Fiscal Year 2022 Financial Highlights

- Total revenues were $707.5 million, an increase of 19.2% compared to the comparable prior year period.

- Gross margin was 33.8%, compared to 36.8% for the comparable prior year period. Non-GAAP gross margin was 34.0%, compared to 36.8% for the comparable prior year period.

- Net income attributable to Hollysys was $83.2 million, a decrease of 7.3% compared to the comparable prior year period. Non-GAAP net income attributable to Hollysys was $94.2 million, a decrease of 5.5% compared to the comparable prior year period.

- Diluted earnings per share was $1.35, a decrease of 7.5% compared to the comparable prior year period. Non-GAAP diluted earnings per share was $1.53, a decrease of 5.6% compared to the comparable prior year period.

- Net cash provided by operating activities was $54.5 million.

- Days sales outstanding (“DSO”) of 171 days, compared to 180 days for the comparable prior year period.

- Inventory turnover days of 58 days, compared to 51 days for the comparable prior year period.

Fourth Quarter of Fiscal Year 2022 Financial Highlights

- Total revenues were $182.1 million, an increase of 14.7% compared to the comparable prior year period.

- Gross margin was 33.7%, compared to 37.8% for the comparable prior year period. Non-GAAP gross margin was 33.9%, compared to 37.9% for the comparable prior year period.

- Net income attributable to Hollysys was $23.0 million, an increase of 4.9% compared to the comparable prior year period. Non-GAAP net income attributable to Hollysys was $24.7 million, a decrease of 12.0% compared to the comparable prior year period.

- Diluted earnings per share was $0.37, an increase of 2.8% compared to the comparable prior year period. Non-GAAP diluted earnings per share was $0.40, a decrease of 13.0% compared to the comparable prior year period.

- Net cash provided by operating activities was $38.8 million.

- DSO of 174 days, compared to 194 days for the comparable prior year period.

- Inventory turnover days of 73 days, compared to 47 days for the comparable prior year period.

See the section entitled “Non-GAAP Measures” for more information about non-GAAP gross margin, non-GAAP net income attributable to Hollysys and non-GAAP diluted earnings per share.

BEIJING, Aug. 12, 2022 /PRNewswire/ — Hollysys Automation Technologies Ltd. (NASDAQ: HOLI) (“Hollysys” or the “Company”), a leading provider of automation and control technologies and applications in China, today announced its unaudited financial results for fiscal year 2022 and the fourth quarter ended June 30, 2022. Dr. Changli Wang, the CEO and director of Hollysys, stated:

“We are delighted to report another fiscal year and the fourth quarter with solid financial and operational performance and firmly adhered to our tenet of automation for better lives, even under an unfavorable environment of the COVID-19 pandemic which constantly brings challenges. We are confident with our outstanding technologies, satisfactory services and established huge customer bases. Looking forward, Hollysys will unswervingly make progress based on the united efforts of our motivated and inspired management team, experts and employees, and will embrace jointly with our customers and investors for a more prosperous and vigorous future.”

The Industrial Automation (“IA”) business maintained its strong momentum with increased market shares as Hollysys undertook more key and challenging projects, which are expected to relieve the pain points of relevant industries by enhancing the efficiency in operation and contribute to achieving the national carbon peaking and carbon neutrality goals. In the chemical and petrochemical field, we adhere to the development strategy of enhancing our focus on significant projects in addition to normal projects. For example, a one-million-ton ethylene project was signed in Tianjin in which we will provide over 100,000 and 20,000 input/output (“I/O”) points that will be connected to our Optical Bus Control System (“OCS”)—the new released version of Distributed Control System (“DCS”), and Safety Instrumented System (“SIS”), along with Gas Detection System (“GDS”), respectively. The success in signing this project proves that Hollysys is capable of supplying control systems for any chemical process, as the advanced control of ethylene is known as the most sophisticated and critical process in the industry. Meanwhile, we present remarkable achievements and maintain our cooperation with national key customers like Sinopec Group and China National Petroleum Corporation (“CNPC”). For instance, a contract of huge SCADA system for the Guangxi Long-distance Natural Gas Pipeline Project was signed with Sinopec. Additionally, Hollysys also provided CNPC with Hia Advanced Process Control (“Hia APC”) for producing 450,000 tons of synthetic ammonia / 800,000 tons of urea fertilizer, which as another milestone, was the first set of a 100% domestic control system application in the large chemical fertilizer industry in China.

We have also manifested remarkable performance and witnessed business growth in the valve and instrument market. For example, we signed with a world leading copper pipe and rod manufacturer for a Phase I project of 150,000 tons of high-performance copper foil, in which Hollysys provided holistic customized integrated, intelligent solutions, and over 4000 sets of various types of meters and valves. The project represents another milestone for Hollysys in electrical instrument installation engineering.

We continue our business growth by upgrading the capabilities of products in the pharmaceutical field. For example, a project for a pharmaceutical company was delivered in which Hollysys provided a customized intelligent control system based on HiaBatch. HiaBatch is remarkably flexible and efficient, which facilitates customers to operate more smartly and is highly recognized among customers in the industry. We successively signed new projects, including a Good Manufacturing Practice (“GMP”) Application Programming Interface (“API”) pilot test and production project along with the supply of DCS, SIS, electrical instrument and Batch Processing System (“BATCH”).

Meanwhile, we constantly upgrade our Engineering Procurement Construction (“EPC”) capacity. In the fourth fiscal quarter, we signed two breakthrough EPC projects regarding the whole workshop’s engineering, which the lays foundation for our further exploration of EPC projects in the future.

Our business has witnessed continuous development in Indonesia and other overseas markets, and our control system, instruments and technologies are widely recognized. We have signed with Indonesian companies a contract for an electrical instrument engineering project and an additional contract of Phase II DCS and electrical instruments. To further cultivate and grow our business in the Central and Southeast Asia market, Hollysys will persevere in attracting talented people, optimizing market promotion and enhancing its overseas brand image.

In the high-speed rail sector, we continued to deliver on existing projects while retaining our market position. We provided on-ground solutions for Xiangyang East-Wanzhou North high-speed railway and participated in the reconstruction of the Beijing Fengtai Hub, which is now Asia’s largest railway hub. Meanwhile, we continued to explore opportunities in service markets, covering replacement and overhaul, upgrades, spare parts sales, etc. The highlight for the service business is the successful launch of China’s fifth high-speed railway with an operating speed of 350 km/h, the Shijiazhuang-Wuhan High-speed Railway. In this project, Hollysys actively responded to our client’s demand for speed acceleration by upgrading the existing on-board and on-ground products. In the subway sector, our SCADA system for Kunming Subway Line 5 was successfully delivered. This marked another contribution of Hollysys to Kunming rail construction following the successful completion of the Kunming Subway Line 3 project and Kunming Changshui Airport Express project (“Kunming Airport project”),. In the subway signaling business, we won the automated people mover project of the T3B terminal and the fourth runway of Chongqing Jiangbei International Airport. This project, which follows our first subway signaling project—Kunming Airport project—represents another significant advancement for Hollysys in subway signaling. The project will utilize our proprietary GoA4 Fully Automatic Operation system and achieve effective and energy-saving operations. We are grateful for the industry recognition gained from our clients in the past year and we expect to make more contributions to China’s urban rail transit system in the future.

