Digitisation an organization shouldn’t be solely dependent on developers, Ramesh Nanda Kumar from Kissflow highlights how “Citizen Development” may be the key.

Navigating the Transformation Paths in the Architecture, Engineering, and Construction (AEC) Industry

Intuitive design software and earth-friendly material are part of the AEC industry evolution. Keeping up with the times with architecture key.

Back to Normal Comes with Recruitment Woes & An Increasing Role for AI in SMEs

Post COVID, SMEs are finding it hard to compete for talent with MNCs. However, they can compete with the right technology and mindset.

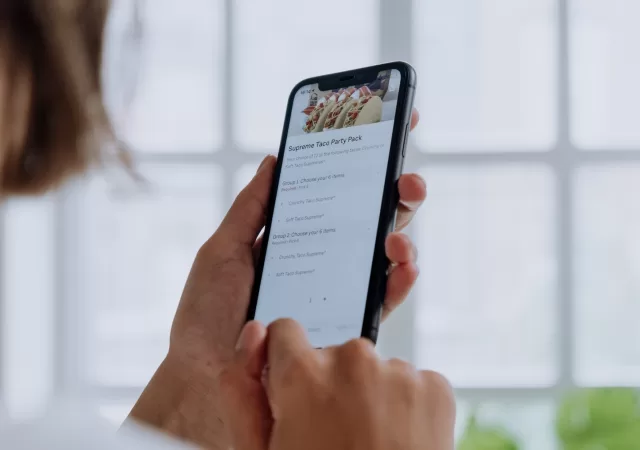

Thriving Forward: Embracing The Digital Lifeline of Restaurants for Continued Business Resilience And Growth

Delving into the food industry, understand how digitalisation is creating a necessity for survival and growth. See how foodpanda is navigating the adaptable landscape in Malaysia.

Recognizing Third-Party Risks & Addressing the Gaps with Identity-Based Security

FSIs and other organisations are facing increased exposure when it comes to third-party risk – an aspect of cybersecurity that has gone unnoticed.

Cisco Networking Academy Looks to Equip 141,000 Malaysians with Digital Skills

Cisco pledges to upskill 141,000 Malaysians over the next 10 years through its Networking Academy program with partnerships with Academia and more.

Cloud, 5G, Machine Learning & Space: Digital Trends Shaping the Future

The business world is being shaped by the adoption of cloud technologies as companies continue their digital transformation journeys. What comes next?

Digitization – The Key to Business Resilience During a Pandemic

Business resilience during the COVID-19 pandemic has been at the forefront of any executive’s mind. We speak to AWS to find out some of the hallmarks of businesses showing resilience.

CFO, CIO Collaboration Is Crucial For COVID-19 Era – And Beyond

With digitization being driven to new heights with the current pandemic, it has become even more crucial for C-level executives to be more collaborative especially when ti comes to the CFO and CIO.

Can cybersecurity keep up with flexible work arrangements?

As companies move to a remote workforce in light of the COVID-19 pandemic, they face an unprecedented cybersecurity risk as they are forced to widen their network. So what can companies do about it?