TORRINGTON, Conn., Aug. 14, 2020 — Dymax Corporation, leading manufacturer of rapid light-curing materials and equipment, is pleased to announce that its Singapore subsidiary, Dymax Asia Pacific Pte Ltd., has received the Singapore 1000 & Singapore SME 1000 award in its annual ranking of best companies in 2020. And it…

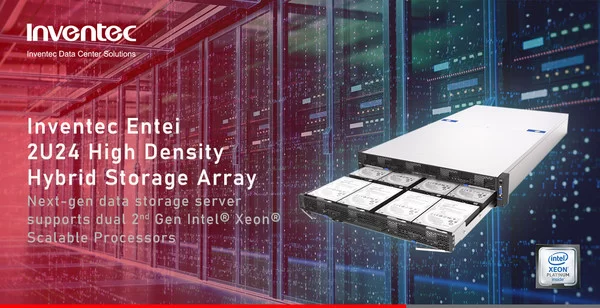

Inventec Introduces Entei, the Advanced Storage Server System

Next-gen data storage server supports dual 2nd Gen Intel Xeon Scalable Processors TAIPEI, Aug. 14, 2020 — To match an ever-growing need for data storage space, Inventec (2356.TW), one of the key suppliers of world’s leading server brands, hyperscale data centers and server system integrators, announced the arrival of Entei – a…

ViewSonic Holds “ColorPro Award Global Photography Contest” to Highlight the Spirit of Kindness

BREA, Calif., Aug. 14, 2020 — ViewSonic International Corp.*, a leading global provider of visual solutions, invited four leaders in the creative industry with many years of experience in providing professional tools and services to creators—Blurb, Shoot the Frame (STF), Tinyspace, and TourBox—to hold the ColorPro Award Global Photography Contest. The…

Qualcomm Announces Pricing Terms of Its Cash Offers for Four Series of Notes Open to Retail Holders Only

SAN DIEGO, Aug. 12, 2020 — Qualcomm Incorporated (NASDAQ: QCOM) announced today the pricing terms of its four separate offers to purchase for cash (each, a "Cash Offer," and collectively, the "Cash Offers") any and all of the outstanding notes listed in the table below (collectively, the "Old Notes"), on the…

ChipMOS REPORTS SECOND QUARTER 2020 RESULTS

Revenue Increases 10.7% in 2Q20 Compared to 2Q19 Gross Profit Increases 34.1% in 2Q20 Compared to 2Q19 Net Debt Reduced by US$49.9 Million to US$144.1 Million in 2Q20, with a US$189.3 Million Balance of Retained Cash and Cash Equivalents Distributed Cash Dividend of NT$1.8 Per Common…

ChipMOS REPORTS JULY 2020 REVENUE; ACHIEVES SIX-YEAR HIGH

HSINCHU, Aug. 10, 2020 /PRNewswire-FirstCall/ — ChipMOS TECHNOLOGIES INC. ("ChipMOS" or the "Company") (Taiwan Stock Exchange: 8150 and NASDAQ: IMOS), an industry leading provider of outsourced semiconductor assembly and test services ("OSAT"), today reported its unaudited consolidated revenue for the month of July 2020, which achieved a six-year high for July revenue. All U.S….

JinkoSolar reshapes PV technology scenarios with its new N-Type Tiger Pro 610W unveiled at SNEC 2020

SHANGRAO, China, Aug. 7, 2020 — JinkoSolar Holding Co., Ltd. ("JinkoSolar" or "Company") (NYSE: JKS) one of the world’s largest and most innovative module manufacturers in the world, today launched its new generation of 610W Tiger Pro High-efficiency monocrystalline TR solar module and its BIPV solutions, Building Integrated Photovoltaics product…

Canadian Solar Reports Second Quarter 2020 Results

GUELPH, ON, Aug. 7, 2020 — Canadian Solar Inc. ("Canadian Solar" or the "Company") (NASDAQ: CSIQ) today announced financial results for the quarter ended June 30, 2020. Second Quarter 2020 Highlights 31% sequential increase in total module shipments to 2.9 GW, exceeding guidance of 2.5 GW to 2.7 GW. Net…

DIVIDEND ALERT: CASH DIVIDEND TO BE DISTRIBUTED TO ChipMOS ADS HOLDERS OF US$1.227 OR APPROXIMATELY US$0.949 AFTER TAIWAN WITHHOLDING TAX AND DEPOSITARY FEES

HSINCHU, Aug. 4, 2020 /PRNewswire-FirstCall/ — ChipMOS TECHNOLOGIES INC. ("ChipMOS" or the "Company") (Taiwan Stock Exchange: 8150 and NASDAQ: IMOS), an industry leading provider of outsourced semiconductor assembly and test services ("OSAT"), announced today that on August 7, 2020 a cash dividend will be distributed of US$1.227 or approximately US$0.949…

Supermicro and Scality Collaborate to Simplify Deployment of Enterprise Software Defined Storage

Supermicro Delivers an Optimized Software-Defined Storage Solution for Large Scale On-Premises Management of Unstructured Data in Partnership with Leading Software Company SAN JOSE, California, July 28, 2020 — Super Micro Computer, Inc. (SMCI), a global leader in enterprise computing, storage, networking solutions, and green computing technology, announced today a new solution…