The mechanical and electrical solutions (“M&E”) segment of the Company manifests a stable performance with our smooth executions on various projects. The risk monitor and control will still be our future focus in this field.

With our continuous dedication to the industry and the support of experienced and passionate experts, we believe that we will continue to create greater value for our clients and shareholders.

|

Fiscal Year and the Fourth Quarter Ended June 30, 2022 Unaudited Financial Results Summary

|

|

|

|

(In USD thousands, except for %, number of shares and per share data)

|

|

|

|

|

|

|

|

Three months ended

June 30,

|

|

|

Fiscal year ended

June 30,

|

|

|

,

|

|

2022

|

2021

|

%

Change

|

|

2022

|

2021

|

%

Change

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

$

|

182,115

|

158,764

|

14.7 %

|

$

|

707,462

|

593,466

|

19.2 %

|

|

Integrated solutions contracts

revenue

|

$

|

149,292

|

126,237

|

18.3 %

|

$

|

573,567

|

460,180

|

24.6 %

|

|

Products sales

|

$

|

11,823

|

7,098

|

66.6 %

|

$

|

38,486

|

28,667

|

34.3 %

|

|

Service rendered

|

$

|

21,000

|

25,429

|

(17.4) %

|

$

|

95,409

|

104,619

|

(8.8) %

|

|

Cost of revenues

|

$

|

120,780

|

98,705

|

22.4 %

|

$

|

468,105

|

375,187

|

24.8 %

|

|

Gross profit

|

$

|

61,335

|

60,059

|

2.1 %

|

$

|

239,357

|

218,279

|

9.7 %

|

|

Total operating expenses

|

$

|

42,215

|

44,402

|

(4.9) %

|

$

|

164,813

|

131,034

|

25.8 %

|

|

Selling

|

$

|

10,863

|

9,601

|

13.1 %

|

$

|

45,301

|

35,197

|

28.7 %

|

|

General and administrative

|

$

|

23,323

|

30,260

|

(22.9) %

|

$

|

80,241

|

69,982

|

14.7 %

|

|

Research and development

|

$

|

16,629

|

14,194

|

17.2 %

|

$

|

69,580

|

55,954

|

24.4 %

|

|

VAT refunds and government

subsidies

|

$

|

(8,600)

|

(9,653)

|

(10.9) %

|

$

|

(30,309)

|

(30,099)

|

0.7 %

|

|

Income from operations

|

$

|

19,120

|

15,657

|

22.1 %

|

$

|

74,544

|

87,245

|

(14.6) %

|

|

Other income, net

|

$

|

256

|

6,863

|

(96.3) %

|

$

|

2,185

|

10,449

|

(79.1) %

|

|

Foreign exchange gain (loss)

|

$

|

4,000

|

(942)

|

(524.6) %

|

$

|

1,789

|

(6,219)

|

(128.8) %

|

|

Gains on disposal of investments in an

equity investee

|

$

|

–

|

–

|

–

|

$

|

7,995

|

–

|

–

|

|

Impairment loss of investments in cost

investees

|

$

|

(773)

|

–

|

–

|

$

|

(773)

|

–

|

–

|

|

Share of net income (loss) of equity

investees

|

$

|

1,280

|

(1,331)

|

(196.2) %

|

$

|

1,838

|

604

|

204.3 %

|

|

Losses on disposal of subsidiaries

|

|

–

|

–

|

–

|

|

(3)

|

–

|

–

|

|

Gains on disposal of an investment in

securities

|

$

|

–

|

3,323

|

(100.0) %

|

$

|

–

|

3,323

|

(100.0) %

|

|

Dividend income from investments in

securities

|

$

|

–

|

456

|

(100.0) %

|

$

|

85

|

912

|

(90.7) %

|

|

Interest income

|

$

|

3,363

|

4,278

|

(21.4) %

|

$

|

12,698

|

14,131

|

(10.1) %

|

|

Interest expenses

|

$

|

(141)

|

(125)

|

12.8 %

|

$

|

(731)

|

(553)

|

32.2 %

|

|

Income tax expenses

|

$

|

3,928

|

6,317

|

(37.8) %

|

$

|

16,634

|

20,554

|

(19.1) %

|

|

Net income (loss) attributable to non-

controlling interests

|

$

|

155

|

(75)

|

(306.7) %

|

$

|

(189)

|

(371)

|

(49.1) %

|

|

Net income attributable to Hollysys

Automation Technologies Ltd.

|

$

|

23,022

|

21,937

|

4.9 %

|

$

|

83,182

|

89,709

|

(7.3) %

|

|

Basic earnings per share

|

$

|

0.38

|

0.36

|

5.6 %

|

$

|

1.36

|

1.48

|

(8.1) %

|

|

Diluted earnings per share

|

$

|

0.37

|

0.36

|

2.8 %

|

$

|

1.35

|

1.46

|

(7.5) %

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses

|

$

|

1,327

|

6,036

|

(78.0) %

|

$

|

9,709

|

9,724

|

(0.2) %

|

|

Amortization of acquired intangible

assets

|

$

|

353

|

90

|

292.2 %

|

$

|

1,356

|

316

|

329.1 %

|

|

Non-GAAP net income attributable to

Hollysys Automation Technologies Ltd.(1)

|

$

|

24,702

|

28,063

|

(12.0) %

|

$

|

94,247

|

99,749

|

(5.5) %

|

|

Non-GAAP basic earnings per share(1)

|

$

|

0.40

|

0.46

|

(13.0) %

|

$

|

1.54

|

1.65

|

(6.7) %

|

|

Non-GAAP diluted earnings per share(1)

|

$

|

0.40

|

0.46

|

(13.0) %

|

$

|

1.53

|

1.62

|

(5.6) %

|

|

Basic weighted average number of

ordinary shares outstanding

|

|

61,195,317

|

60,698,727

|

0.8 %

|

|

61,007,506

|

60,566,709

|

0.7 %

|

|

Diluted weighted average number of

ordinary shares outstanding

|

|

61,788,905

|

61,025,425

|

1.3 %

|

|

61,568,176

|

61,513,749

|

0.1 %

|

________

|

(1) See the section entitled “Non-GAAP Measures” for more information about these non-GAAP measures.

|

Operational Results Analysis for the Fiscal Year Ended June 30, 2022

Compared to the prior fiscal year, the total revenues for fiscal year 2022 increased from $593.5 million to $707.5 million, representing an increase of 19.2%. Broken down by the revenue types, integrated solutions contracts revenue increased by 24.6% to $573.6 million, products sales revenue increased by 34.3% to $38.5 million, and services revenue decreased by 8.8% to $95.4 million.

