Malaysia’s financial landscape continues to evolve the official launch of KAF Digital Bank, which is commencing operations on August 8, 2025. The bank received its license from Bank Negara Malaysia in December 2024. It is led by a consortium headed by KAF Investment Bank Berhad. This new digital bank is designed to be accessible, simple, and transparent, with a mission to serve the underserved and unserved communities of Malaysia. Its launch is a major step towards promoting financial inclusion in the country and a clear signal that digital banking is here to stay.

A Bank Built for Inclusivity

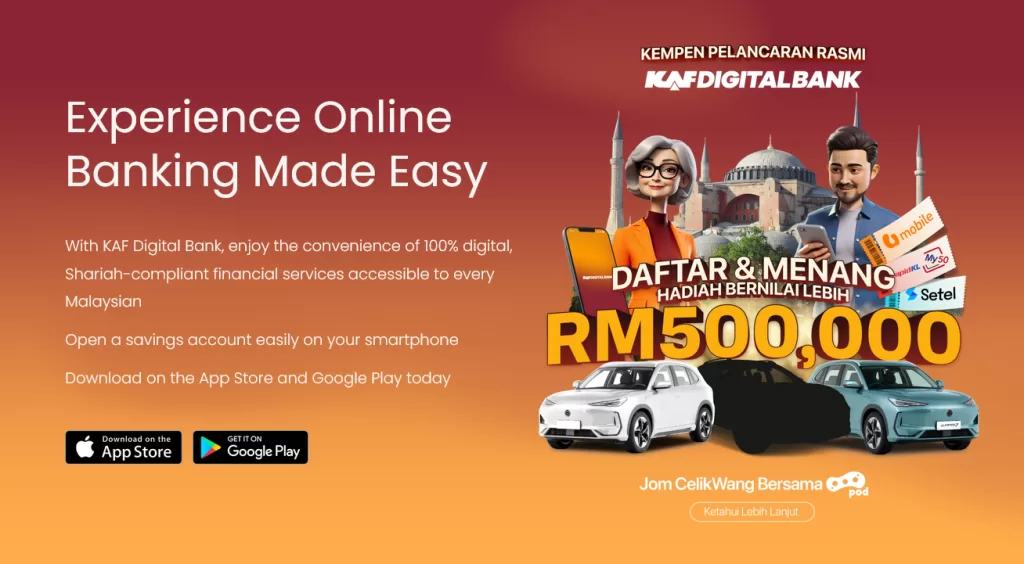

KAF Digital Bank is led by a consortium that includes KAF Investment Bank Berhad, Carsome, MoneyMatch, Jirnexu, and StoreHub. The bank’s core mission is to bring financial services to a segment of the population that has been historically left behind by traditional banks. The bank aims to provide a platform for those who are underserved and unserved, offering them a range of services that are both accessible and easy to use. The bank’s focus on inclusivity is further highlighted by its commitment to offering Shariah-compliant financial products, making it a viable option for a wider range of Malaysians.

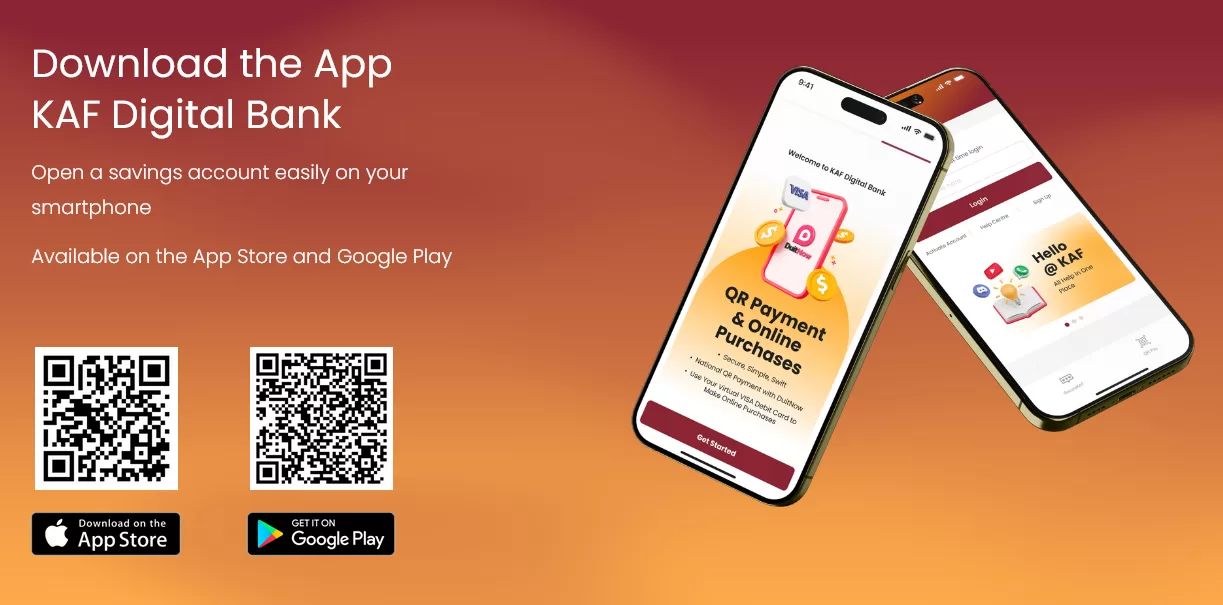

The bank’s services will be available through a user-friendly mobile app. The app will offer a “Digital Account” for instant savings and a “Digital Wallet” for seamless payments and transfers. This dual-service approach is designed to simplify a user’s financial life, allowing them to manage their money, save for the future, and make payments all from a single platform. The bank’s focus on a simplified user experience and financial literacy tools will also help to empower consumers to make better financial decisions.

With its launch, KAF Digital Bank is joining a growing number of digital banks in Malaysia, such as GXBank and Boost Bank, that are looking to serve the modern consumer. Users can now download the KAF Digital Bank app from the Apple App Store and Google Play Store.