2020 will be remembered as the year the world experienced its largest ever work-from-home experiment as the global pandemic forced businesses to move operations online and adapt to a new distributed workforce.

As some markets around the globe gradually ease some restrictions and allow employees to go back to the office, the situation remains in a delicate balance and work as we know it has been redefined for many. Increasingly, organisations are embracing the new work model and the many benefits that come with it including increased employee well-being and better work-life balance. In fact, some organisations are now establishing permanent work-from-home policies with 60 percent of the largest companies integrating flexible virtual-physical collaborative environments by 2021, according to Bain & Company. This is supported by Lenovo’s Work From Home survey which found that nearly half (46 percent) of employees are as productive when working from home as they are in the office, with 15 percent saying that productivity increases at home.

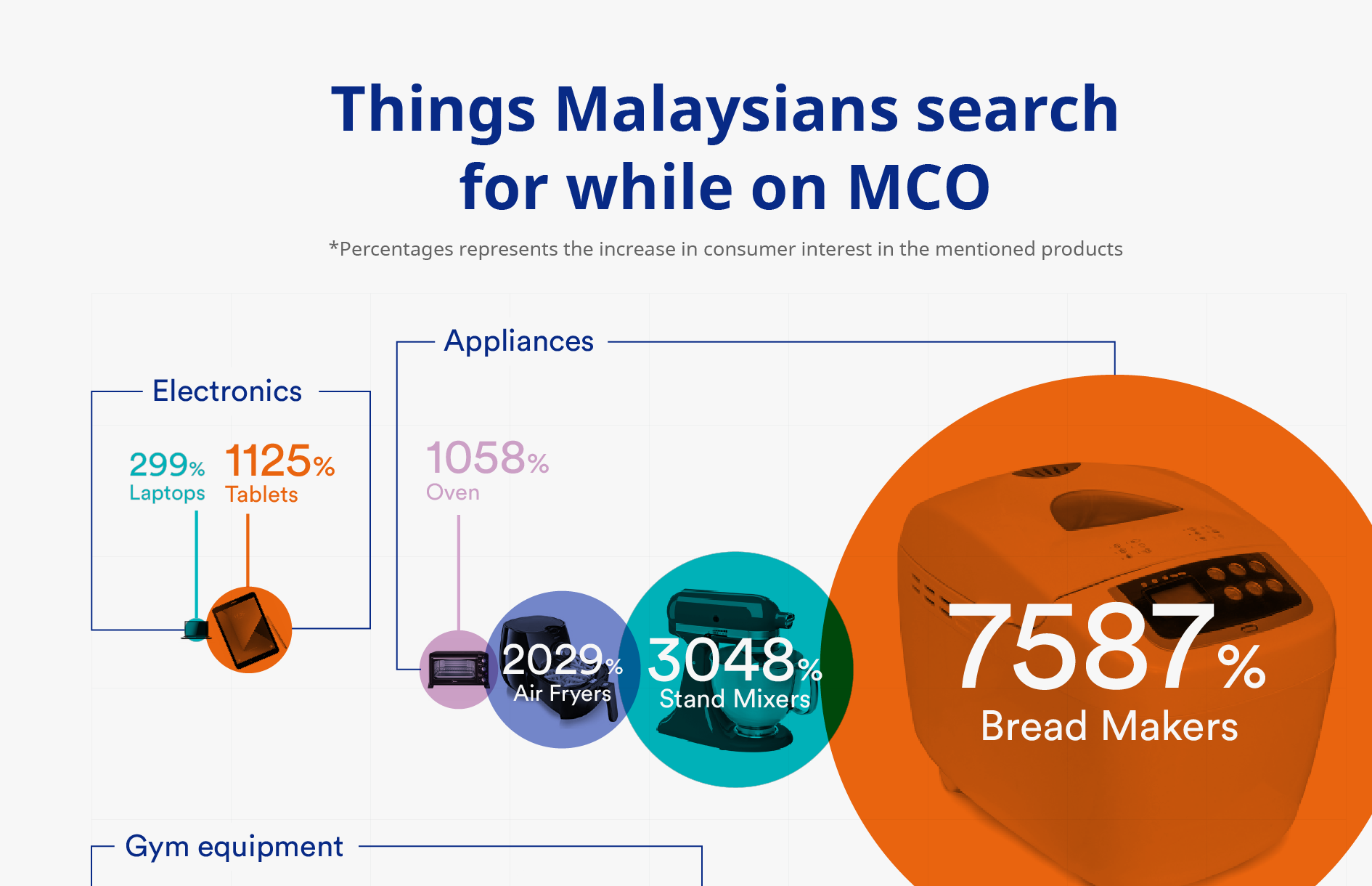

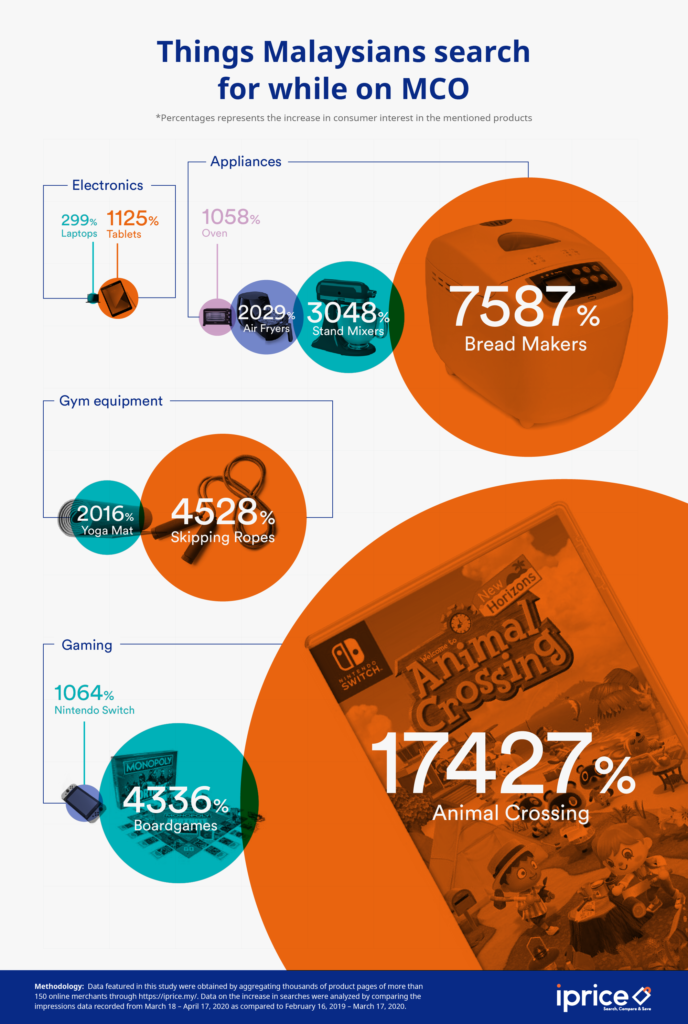

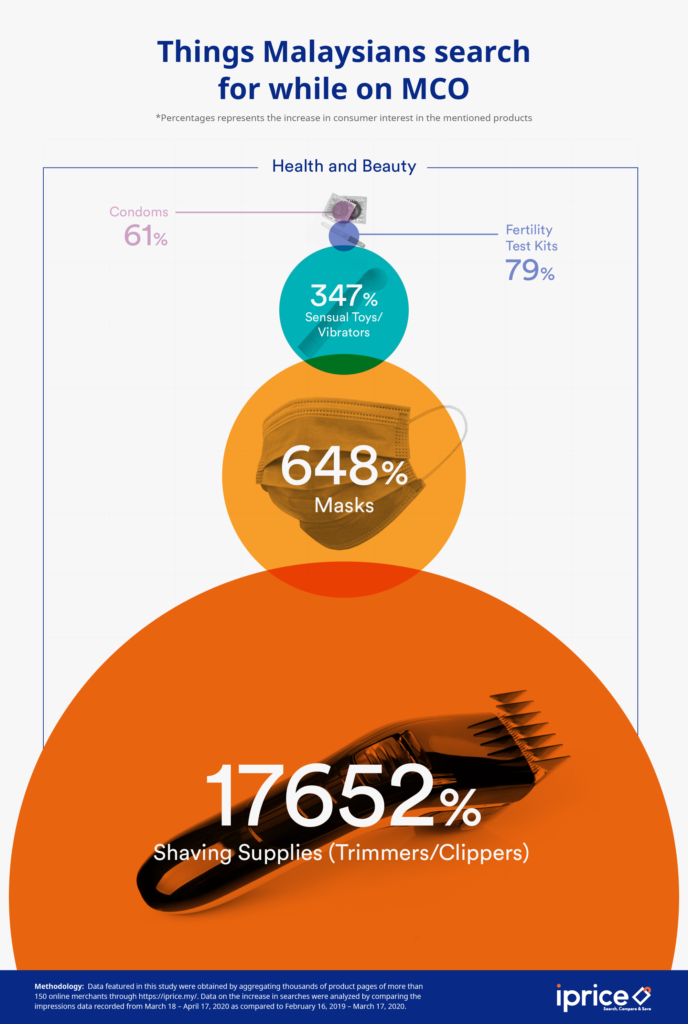

The survey also found that 87 percent of workers feel somewhat ready to adapt to a distributed, work-from-anywhere environment if required. So too are cybercriminals. The looming uncertainty among employees of the delicate, everchanging global circumstances, combined with their unfamiliarity with the new work arrangement, has created a wealth of opportunities for cyber-attacks. Cyber criminals are taking advantage of the situation to launch COVID-themed attacks, phishing attempts and spread fake news. In Malaysia, cybersecurity cases have seen a surge of more than 90% during the Movement Control Order (MCO) so far compared to the same period last year, CyberSecurity Malaysia revealed.

Watch for your blind spots