The Company’s total revenues can also be presented by segment as shown in the table below:

|

(In USD thousands)

|

|

|

|

|

|

|

|

Fiscal year ended June 30,

|

|

|

|

2022

|

|

2021

|

|

|

|

$

|

|

% to Total

Revenues

|

|

$

|

|

% to Total

Revenues

|

|

|

Industrial Automation

|

|

439,918

|

|

62.2

|

|

337,052

|

|

56.8

|

|

|

Rail Transportation Automation

|

|

183,785

|

|

26.0

|

|

188,171

|

|

31.7

|

|

|

Mechanical and Electrical Solution

|

|

83,759

|

|

11.8

|

|

68,243

|

|

11.5

|

|

|

Total

|

|

707,462

|

|

100.0

|

|

593,466

|

|

100.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin was 33.8% for fiscal year 2022, as compared to 36.8% for the prior fiscal year. Gross margins for integrated solutions contracts, product sales, and services rendered were 26.4%, 73.4% and 62.7% for fiscal year 2022, as compared to 26.9%, 81.5% and 68.1% for the prior fiscal year, respectively. Non-GAAP gross margin was 34.0% for fiscal year 2022, as compared to 36.8% for the prior fiscal year. Non-GAAP gross margin of integrated solutions contracts was 26.6% for fiscal year 2022, as compared to 27.0% for the prior fiscal year. See the section entitled “Non-GAAP Measures” for more information about non-GAAP gross margin and non-GAAP gross margin of integrated solutions contracts.

Selling expenses were $45.3 million for fiscal year 2022, representing an increase of $10.1 million, or 28.7%, compared to $35.2 million for the prior fiscal year. The increase was in line with our sales growth. Selling expenses as a percentage of total revenues were 6.4% and 5.9% for fiscal year 2022 and 2021, respectively. The increase of selling expenses was mainly due to the significant increase of sales scale year over year.

General and administrative expenses were $80.2 million for fiscal year 2022, representing an increase of $10.3 million, or 14.7%, compared to $70.0 million for the prior fiscal year, which was primarily due to a $7.5 million increase in credit losses and a $5.7 million increase in labor cost. Share-based compensation expenses were $9.7 million and $9.7 million for fiscal year 2022 and 2021, respectively. General and administrative expenses as a percentage of total revenues were 11.3% and 11.8% for fiscal year 2022 and 2021, respectively.

Research and development expenses were $69.6 million for fiscal year 2022, representing an increase of $13.6 million, or 24.4%, compared to $56.0 million for the prior fiscal year, which was primarily due to our increased investments in research and development in connection with the upgrading of mainstream products and new products developed to meet the needs of the digital infrastructure market, such as the new generation DCS Macs V7, SIS Upgrade, OCS, smart factory and smart city rail. R&D expenses as a percentage of total revenues were 9.8% and 9.4% for fiscal year 2022 and 2021, respectively.

The VAT refunds and government subsidies were $30.3 million for fiscal year 2022, as compared to $30.1 million for the prior fiscal year, representing a $0.2 million, or 0.7%, increase.

The income tax expenses and the effective tax rate were $16.6 million and 16.7% for fiscal year 2022, as compared to $20.6 million and 18.7% for the prior fiscal year. The effective tax rate fluctuates, as the Company’s subsidiaries contributed different pre-tax income at different tax rates.

Net income attributable to Hollysys was $83.2 million for fiscal year 2022, representing a decrease of 7.3% from $89.7 million reported in the prior fiscal year. Non-GAAP net income attributable to Hollysys was $94.2 million or $1.53 per diluted share. See the section entitled “Non-GAAP Measures” for more information about non-GAAP net income attributable to Hollysys.

Diluted earnings per share was $1.35 for fiscal year 2022, representing a decrease of 7.5% from $1.46 in the prior fiscal year. Non-GAAP diluted earnings per share was $1.53 for fiscal year 2022, representing a decrease of 5.6% from $1.62 in the prior fiscal year. These were calculated based on 61.6 million and 61.5 million diluted weighted average ordinary shares outstanding for the fiscal year ended June 30, 2022 and 2021, respectively. See the section entitled “Non-GAAP Measures” for more information about non-GAAP diluted earnings per share.

Operational Results Analysis for the Fourth Quarter Ended June 30, 2022

Compared to the fourth quarter of the prior fiscal year, the total revenues for the three months ended June 30, 2022 increased from $158.8 million to $182.1 million, representing an increase of 14.7%. Broken down by the revenue types, integrated solutions contracts revenue increased by 18.3% to $149.3 million, products sales revenue increased by 66.6% to $11.8 million, and services revenue decreased by 17.4% to $21.0 million.

The Company’s total revenues can also be presented by segment as shown in the table below:

|

(In USD thousands)

|

|

|

|

|

|

|

|

|

|

Three months ended June 30,

|

|

|

|

2022

|

|

2021

|

|

|

|

$

|

% to Total

Revenues

|

|

$

|

% to Total

Revenues

|

|

|

Industrial Automation

|

|

121,771

|

66.9

|

|

94,779

|

59.7

|

|

|

Rail Transportation Automation

|

|

34,215

|

18.8

|

|

47,533

|

29.9

|

|

|

Mechanical and Electrical Solution

|

|

26,129

|

14.3

|

|

16,452

|

10.4

|

|

|

Total

|

|

182,115

|

100.0

|

|

158,764

|

100.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin was 33.7% for the three months ended June 30, 2022, as compared to 37.8% for the same period of the prior fiscal year. Gross margin of integrated solutions contracts, product sales, and service rendered was 27.1%, 75.4% and 57.1% for the three months ended June 30, 2022, as compared to 27.8%, 84.3% and 74.6% for the same period of the prior fiscal year, respectively. Non-GAAP gross margin was 33.9% for the three months ended June 30, 2022, as compared to 37.9% for the same period of the prior fiscal year. Non-GAAP gross margin of integrated solutions contracts was 27.3% for the three months ended June 30, 2022, as compared to 27.9% for the same period of the prior fiscal year. See the section entitled “Non-GAAP Measures” for more information about non-GAAP gross margin and non-GAAP gross margin of integrated solutions contracts.

Selling expenses were $10.9 million for the three months ended June 30, 2022, representing an increase of $1.3 million, or 13.1%, compared to $9.6 million for the same period of the prior fiscal year. The increase was in line with our sales growth. Selling expenses as a percentage of total revenues were 6.0% and 6.0% for the three months ended June 30, 2022 and 2021, respectively.

