Asia’s leading mobile on-demand services and payments platform, has invested in Bank Jago, an Indonesia-listed technology-based bank, as part of…

QuantalRF secures CHF17M / $19M Series B funding to develop and commercialize disruptive RF front-end solutions

ZÜRICH and SAN DIEGO, Dec. 16, 2020 — QuantalRF, an emerging RF semiconductor company developing transformative wireless communication solutions, has announced the closing of an oversubscribed Series B funding round, resulting in CHF17 million / $19 million. The growth equity round was led…

Tive Secures $12 Million Series A Capital Funding

Backed by RRE Ventures and Two Sigma Ventures, Tive offers real-time, in-transit location and condition insights to every part of the supply chain BOSTON, Dec. 16, 2020 — Tive, Inc., a leading provider of global supply chain visibility insights, announced today that it secured a $12 million Series A funding…

SpaceChain Receives Grant from EUREKA GlobalStars-Singapore Call to Jointly Develop Decentralised Satellite Infrastructure with Consortium Partners

Milestone brings together SpaceChain, Addvalue Innovation and Alba Orbital on a mission to democratise access to space innovations HARWELL, England, Dec. 10, 2020 — EUREKA, in partnership with Enterprise Singapore and Innovate UK, has awarded GBP440,000 in funding together with access to research and development facilities and resources to SpaceChain UK Limited (SpaceChain)…

Climatetrade announces a partnership with Algorand and Investment from Borderless Capital

VALENCIA, Spain, Dec. 2, 2020 — Climatetrade, a blockchain-marketplace for CO2 carbon offsetting, announced today it will leverage the Algorand, a scalable, secure and decentralized digital blockchain technology network. to bring its technology to the next level. In addition, Borderless Capital has participated in…

JinkoSolar Sells Its Stake in Abu Dhabi Sweihan Power Station

SHANGRAO, China, Nov. 27, 2020 — JinkoSolar Holding Co., Ltd. ("JinkoSolar" or the "Company") (NYSE:JKS), one of the largest and most innovative solar module manufacturers in the world, today announced that its wholly-owned subsidiary JinkoSolar Sweihan (HK) Limited ("Sweihan HK") has signed a share and debt purchase agreement with Jinko…

Osome Raises US$3m in Funding from XA Network and AltaIR Capital

The accounting and corporate compliance super app will use funds to further develop its engineering, product development, and marketing SINGAPORE, Nov. 6, 2020 " — Osome, a growing super app in the accounting and corporate compliance space, has raised US$3 million in funding by XA Network and AltaIR Capital. Small to…