With employees accessing confidential data from various devices, locations, and unsecured networks, it opens more endpoints and vulnerabilities for cyberattacks. In our hyper-digital and mobile world, hardware security is becoming ever more critical, as across the globe, each person is expected to own 6.58 network connected devices in 2020. In fact, according to cybersecurity solutions provider Sepio Systems, there has been a 300 percent increase in the number of new connected devices from unknown vendors attached to the enterprise network.

While a majority of employees are working primarily from home, it is only a matter of time before they begin heading back to shared workspaces, coffee shops and planes and once again enjoy the flexibility of working from anywhere. This means that an organisation’s network, database and confidential files may be accessed from unsecured VPNs, unknown networks, and rogue access points. Without proper security standards put in place, hackers can easily gain access to an organisation’s network via vulnerable devices and execute attacks remotely. Organisations must take this into consideration and be on the offensive to mitigate potential attacks before malicious entities infiltrate company systems and confidential data.

Adopt a Zero Trust mindset

The nature of a distributed workforce removes the luxury of face-to-face identification and validation. Tech Wire Asia reported that cyber scams based on COVID-19 becomes prevalent in recent months, as hackers look to capitalize on the virus-driven uncertainty affecting individuals, enterprises, and governments. This means that organisations must double down on their efforts in credential and access management and continue to educate employees to identify and weed out impersonation scams and phishing attempts. As hackers grow in sophistication, organisations and employees must take a Zero Trust. In order to protect business and employee data, organisations must implement a system to ensure that the right people have access to the right data at the right time, on a ‘need-to-know’ basis.

Empowering a distributed workforce with cybersecurity