General and administrative expenses were $23.3 million for the three months ended June 30, 2022, representing a decrease of $6.9 million, or 22.9%, compared to $30.3 million for the same period of the prior fiscal year, which was primarily due to a $7.4 million decrease in third-party consulting fees and a $4.7 million decrease in share-based compensation expenses. Share-based compensation expenses were $1.3 million and $6.0 million for the three months ended June 30, 2022 and 2021, respectively. General and administrative expenses as a percentage of total revenues were 12.8% and 19.1% for the three months ended June 30, 2022 and 2021, respectively. The decrease of G&A in the fourth quarter is mainly due to the lower third-party consulting fees year-over-year.

Research and development expenses were $16.6 million for the three months ended June 30, 2022, representing an increase of $2.4 million, or 17.2%, compared to $14.2 million for the same period of the prior fiscal year. Research and development expenses as a percentage of total revenues were 9.1% and 8.9% for the three months ended June 30, 2022 and 2021, respectively.

The VAT refunds and government subsidies were $8.6 million for three months ended June 30, 2022, as compared to $9.7 million for the same period in the prior fiscal year, representing a $1.1 million, or 10.9%, decrease.

The income tax expenses and the effective tax rate were $3.9 million and 14.5% for the three months ended June 30, 2022, respectively, as compared to $6.3 million and 22.4% for the comparable period in the prior fiscal year, respectively. The effective tax rate fluctuates, as the Company’s subsidiaries contributed different pre-tax income at different tax rates.

Net income attributable to Hollysys was $23.0 million for three months ended June 30, 2022, representing an increase of 4.9% from $21.9 million reported in the comparable period in the prior fiscal year. Non-GAAP net income attributable to Hollysys was $24.7 million or $0.40 per diluted share. See the section entitled “Non-GAAP Measures” for more information about non-GAAP net income attributable to Hollysys.

Diluted earnings per share was $0.37 for the three months ended June 30, 2022, representing an increase of 2.8% from $0.36 for the comparable period in the prior fiscal year. Non-GAAP diluted earnings per share was $0.40 for the three months ended June 30, 2022, representing a decrease of 13.0% from $0.46 for the comparable period in the prior fiscal year. These were calculated based on 61.8 million and 61.0 million diluted weighted average ordinary shares outstanding for the three months ended June 30, 2022 and 2021, respectively. See the section entitled “Non-GAAP Measures” for more information about non-GAAP diluted earnings per share.

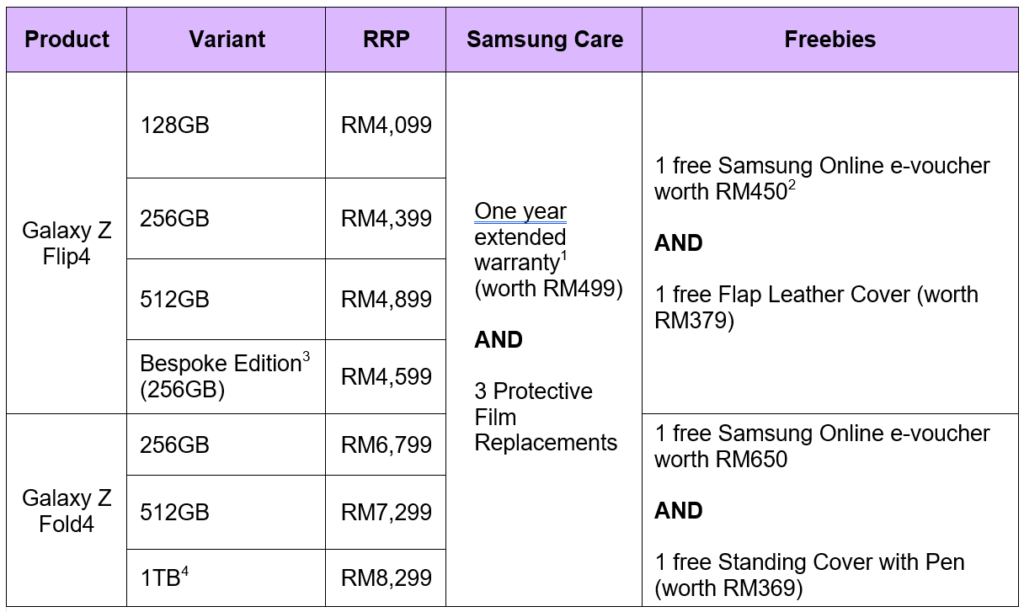

Contracts and Backlog Highlights

Hollysys achieved $1,057.9 million and $289.9 million in terms of the value of new contracts for the fiscal year and the three months ended June 30, 2022, respectively. The order backlog of contracts was $944.3 million as of June 30, 2022. The order backlog of contracts represents the amount of unrealized revenue to be earned from the contracts that Hollysys won. The detailed breakdown of new contracts and backlog by segment is shown in the table below:

|

(In USD thousands, except for %)

|

|

|

|

|

|

|

|

|

Value of New contracts

achieved for the fiscal

year

ended June 30, 2022

|

|

|

Value of New contracts

achieved for the three

months

ended June 30, 2022

|

|

|

Backlog as of Jun 30,

2022

|

|

|

|

|

|

|

|

|

|

$

|

|

% of Total

Contract

Value

|

|

|

$

|

% of Total

Contract

Value

|

|

|

$

|

% of Total

Backlog

|

|

Industrial Automation

|

|

582,776

|

55.1

|

|

|

193,980

|

67.0

|

|

|

384,805

|

40.7

|

|

Rail Transportation

|

|

303,819

|

28.7

|

|

|

79,524

|

27.4

|

|

|

359,301

|

38.1

|

|

Mechanical and Electrical Solutions

|

|

171,333

|

16.2

|

|

|

16,359

|

5.6

|

|

|

200,166

|

21.2

|

|

Total

|

|

1,057,928

|

100.0

|

|

|

289,863

|

100.0

|

|

|

944,272

|

100.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow Highlights

For the fiscal year ended June 30, 2022, the total net cash inflow was $23.5 million. The net cash provided by operating activities was $54.5 million. The net cash provided by investing activities was $13.3 million, mainly consisting of $100.6 million maturity of short-term investments, $3.8 million proceeds from disposal of a subsidiary, $9.5 million proceeds received from disposal of equity investments, which was partially offset by $26.4 million purchases of property, plant and equipment, $64.4 million purchases of short-term investments, and $8.7 million cash prepaid for acquisition of a subsidiary. The net cash used in financing activities was $19.6 million, mainly consisting of $19.8 million payment of dividends.

