|

Chip industry to add 38 new 300mm fabs by 2024

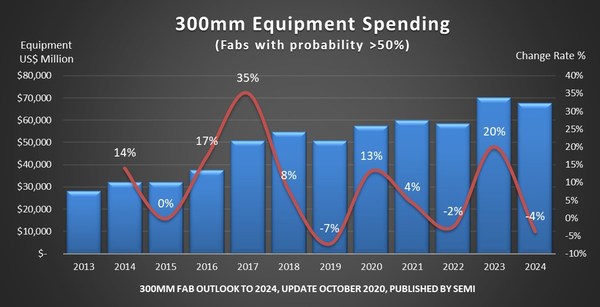

MILPITAS, California, Nov. 3, 2020 — 300mm fab investments in 2020 will grow by 13% year-over-year (YoY) to eclipse the previous record high set in 2018 and log another banner year for the semiconductor industry in 2023, SEMI reported today in its 300mm Fab Outlook to 2024. The COVID-19 pandemic has sparked the 2020 surge in fab spending by accelerating digital transformations worldwide, and the increase is expected to stretch into 2021.

Powering the growth is rising demand for cloud services, servers, laptops, gaming and healthcare technology. Fast-evolving technologies such as 5G, Internet of Things (IoT), automotive, artificial intelligence (AI) and machine learning that continue to fuel demand for greater connectivity, large data centers and big data are also behind the increase.

"The COVID-19 pandemic is accelerating a digital transformation sweeping across nearly every industry imaginable to reshape the way we work and live," said Ajit Manocha, SEMI president and CEO. "The projected record spending and 38 new fabs reinforce the role of semiconductors as the bedrock of leading-edge technologies that are driving this transformation and promise to help solve some of the world’s greatest challenges."

Growth in semiconductor fab investments will continue in 2021 but at a slower rate of 4% YoY. Mirroring previous industry cycles, the report also predicts a mild slowdown in 2022 and another slight downturn in 2024 following a $70 billion record high in 2023. See figure 1.

Adding 38 New 300mm Fabs

The SEMI 300mm Fab Outlook to 2024 shows the chip industry adding at least 38 new 300mm volume fabs from 2020 to 2024, a conservative projection that does not factor in low-probability or rumored fab projects. During the same period, per-month fab capacity will grow by about 1.8 million wafers to reach over 7 million. See figure 2.

Under a high-probability project forecast, the industry will add at least 38 new 300mm volume fabs from 2019 to 2024. Taiwan will add 11 volume fabs and Mainland China eight to account for half of the total. The chip industry will command 161 300mm volume fabs by 2024.

Capacity and Spending Growth by Region

Mainland China will rapidly increase its global share of 300mm capacity, from 8% in 2015 to 20% in 2024, reaching 1.5 million 300mm wpm in the final year of the reporting period. While non-Chinese companies will account for a substantial portion of that growth, Chinese-owned organizations are accelerating their capacity investments. These companies will represent about 43% of Mainland China’s fab capacity in 2020, a proportion expected to reach 50% by 2022 and 60% by 2024.

Japan’s share of 300mm installed capacity continues to trend downward, from 19% in 2015 to 12% in 2024. The Americas’ share is also ticking lower, from 13% in 2015 to a projected 10% in 2024.

The biggest regional spenders will be Korea, with investments between US$15 billion and US$19 billion, followed by Taiwan, which will pour between US$14 billion and US$17 billion into 300mm fabs, and then Mainland China, with between US$11 billion and $13 billion in investments.

Regions spending less will see the steepest increases in investments between 2020 to 2024. Europe/Mideast will lead the pack with impressive 164% growth, followed by Southeast Asia at 59%, Americas at 35%, and Japan at 20%.

Spending Growth by Product Sector

Memory accounts for the bulk of the increase in 300mm fab spending. Actual and forecast investments show a steady rise in the upper single digits for each year from 2020 to 2023, with a stronger increase of 10% in store for 2024.

DRAM and 3D NAND contributions to 300mm fab spending will be uneven from 2020 to 2024. Investments for logic/MPU, however, will see steady improvement from 2021 to 2023. Power-related devices will be the standout sector in 300mm fab investments, with over 200% growth in 2021 and double-digit increases in 2022 and 2023.

Tracking 286 fabs and lines from 2013 to 2024, the 300mm Fab Outlook to 2024 reflects 247 updates to 104 fabs, nine new fab and line listings, and two cancellations since the publication of the March 2020 report.

About SEMI

SEMI® connects more than 2,400 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA) and the MEMS & Sensors Industry Group (MSIG) are SEMI Strategic Association Partners, defined communities within SEMI focused on specific technologies. Visit www.semi.org to learn more, contact one of our worldwide offices, and connect with SEMI on LinkedIn and Twitter.

Association Contacts

Michael Hall/SEMI

Phone: 1.408.943.7988

Email: [email protected]

Christian G. Dieseldorff/SEMI

Phone: 1.408.943.7940

Email: [email protected]

Photo: https://techent.tv/wp-content/uploads/2020/11/300mm-fab-spending-to-boom-through-2023-with-two-record-highs-semi-reports.jpg

Logo: https://techent.tv/wp-content/uploads/2020/11/300mm-fab-spending-to-boom-through-2023-with-two-record-highs-semi-reports-2.jpg

Related Links :

http://www.semi.org