Led by Optum Ventures and Oxford Sciences Innovation, new funding will propel Rey’s launch of a tech-enabled, on-demand mental health clinic in response to growing demand for high-quality care in an increasingly resource constrained market AUSTIN, Texas, July 31, 2021 — Rey, a…

Kasisto Announces Series C Funding to Fuel Rapid Growth, Powering the Financial Services Industry with Cutting Edge Conversational AI Technology

$15.5 Million Round Co-Led by Naples Technology Ventures and NCR Corporation NEW YORK, July 28, 2021 — Kasisto, creators of KAI, the leading digital experience platform for the financial services industry, today announced the close of its $15.5 million Series C funding round. The…

Osome Raises a $16M Series A to Expand its AI-based Accounting Platform to Global Markets

SINGAPORE, June 18, 2021 — Osome, a super-app that digitizes accounting and compliance services for SMEs, has raised $16M in a Series A funding from a group of investors including Target Global, AltaIR Capital, Phystech Ventures, S16VC, and Peng T. Ong, an angel investor. The capital enables Osome to expand…

Red Date Technology, Architect Behind the Blockchain-based Service Network (BSN), Closes Landmark ‘Series A’ Funding

USD30 Million Series A Equity Financing Led by Global Investors Prosperity7 Ventures and Kenetic HONG KONG, June 10, 2021 — Red Date Technology, the architect behind the world’s largest blockchain connectivity network, the Blockchain-based Service Network (BSN), announced that it has completed USD 30 million Series A equity financing. The round…

MarTech Startup Affable.ai Raises USD 2M to Boost the Adoption of its Influencer Marketing Platform

Investors: Prime Venture Partners, Decacorn Capital, SGInnovate BENGALURU, India and SINGAPORE, May 18, 2021 — Singapore-based Martech startup, Affable.ai has raised USD Two Million from Prime Venture Partners, Decacorn Capital & SGInnovate. Affable’s AI-driven, Self-service SaaS platform helps brands and agencies run high impact influencer…

China Distance Education Holdings Limited Announces Shareholders’ Approval of Going-Private Transaction

BEIJING, Feb. 26, 2021 — China Distance Education Holdings Limited (NYSE: DL) (the "Company"), a leading provider of online education and value-added services for professionals and corporate clients in China, today announced that at an extraordinary general meeting (the "EGM") held today Beijing Time, the Company’s shareholders voted at the…

Personetics secures a $75 million investment from Warburg Pincus to accelerate the global expansion of its AI-driven personalization and engagement solutions for financial institutions

– Over 95 million bank customers now ‘self-driving’ their finances with Personetics – Banks reaping the rewards with an up to 35% increase in mobile app engagement and 20% increase in customer account and balance growth – The global market for financial services personalization solutions is valued at $13 billion…

Thailand 2020 Investment Applications at Over 480 Billion Baht, Led by E&E and Food, BOI Says

BANGKOK, Feb. 10, 2021 — The Thailand Board of Investment (BOI) said today that local and foreign investors had in 2020 filed a total of 1,717 applications for investment promotion, representing a combined investment value of 481.1 billion baht (USD16 billion), led by projects in the electric and electronics and…

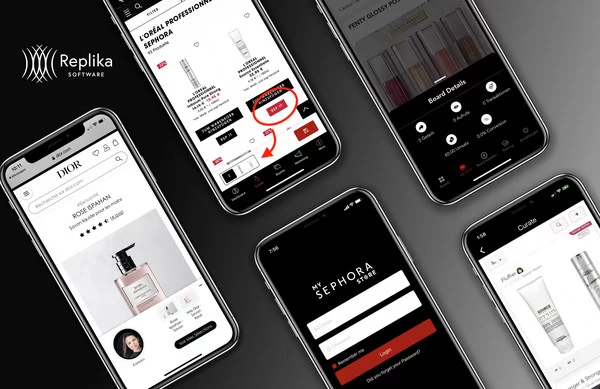

Replika Software Secures Series A Financing from LVMH Luxury Ventures and L’Oréal BOLD Ventures to Power the Future of Social Selling

NEW YORK, Jan. 27, 2021 — Replika Software, the turnkey social selling solution enabling brands to empower their networks of social sellers to inspire and sell online, has completed its Series A financing round with LVMH Luxury Ventures and L’Oréal BOLD, both investment arms of their parent companies. The funding…

CooTek Announces Entering Into A Combined Financing Package

SHANGHAI, Jan. 25, 2021 — CooTek (Cayman) Inc. (NYSE: CTK) ("CooTek" or the "Company"), a fast-growing global mobile internet company, today announced that it entered into a combined financing package with YA II PN, Ltd., a Cayman Islands exempt limited partnership managed by Yorkville Advisor Global, LP (the "Purchaser"), including…