For the three months ended June 30, 2022, the total net cash inflow was $6.9 million. The net cash provided by operating activities was $38.8 million. The net cash provided by investing activities was $23.6 million, mainly consisting of $37.8 million maturity of short-term investments, which was partially offset by $7.3 million purchases of property, plant and equipment, $6.9 million purchases of short-term investments. The net cash used in financing activities was $19.4 million, mainly consisting of $19.8 million payment of dividends.

Balance Sheet Highlights

The total amount of cash and cash equivalents was $679.8 million, $669.8 million, and $664.3 million as of June 30, 2022, March 31, 2022, and June 30, 2021, respectively.

For fiscal year ended June 30, 2022, DSO were 171 days, as compared to 180 days from the prior year, and inventory turnover was 58 days, as compared to 51 days from the prior year.

For the three months ended June 30, 2022, DSO was 174 days, as compared to 194 days for the comparable prior fiscal year and 215 days for the last fiscal quarter; inventory turnover days were 73 days, as compared to 47 days for the comparable prior fiscal year and 69 days for the last fiscal quarter. The significant increase in inventories was mainly due to the company’s increase in safety stock in response to supply chain fluctuations.

Financial Performance Guidance

Based on information available as of the date of this press release, Hollysys provides the following financial performance guidance for the full fiscal year 2023:

– The revenue is expected to be between $810 million and $885 million, with a year-on-year increase of 15% to 25%.

About Hollysys Automation Technologies Ltd.

Hollysys is a leading automation control system solutions provider in China, with overseas operations in eight other countries and regions throughout Asia. Leveraging its proprietary technology and deep industry know-how, Hollysys empowers its customers with enhanced operational safety, reliability, efficiency, and intelligence which are critical to their businesses. Hollysys derives its revenues mainly from providing integrated solutions for industrial automation and rail transportation automation. In industrial automation, Hollysys delivers the full spectrum of automation hardware, software, and services spanning field devices, control systems, enterprise manufacturing management and cloud-based applications. In rail transportation automation, Hollysys provides advanced signaling control and SCADA (Supervisory Control and Data Acquisition) systems for high-speed rail and urban rail (including subways). Founded in 1993, with technical expertise and innovation, Hollysys has grown from a research team specializing in automation control in the power industry into a group providing integrated automation control system solutions for customers in diverse industry verticals. As of June 30, 2021, Hollysys had cumulatively carried out more than 35,000 projects for approximately 20,000 customers in various sectors including power, petrochemical, high-speed rail, and urban rail, in which Hollysys has established leading market positions.

SAFE HARBOR STATEMENTS

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact included herein are “forward-looking statements,” including statements regarding the ability of the Company to achieve its commercial objectives; the business strategy, plans and objectives of the Company and its subsidiaries; and any other statements of non-historical information. These forward-looking statements are often identified by the use of forward-looking terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “target,” “confident,” or similar expressions, involve known and unknown risks and uncertainties. Such forward-looking statements, based upon the current beliefs and expectations of Hollysys’ management, are subject to risks and uncertainties, which could cause actual results to differ from the forward looking statements. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the Company’s reports that are filed with the Securities and Exchange Commission and available on its website (http://www.sec.gov). All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not assume a duty to update these forward-looking statements.

For further information, please contact:

Hollysys Automation Technologies Ltd.

www.hollysys.com

+8610-58981386

investors@hollysys.com

|

HOLLYSYS AUTOMATION TECHNOLOGIES LTD.

|

|

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

|

|

(In USD thousands except for number of shares and per share data)

|

|

|

|

Three months ended

|

|

Fiscal year ended

|

|

|

June 30,

|

|

June 30,

|

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

Net revenues

|

|

|

|

|

|

|

|

|

|

Integrated solutions contracts revenue

|

$

|

149,292

|

$

|

126,237

|

$

|

573,567

|

$

|

460,180

|

|

Products sales

|

|

11,823

|

|

7,098

|

|

38,486

|

|

28,667

|

|

Revenue from services

|

|

21,000

|

|

25,429

|

|

95,409

|

|

104,619

|

|

Total net revenues

|

|

182,115

|

|

158,764

|

|

707,462

|

|

593,466

|

|

|

|

|

|

|

|

|

|

|

Costs of integrated solutions contracts

|

|

108,866

|

|

91,142

|

|

422,236

|

|

336,471

|

|

Cost of products sold

|

|

2,913

|

|

1,115

|

|

10,247

|

|

5,293

|

|

Costs of services rendered

|

|

9,001

|

|

6,448

|

|

35,622

|

|

33,423

|

|

Gross profit

|

|

61,335

|

|

60,059

|

|

239,357

|

|

218,279

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Selling

|

|

10,863

|

|

9,601

|

|

45,301

|

|

35,197

|

|

General and administrative

|

|

23,323

|

|

30,260

|

|

80,241

|

|

69,982

|

|

Research and development

|

|

16,629

|

|

14,194

|

|

69,580

|

|

55,954

|

|

VAT refunds and government subsidies

|

|

(8,600)

|

|

(9,653)

|

|

(30,309)

|

|

(30,099)

|

|

Total operating expenses

|

|

42,215

|

|

44,402

|

|

164,813

|

|

131,034

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

19,120

|

|

15,657

|

|

74,544

|

|

87,245

|

|

|

|

|

|

|

|

|

|

|

Other income, net

|

|

256

|

|

6,863

|

|

2,185

|

|

10,449

|

|

Foreign exchange gain (loss)

|

|

4,000

|

|

(942)

|

|

1,789

|

|

(6,219)

|

|

Gains on disposal of an investment in an equity investee

|

|

–

|

|

–

|

|

7,995

|

|

–

|

|

Losses on disposal of subsidiaries

|

|

–

|

|

–

|

|

(3)

|

|

–

|

|

Gains on disposal of an investment in securities

|

|

–

|

|

3,323

|

|

–

|

|

3,323

|

|

Impairment loss of investments in cost investees

|

|

(773)

|

|

–

|

|

(773)

|

|

–

|

|

Share of net income (loss) of equity investees

|

|

1,280

|

|

(1,331)

|

|

1,838

|

|

604

|

|

Dividend income from investments in securities

|

|

|

|

456

|

|

85

|

|

912

|

|

Interest income

|

|

3,363

|

|

4,278

|

|

12,698

|

|

14,131

|

|

Interest expenses

|

|

(141)

|

|

(125)

|

|

(731)

|

|

(553)

|

|

Income before income taxes

|

|

27,105

|

|

28,179

|

|

99,627

|

|

109,892

|

|

|

|

|

|

|

|

|

|

|

Income taxes expenses

|

|

3,928

|

|

6,317

|

|

16,634

|

|

20,554

|

|

Net income

|

|

23,177

|

|

21,862

|

|

82,993

|

|

89,338

|

|

|

|

|

|

|

|

|

|

|

Less: Net income (loss) attributable to non-controlling interests

|

155

|

|

(75)

|

|

(189)

|

|

(371)

|

|

Net income attributable to Hollysys Automation

\Technologies Ltd.

