Getting insurance and Takaful coverage has long been a complex, mind boggling experience thanks to the multitudes of options and providers. insureKU is looking to simplify that process. The new startup is calling itself Malaysia’s first fully digital, end-to-end insurance and takaful aggregator. The company has officially launched its services, providing a platform for Malaysian consumers to compare, select, and purchase insurance and takaful plans online.

As an insurance aggregator, insureKU’s platform gathers and presents insurance products from various providers in one place, allowing consumers to easily compare options. The platform, which shares the same name, is developed in partnership with Censof Maal Sdn Bhd, a subsidiary of Censof Holdings Berhad. Its primary aim is to offer this service with a focus on user-friendliness. The development partnership leverages Censof Holdings Berhad’s extensive experience as a technology company specialising in financial management and solutions.

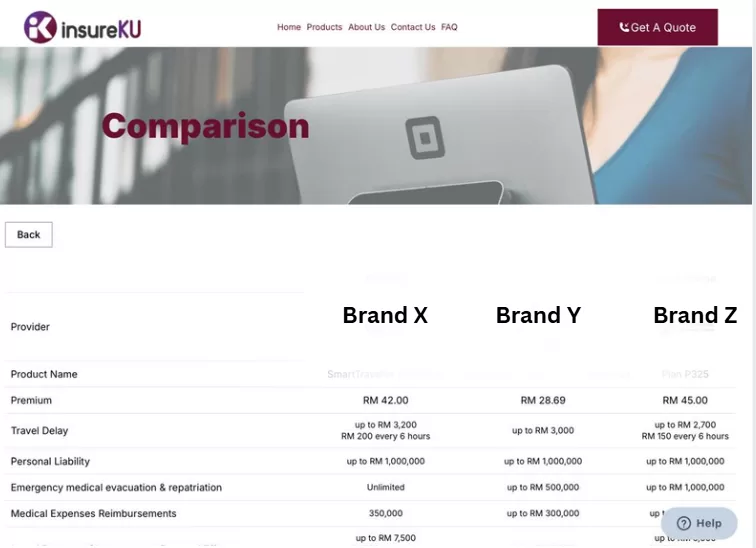

insureKU will initially feature travel insurance options, with plans to expand into other insurance categories later in the year. The platform’s comparison tool allows users to specify, identify, understand and purchase their specific travel insurance product in under three minutes. Initial insurance providers include Generali, Tokio Marine, and Tune Protect.

insureKU emphasizes its use of technology to provide an intuitive and empowering solution for consumers. As an early authorized participant in Bank Negara Malaysia’s Financial Technology Regulatory Sandbox, insureKU has undergone a year of development and testing.

insureKU aims to simplify the insurance process through education, comparison tools, and aggregated information, with the goal of offering competitive pricing by passing on savings to consumers. Upcoming features include multi-lingual support and financial planning tools such as the Need Analysis Calculator and Financial Budget Calculator.

To celebrate the service launch, insureKU is offering the first 100 customers who purchase travel insurance through the platform exclusive merchandise items.