GXBank, the Grab-led digital bank, has quietly introduced its GX Debit Card. This announcement comes on the heels of the announcement of its banking app earlier this month. While the current app focuses on basic savings, the anticipation surrounding the debit card launch is generating considerable interest.

According to the GXBank website, the GX Debit Card will be launched soon. The card features a sleek, minimalistic, modern design in renders. It is also being touted to provide users with unlimited 1% cashback on everyday transactions. That is on top of GXBank’s pledge to not markup on exchange rates and have transparent overseas transaction fees for the time being.

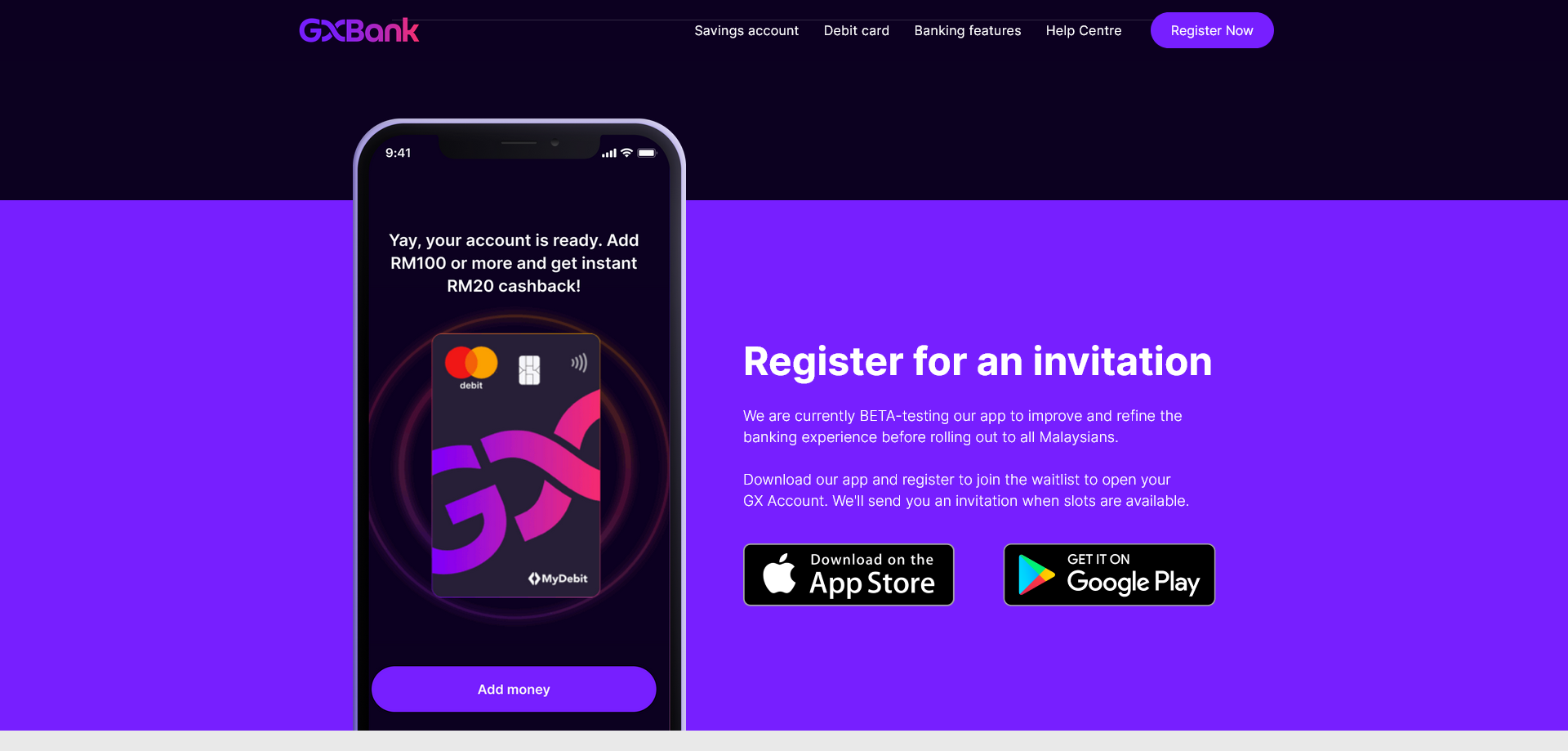

The GX Debit Card claims to be “the only cashback card with no limits,” offering 1% cashback across various spending categories. The promotion of an RM1 fee waiver at 10,000 MEPS ATMs nationwide adds to the card’s appeal. However, accessing the card presents a challenge as GXBank’s public beta is limited to 20,000 Malaysians.

Being a digital bank, GX Debit Card users can expect convenient card management through the app – which is not in beta. The app will allow users to self-serve features like freezing the card and customizing transaction preferences. That said, there doesn’t seem to be anything indicating support for popular digital wallets like Apple Pay, Google Pay, or Samsung Pay.

While the GX Debit Card offers enticing cashback benefits, it’s worth noting that there are fees which are currently being waived. According to the documentation available, this includes an RM12 card issuance fee and an RM1 transaction fee for MEPS ATM withdrawals. Additionally, there is a 1.2% administration fee for foreign currency transactions or overseas card use. There isn’t any word on when the fees will be enforced. However, the product information sheet points to the waivers only being until 31 December 2024.

Users interested in trying out the offering from GX Bank will need to register on the waitlist for the app and request the debit card from there. However, there is no word on how long this will take or if GXBank will be expanding the public beta currently underway with 20,000 participants.