|

$

|

23,022

|

$

|

21,937

|

$

|

83,182

|

$

|

89,709

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income, net of tax of nil

|

|

|

|

|

|

|

|

|

Translation adjustments

|

|

(67,103)

|

|

18,280

|

|

(46,590)

|

|

96,577

|

|

Comprehensive (loss) income

|

|

(43,926)

|

|

40,142

|

|

36,403

|

|

185,915

|

|

|

|

|

|

|

|

|

|

|

Less: comprehensive income (loss) attributable to non-

controlling interests

|

64

|

|

(12)

|

|

(1,310)

|

|

(125)

|

|

Comprehensive (loss) income attributable to Hollysys

Automation Technologies Ltd.

|

$

|

(43,990)

|

$

|

40,154

|

$

|

37,713

|

$

|

186,040

|

|

|

|

|

|

|

|

|

|

|

Net income per ordinary share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

0.38

|

|

0.36

|

|

1.36

|

|

1.48

|

|

Diluted

|

|

0.37

|

|

0.36

|

|

1.35

|

|

1.46

|

|

Shares used in net income per share computation:

|

|

|

|

|

|

|

|

|

|

Basic

|

61,195,317

|

|

60,698,727

|

|

61,007,506

|

|

60,566,709

|

|

Diluted

|

61,788,905

|

|

61,025,425

|

|

61,568,176

|

|

61,513,749

|

|

|

|

|

|

|

|

|

|

HOLLYSYS AUTOMATION TECHNOLOGIES LTD.

|

|

CONSOLIDATED BALANCE SHEETS

|

|

(In USD thousands except for number of shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

March 31,

|

|

|

|

|

2022

|

|

2022

|

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

ASSETS

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

679,754

|

$

|

669,799

|

|

|

Short-term investments

|

|

12,203

|

|

44,085

|

|

|

Restricted cash

|

|

38,486

|

|

36,298

|

|

|

Accounts receivable, net of allowance for credit losses of $77,603 and $76,061 as

of June 30, 2022 and March 31, 2022, respectively

|

|

317,763

|

|

360,589

|

|

|

Costs and estimated earnings in excess of billings, net of allowance for credit losses

of $12,178 and $11,077 as of June 30, 2022 and March 31, 2022, respectively

|

|

228,877

|

|

220,645

|

|

|

Accounts receivable retention

|

|

6,005

|

|

6,002

|

|

|

Other receivables, net of allowance for credit losses of $12,449 and $15,798 as of

June 30, 2022 and March 31, 2022, respectively

|

|

26,100

|

|

28,734

|

|

|

Advances to suppliers

|

|

33,851

|

|

32,348

|

|

|

Amounts due from related parties

|

|

27,360

|

|

21,064

|

|

|

Inventories

|

|

91,243

|

|

89,175

|

|

|

Prepaid expenses

|

|

667

|

|

756

|

|

|

Income tax recoverable

|

|

258

|

|

164

|

|

Total current assets

|

|

1,462,567

|

|

1,509,659

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

Restricted cash

|

|

787

|

|

6,026

|

|

|

Costs and estimated earnings in excess of billings

|

|

3,021

|

|

2,648

|

|

|

Accounts receivable retention

|

|

6,561

|

|

5,850

|

|

|

Prepaid expenses

|

|

1

|

|

2

|

|

|

Property, plant and equipment, net

|

|

98,249

|

|

97,700

|

|

|

Prepaid land leases

|

|

12,447

|

|

13,135

|

|

|

Intangible assets, net

|

|

10,742

|

|

11,767

|

|

|

Investments in equity investees

|

|

46,581

|

|

42,152

|

|

|

Investments securities

|

|

1,693

|

|

2,576

|

|

|

Goodwill

|

|

20,539

|

|

20,822

|

|

|

Deferred tax assets

|

|

4,540

|

|

16,186

|

|

|

Operating lease right-of-use assets

|

|

4,045

|

|

4,447

|

|

Total non-current assets

|

|

209,206

|

|

223,311

|

|

Total assets

|

|

1,671,773

|

|

1,732,970

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

Short-term bank loans

|

|

66

|

|

–

|

|

|

Current portion of long-term loans

|

|

15,210

|

|

15,346

|

|

|

Accounts payable

|

|

173,953

|

|

176,849

|

|

|

Construction costs payable

|

|

92

|

|

98

|

|

|

Deferred revenue

|

|

206,222

|

|

211,593

|

|

|

Accrued payroll and related expenses

|

|

23,535

|

|

17,878

|

|

|

Income tax payable

|

|

4,509

|

|

9,068

|

|

|

Warranty liabilities

|

|

3,280

|

|

6,814

|

|

|

Other tax payables

|

|

11,587

|

|

4,443

|

|

|

Accrued liabilities

|

|

37,282

|

|

36,051

|

|

|

Amounts due to related parties

|

|

6,299

|

|

2,250

|

|

|

Other liability

|

|

3

|

|

3

|

|

|

Operating lease liabilities

|

|

2,518

|

|

2,224

|

|

Total current liabilities

|

|

484,556

|

|

482,617

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

Accrued liabilities

|

|

3,349

|

|

2,047

|

|

|

Long-term loans

|

|

434

|

|

523

|

|

|

Accounts payable

|

|

1,556

|

|

1,338

|

|

|

Deferred tax liabilities

|

|

12,966

|

|

13,600

|

|

|

Warranty liabilities

|

|

1,722

|

|

2,618

|

|

|

Operating lease liabilities

|

|

1,282

|

|

1,912

|

|

|

Other liability

|

|

80

|

|

76

|

|

Total non-current liabilities

|

|

21,389

|

|

22,114

|

|

Total liabilities

|

|

505,945

|

|

504,731

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

–

|

|

–

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

Ordinary shares, par value $0.001 per share, 100,000,000 shares authorized;

61,962,449 shares and 61,962,249 shares issued and outstanding as of June 30,

2022 and March 31, 2022, respectively

|

|

62

|

|

62

|

|

|

Additional paid-in capital

|

|

243,476

|

|

242,149

|

|

|

Statutory reserves

|

|

77,263

|

|

64,978

|

|

|

Retained earnings

|

|

857,141

|

|

866,215

|

|

|

Accumulated other comprehensive income

|

|

(12,655)

|

|

54,358

|

|

Total Hollysys Automation Technologies Ltd. stockholder’s equity

|

|

1,165,287

|

|

1,227,762

|

|

|

Non-controlling interests

|

|

541

|

|

477

|

|

Total equity

|

|

1,165,828

|

|

1,228,239

|

|

Total liabilities and equity

|

$

|

1,671,773

|

$

|

1,732,970

|

|

HOLLYSYS AUTOMATION TECHNOLOGIES LTD

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(In USD thousands).

