Maybank is ramping up its security measures to protect customers from unauthorized transactions and financial scams. The bank has introduced an additional verification process for its Secure2u authentication method used for online banking transactions on the MAE app and Maybank2u web.

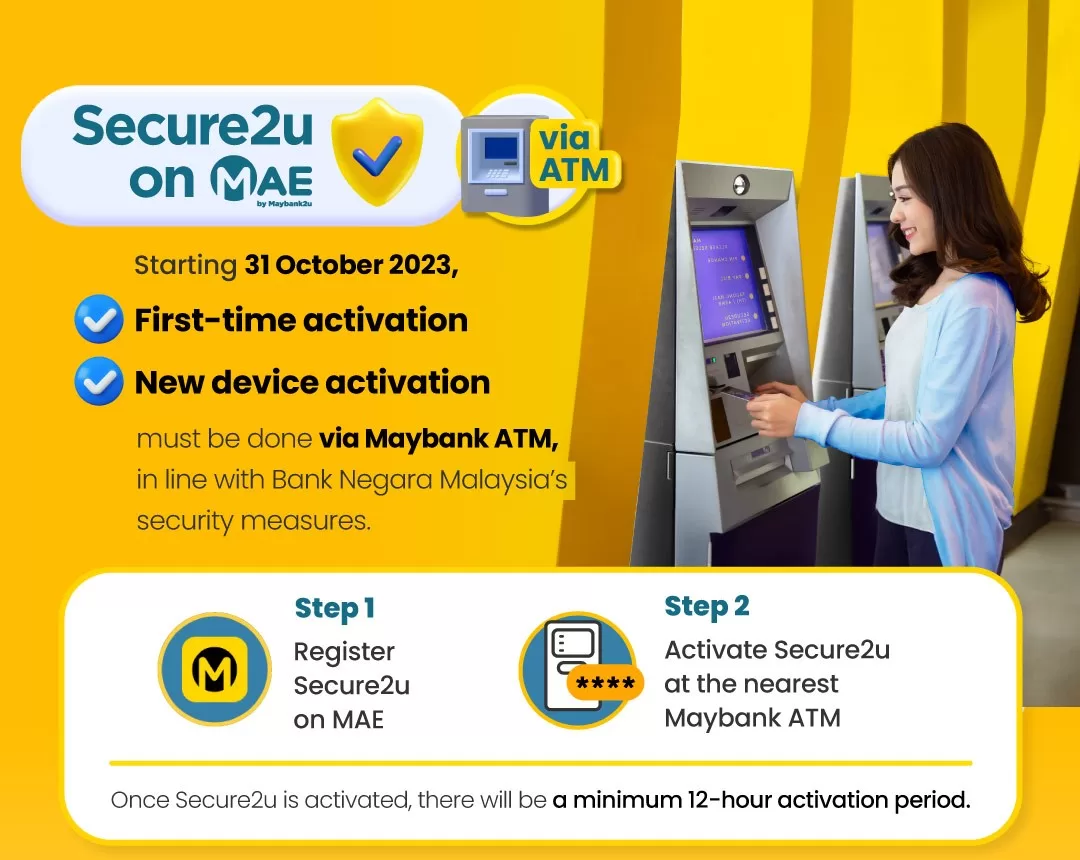

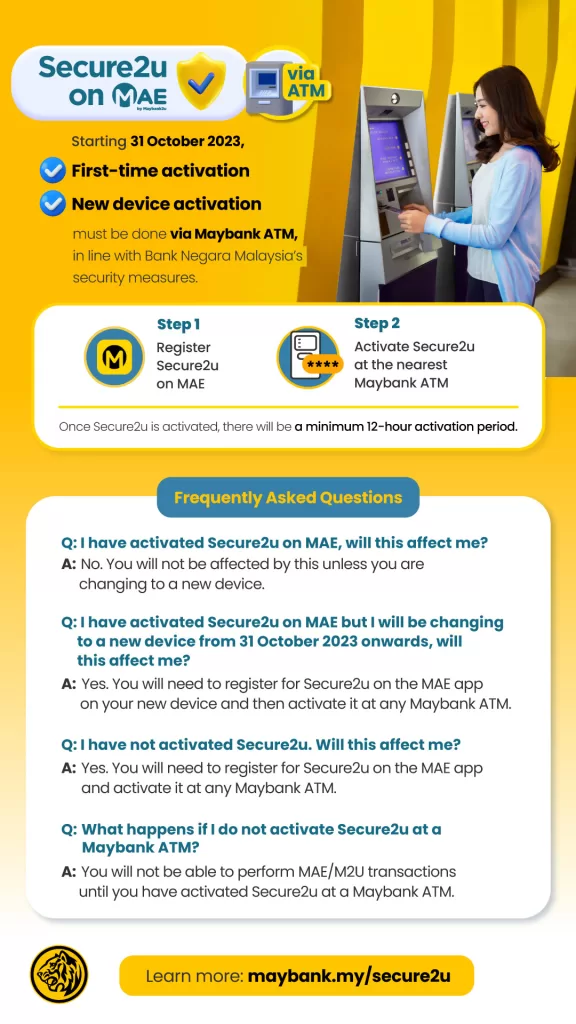

Starting October 31, 2023, first-time Secure2u users or those accessing it from a new device can securely activate it at any Maybank ATM across Malaysia. This new measure complements the five anti-scam measures introduced by the bank in July 2023.

Dato’ John Chong, Group CEO of Community Financial Services at Maybank, explained the significance of this initiative. He stated that allowing customers to self-activate Secure2u via an ATM enables them to physically verify their identity, giving them greater control over their online banking authorization process. This not only safeguards their accounts but also their finances from potential scammers.

The activation process is simple. Customers need to follow two steps:

- Register for Secure2u on the MAE app, and

- Activate Secure2u using their debit, credit, or charge card PIN number at any of Maybank’s 3,000 ATMs nationwide.

Once activated via ATM, customers can begin approving transactions after a 12-hour wait period. The bank may adjust this cooling-off period based on scam trends and transaction patterns. This step ensures that customers have sole approval authority over their Secure2u registration, adding an extra layer of security.

Maybank’s extensive network of ATMs ensures easy access for customers. These ATMs operate from 6:00 AM to 12:00 AM daily and are strategically located in branches, service centres, shopping malls, petrol stations, train stations, hospitals, and more.

For a step-by-step guide on Secure2u activation and more information, visit maybank.my/secure2u.