Uncover how GX Bank is transforming the financial landscape through its Impian GIGih initiative, focused on the Gig economy and the B40 segment.

GXBank is Now Open to All Malaysians

The new GXBank Berhad app is officially launched – Malaysia’s first digital bank! User-friendly and accessible banking experience with an innovative approach to revolutionize the financial landscape.

GXBank Quietly Unveils GX Debit Card with Unlimited 1% Cashback

GXBank has quietly unveiled its GX Debit Card on its official website highlighting key features like an unlimited 1% cashback.

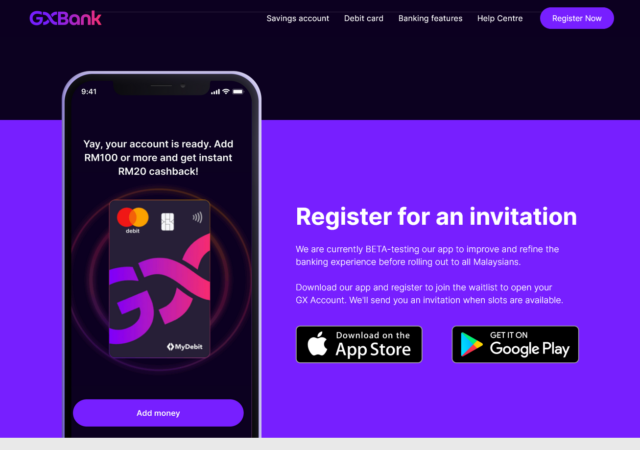

GX Bank Beta App Now Available to Select Malaysians

GX Bank Berhad’s user-centric app prioritizing trust and security, in compliance with regulatory norms, is here to serve you. Get the app and 24/7 customer support today!