|

|

|

|

|

Three months ended

|

|

Fiscal year ended

|

|

June 30, 2022

|

|

June 30, 2022

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

Cash flows from operating activities:

|

|

|

|

|

|

Net income

|

$

|

23,177

|

$

|

82,993

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

Depreciation of property, plant and equipment

|

|

2,568

|

|

10,263

|

|

Amortization of prepaid land leases

|

|

70

|

|

382

|

|

Amortization of intangible assets

|

|

311

|

|

1,356

|

|

Allowance for credit losses

|

|

7,411

|

|

16,122

|

|

Gains on disposal of property, plant and equipment

|

|

(52)

|

|

(75)

|

|

Share of net income of equity investees

|

|

(1,280)

|

|

(1,838)

|

|

Share-based compensation expenses

|

|

1,327

|

|

9,709

|

|

Deferred income tax expenses

|

|

10,981

|

|

4,179

|

|

Losses on disposal of subsidiaries

|

|

3

|

|

3

|

|

Impairment loss on investment in a cost investee

|

|

773

|

|

773

|

|

Gains on disposal of an investment in an equity investee

|

|

25

|

|

(7,995)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Accounts receivable and retention

|

|

12,682

|

|

(11,807)

|

|

Costs and estimated earnings in excess of billings

|

|

(20,444)

|

|

(39,839)

|

|

Inventories

|

|

(6,636)

|

|

(40,007)

|

|

Advances to suppliers

|

|

(3,184)

|

|

(14,274)

|

|

Other receivables

|

|

1,251

|

|

(3,425)

|

|

Prepaid expenses

|

|

80

|

|

257

|

|

Due from related parties

|

|

(8,528)

|

|

4,903

|

|

Accounts payable

|

|

5,570

|

|

28,470

|

|

Deferred revenue

|

|

5,541

|

|

19,221

|

|

Accruals and other payables

|

|

(146)

|

|

(16,417)

|

|

Due to related parties

|

|

4,049

|

|

4,638

|

|

Income tax payable

|

|

(4,373)

|

|

1,423

|

|

Other tax payables

|

|

7,650

|

|

5,511

|

|

Net cash provided by operating activities

|

|

38,826

|

|

54,526

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

Purchases of short-term investments

|

|

(6,937)

|

|

(64,383)

|

|

Purchases of property, plant and equipment

|

|

(7,291)

|

|

(26,369)

|

|

Proceeds from disposal of a subsidiary

|

|

–

|

|

3,797

|

|

Proceeds from disposal of property, plant and equipment

|

|

63

|

|

140

|

|

Maturity of short-term investments

|

|

37,813

|

|

100,562

|

|

Investment of an equity investee

|

|

–

|

|

(1,261)

|

|

Proceeds received from disposal of equity investments

|

|

–

|

|

9,497

|

|

Acquisition of a subsidiary, net of cash acquired

|

|

–

|

|

(8,726)

|

|

Net cash provided by investing activities

|

|

23,648

|

|

13,257

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

Proceeds from short-term bank loans

|

|

68

|

|

128

|

|

Repayments of short-term bank loans

|

|

1

|

|

(59)

|

|

Proceeds from long-term bank loans

|

|

537

|

|

876

|

|

Repayments of long-term bank loans

|

|

(151)

|

|

(673)

|

|

Payment of dividends

|

|

(19,828)

|

|

(19,828)

|

|

Net cash used in financing activities

|

|

(19,373)

|

|

(19,556)

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes

|

|

(36,197)

|

|

(24,747)

|

|

Net increase in cash, cash equivalents and restricted cash

|

$

|

6,904

|

|

23,480

|

|

|

|

|

|

|

|

Cash, cash equivalents and restricted cash, beginning of period

|

$

|

712,123

|

|

695,547

|

|

Cash, cash equivalents and restricted cash, end of period

|

|

719,027

|

|

719,027

|

Non-GAAP Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, in evaluating our results, we use the following non-GAAP financial measures: non-GAAP gross profit and non-GAAP gross margin, non-GAAP gross profit and non-GAAP gross margin of integrated solutions contracts, non-GAAP net income attributable to Hollysys Automation Technologies Ltd., as well as non-GAAP basic and diluted earnings per share.

These non-GAAP financial measures serve as additional indicators of our operating performance and not as any replacement for other measures in accordance with U.S. GAAP. We believe these non-GAAP measures help identify underlying trends in the Company’s business that could otherwise be distorted by the effect of the share-based compensation expenses, which are calculated based on the number of shares or options granted and the fair value as of the grant date, and amortization of acquired intangible assets. They will not result in any cash inflows or outflows. We believe that using non-GAAP measures help our shareholders to have a better understanding of our operating results and growth prospects.

Non-GAAP gross profit and non-GAAP gross margin, non-GAAP gross profit and non-GAAP gross margin of integrated solutions contracts, non-GAAP net income attributable to Hollysys Automation Technologies Ltd., as well as non-GAAP basic and diluted earnings per share should not be considered in isolation or construed as an alternative to gross profit and gross margin, gross profit and gross margin of integrated solutions contracts, net income attributable to Hollysys Automation Technologies Ltd., basic and diluted earnings per share, or any other measure of performance, or as an indicator of the Company’s operating performance. Investors are encouraged to review the historical non-GAAP financial measures to the most directly comparable GAAP measures. Non-GAAP gross profit and gross margin, non-GAAP gross profit and non-GAAP gross margin of integrated solutions contracts, non-GAAP net income attributable to Hollysys Automation Technologies Ltd., as well as non-GAAP basic and diluted earnings per share presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to the Company’s data. The Company encourages investors and others to review the Company’s financial information in its entirety and not rely on a single financial measure.

