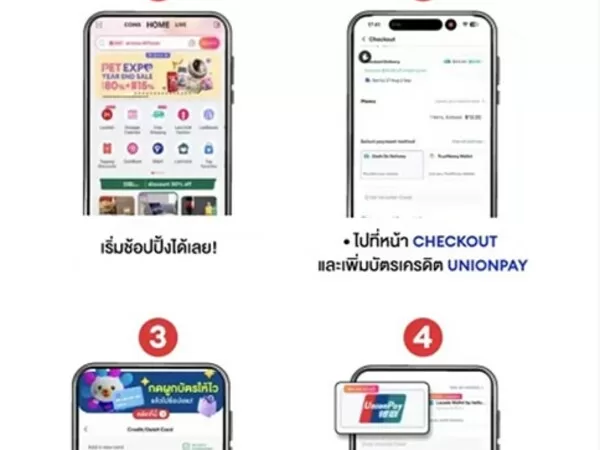

BANGKOK, Oct. 13, 2023 — UnionPay International announced today a partnership with Lazada to enable the acceptance of UnionPay cards on Lazada app. This partnership aims to provide more…

Dowsure Signs multi-million-dollar Asset-Backed Loan with HSBC

SHENZHEN, China, Aug. 25, 2023 — Dowsure as a pioneer of digital API platforms for cross-border e-commerce, today announced that it has received a multi-million-dollar Asset-Backed Loan from HSBC….

Asia’s EV Race: Selex Motors raises $3 million from ADB Ventures, Schneider Electric Energy Access Asia and others

Accelerating the fastest growing EV ASEAN nation to effectively reduce carbon footprint of the last mile transportation segment. SINGAPORE, April 24, 2023 — Hanoi-based Selex Smart Electric Vehicles JSC (Selex…

PINTEC Announces US$4 million Private Placement of Class A Ordinary Shares

BEIJING, March 18, 2023 — Pintec Technology Holdings Limited (Nasdaq: PT) ("PINTEC" or the "Company"), a leading independent technology platform enabling financial services in China, today announced that it…

Lloyds Banking Group invests £10 million in digital identity company Yoti

Investment will be used to develop innovative technology that protects customers’ identities and personal data online Lloyds Banking Group will support Yoti in developing a new, reusable digital…

Pixelworks Announces Strategic Equity Investment in Shanghai Subsidiary

Reaffirms Revenue Guidance for Fourth Quarter 2022 PORTLAND, Ore., Dec. 31, 2022 — Pixelworks, Inc. (NASDAQ: PXLW) (the "Company"), a leading provider of innovative video and display processing solutions,…

Hedonova enters the renewable energy sector by investing $16M in a Chilean energy storage plant

Total investment of $16M The plant is located 800 kms north of Chile’s capital Santiago in the Atacama region The plant can store up to 2000 megawatts which…

VUZ the Leading Immersive Social App Raises $20M in Series B Round

DUBAI, UAE, Oct. 15, 2022 — VUZ, the leading immersive social app, that allows users to stream and experience a new level of immersive realism in XR and other digital…

GAMURS CLOSES $17.8M AUD SERIES A FUNDING ROUND LED BY U.S. INVESTORS ELYSIAN PARK VENTURES AND CERRO CAPITAL

Leading Gaming, Esports, and Entertainment Media Network Will Accelerate Strategic Acquisition Opportunities and Expand Into Adjacent Markets SYDNEY, Oct. 6, 2022 — GAMURS,…

Automation Anywhere Secures $200 Million in Financing from Silicon Valley Bank and Hercules Capital

SAN JOSE, Calif., Oct. 3, 2022 — Automation Anywhere, Inc. , a global leader in Robotic Process Automation (RPA), announced today that it…