GX Bank Berhad (GX Bank) is pushing boundaries as Malaysia’s first digital bank to go to market. The digital bank received approval to operate from Bank Negara Malaysia ahead of the April 2024 deadline. The bank focuses on serving the underserved through innovative channels, including a dedicated app and 24/7 customer support.

After its initial announcement back in September, GX Bank is already rolling out its official app in beta. The beta app is set to roll out to 20,000 Malaysians on November 14, 2023, following successful internal testing. GX Bank’s app is developed to be user-centric. The app comes with a user-friendly interface prioritizing trust and security. Chief Technology Officer Fadrizul Hasani emphasizes compliance with regulatory norms, ensuring user data and funds’ safety.

During beta-testing, users can create a GX Bank Savings Account and set up to 10 “Pockets” for specific savings goals. Money placed in these pockets will earn daily interest of up to 3%. Being the first digital bank to go to market, it may be daunting to be an early adopter. That said, deposits of up to RM250,000 in GX Bank are protected by Perbadanan Insurans Deposit Malaysia (PDIM). In addition, users are able to lock their accounts in case of fraud and limit daily spending. GX Bank is also offering exciting benefits including RM20 cashback with a minimum of RM100 deposit, withdrawal fee waivers, and unlimited cashback with the upcoming debit card feature.

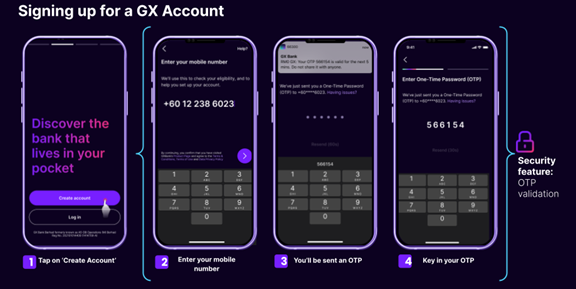

Simple Onboarding Process

GX Bank promises a seamless onboarding experience. With a few taps, users can download the app, complete the eKYC process, upload their MyKad, and deposit a minimum of RM10 to start saving.

To set up your account, all you need to do is:

- Download the app from the Google Play Store or Apple App Store

- Upload a digital copy of the national identity card (MyKad)

- Complete the eKYC process as stated in the app

- Add a minimum of RM10 into the savings account and set up Pockets (if you want to)

Existing Grab users can access the GX Bank app through the Grab App.