We define non-GAAP gross profit and non-GAAP gross margin as gross profit and gross margin, respectively, adjusted to exclude non-cash amortization of acquired intangibles. The following table provides a reconciliation of our gross profit and gross margin to non-GAAP gross profit and non-GAAP gross margin for the periods indicated.

|

(In USD thousands, except for %)

|

|

|

|

Three months ended

|

|

Fiscal year ended

|

|

|

|

June 30,

|

|

June 30,

|

|

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

$

|

61,335

|

$

|

60,059

|

$

|

239,357

|

$

|

218,279

|

|

Gross margin(1)

|

|

33.7 %

|

|

37.8 %

|

|

33.8 %

|

|

36.8 %

|

|

Add:

|

|

|

|

|

|

|

|

|

|

Amortization of acquired intangible assets

|

|

353

|

|

90

|

|

1,356

|

|

316

|

|

Non-GAAP gross profit

|

$

|

61,688

|

$

|

60,149

|

$

|

240,713

|

$

|

218,595

|

|

Non-GAAP gross margin(2)

|

|

33.9 %

|

|

37.9 %

|

|

34.0 %

|

|

36.8 %

|

|

|

|

|

|

|

|

|

|

|

__________

|

(1) Gross margin represents gross profit for the period as a percentage of revenues for such period.

|

|

(2) Non-GAAP gross margin represents non-GAAP gross profit for the period as a percentage of revenues for such period.

|

We define non-GAAP gross profit and non-GAAP gross margin of integrated solutions contracts as gross profit and gross margin of integrated solutions contracts, respectively, adjusted to exclude non-cash amortization of acquired intangibles associated with integrated solutions contracts. The following table provides a reconciliation of the gross profit of integrated solutions contracts to non-GAAP gross profit and non-GAAP gross margin of integrated solutions contracts for the periods indicated.

|

(In USD thousands, except for %)

|

|

|

Three months ended June 30,

|

|

Fiscal year ended June 30,

|

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

Gross profit of integrated

solutions contracts

|

$

|

40,426

|

$

|

35,095

|

$

|

151,331

|

$

|

123,709

|

|

Gross margin of integrated

solutions contracts(1)

|

|

27.1 %

|

|

27.8 %

|

|

26.4 %

|

|

26.9 %

|

|

|

|

|

|

|

|

|

|

|

Add:

Amortization of acquired intangible

assets

|

|

353

|

|

90

|

|

1,356

|

|

316

|

|

Non-GAAP gross profit of

integrated solutions contracts

|

$

|

40,779

|

$

|

35,185

|

$

|

152,687

|

$

|

124,025

|

|

Non-GAAP gross margin of

integrated solutions contracts(2)

|

|

27.3 %

|

|

27.9 %

|

|

26.6 %

|

|

27.0 %

|

__________

|

(1) Gross margin of integrated solutions contracts represents gross profit of integrated solutions contracts for the period as a percentage of integrated solutions contracts revenue for such period.

|

|

(2) Non-GAAP gross margin of integrated solutions contracts represents non-GAAP gross profit of integrated solutions contracts for the period as a percentage of integrated solutions contracts revenue for such period.

|

We define non-GAAP net income attributable to Hollysys as net income attributable to Hollysys adjusted to exclude the share-based compensation expenses and non-cash amortization of acquired intangible assets. The following table provides a reconciliation of net income attributable to Hollysys to non-GAAP net income attributable to Hollysys for the periods indicated.

|

(In USD thousands)

|

|

|

|

Three months ended

|

|

Fiscal year ended

|

|

|

|

June 30,

|

|

June 30,

|

|

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Hollysys Automation

Technologies Ltd.

|

$

|

23,022

|

$

|

21,937

|

$

|

83,182

|

$

|

89,709

|

|

Add:

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses

|

|

1,327

|

|

6,036

|

|

9,709

|

|

9,724

|

|

Amortization of acquired intangible assets

|

|

353

|

|

90

|

|

1,356

|

|

316

|

|

Non-GAAP net income attributable to Hollysys

Automation Technologies Ltd.

|

$

|

24,702

|

$

|

28,063

|

$

|

94,247

|

$

|

99,749

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP basic (or diluted) earnings per share represents non-GAAP net income attributable to Hollysys divided by the weighted average number of ordinary shares outstanding during the periods (or on a diluted basis). The following table provides a reconciliation of our basic (or diluted) earnings per share to non-GAAP basic (or diluted) earnings per share for the periods indicated.

|

(In USD thousands, except for number of shares and per share data)

|

|

|

|

Three months ended

|

|

Fiscal year ended

|

|

|

|

June 30,

|

|

June 30,

|

|

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Hollysys

Automation Technologies Ltd.

|

$

|

23,022

|

$

|

21,937

|

$

|

83,182

|

$

|

89,709

|

|

Add:

|

|

|

|

|

|

|

|

|

|

Share-based compensation expenses

|

|

1,327

|

|

6,036

|

|

9,709

|

|

9,724

|

|

Amortization of acquired intangible assets

|

|

353

|

|

90

|

|

1,356

|

|

316

|

|

Non-GAAP net income attributable to

Hollysys Automation Technologies

Ltd.

|

$

|

24,702

|

$

|

28,063

|

$

|

94,247

|

$

|

99,749

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of basic ordinary

shares

|

|

61,195,317

|

|

60,698,727

|

|

61,007,506

|

|

60,566,709

|

|

Weighted average number of diluted ordinary

shares

|

|

61,788,905

|

|

61,025,425

|

|

61,568,176

|

|

61,513,749

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share(1)

|

$

|

0.38

|

$

|

0.36

|

$

|

1.36

|

$

|

1.48

|

|

Add:

Non-GAAP adjustments to net income per

share(2)

|

|

0.02

|

|

0.10

|

|

0.18

|

|

0.17

|

|

Non-GAAP basic earnings per share(3)

|

$

|

0.40

|

$

|

0.46

|

$

|

1.54

|

$

|

1.65

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share(1)

|

$

|

0.37

|

$

|

0.36

|

$

|

1.35

|

$

|

1.46

|

|

Add:

Non-GAAP adjustments to net income per

share(2)

|

|

0.03

|

|

0.10

|

|

0.18

|

|

0.16

|

|

Non-GAAP diluted earnings per share(3)

|

$

|

0.40

|

$

|

0.46

|

$

|

1.53

|

$

|

1.62

|

|

|

|

|

|

|

|

|

|

|

|

|

________

|

(1) Basic (or diluted) earnings per share is derived from net income attributable to ordinary shareholders for computing basic (or diluted) earnings per share divided by weighted average number of shares (or on a diluted basis).

|

|

(2) Non-GAAP adjustments to net income per share are derived from non-GAAP adjustments to net income divided by weighted average number of shares (or on a diluted basis).

|

|

(3) Non-GAAP basic (or diluted) earnings per share is derived from non-GAAP net income attributable to ordinary shareholders for computing non-GAAP basic (or diluted) earnings per share divided by weighted average number of shares (or on a diluted basis).

|

View original content:https://www.prnewswire.com/news-releases/hollysys-automation-technologies-reports-unaudited-financial-results-for-the-fiscal-year-and-the-fourth-quarter-ended-june-30-2022-301604882.html

View original content:https://www.prnewswire.com/news-releases/hollysys-automation-technologies-reports-unaudited-financial-results-for-the-fiscal-year-and-the-fourth-quarter-ended-june-30-2022-301604882.html

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/thailands-first-communication-satellite-production-by-mu-space-corp-passes-the-international-standard-test-by-gistda-301604975.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/thailands-first-communication-satellite-production-by-mu-space-corp-passes-the-international-standard-test-by-gistda-301604975.html