To reap the full benefits of a distributed workforce in the long run, organisations must provide employees with secure devices and create a safe digital environment to operate in, allowing them to focus on the job at hand. This shift to a decentralised work environment means that IT teams must have extended visibility over digital platforms and the organisations digital ecosystems in order to identify and mitigate potential threats in a timely manner.

However, with the shortage of cyber talent and growing digital footprint, this can take a toll on IT teams. IT teams must be supported to enhance their capabilities with solutions that provide both hardware and software security. For example, Lenovo’s ThinkShield solution helps secure devices from development through disposal, giving IT admins more visibility into end points and providing easier and more secure authentication. Lenovo has also partnered with SentinelOne to leverage its behavioral AI technology to predict tomorrow’s attacks today and allow ThinkShield devices to predict cyberattacks and enable devices to self-heal from any attack instantaneously, adding another critical layer to our ThinkShield offering.

As employees have quickly adapted to new work structures in these unique times, organisations must also embrace the risk that comes with it and put in place the right measures and solutions to create a secure and robust environment for employees to operate in. One way Lenovo helps organisations empower employees is by offering services that supports remote workers. For employees who do not have access to IT helpdesks, Lenovo’s Premier Support allows for direct, 24/7 access to elite Lenovo engineers who provide unscripted troubleshooting and comprehensive support for hardware and software. This results in less downtime for end users when things go wrong, freeing IT staff up to focus on strategic efforts.

Only then will organisations and employees be able to reap the full benefits of a distributed workforce and build a stronger digital foundation to effectively navigate and succeed in the new world of work.