Revenue and Net Profit Increased to $4.0 Million and $1.4 Million Respectively (Basic Earnings of $0.03 Per Share) with Technology-Driven Services Revenue Accounting for Approximately 43.8% of its Revenue

KUALA LUMPUR, Malaysia, Aug. 29, 2023 /PRNewswire/ — Starbox Group Holdings Ltd. (Nasdaq: STBX) (“Starbox” or the “Company”), a service provider of cash rebates, digital advertising, and payment solutions with a goal of becoming a comprehensive AI solutions provider within Southeast Asia, today announced its unaudited financial results for the six months ended March 31, 2023.

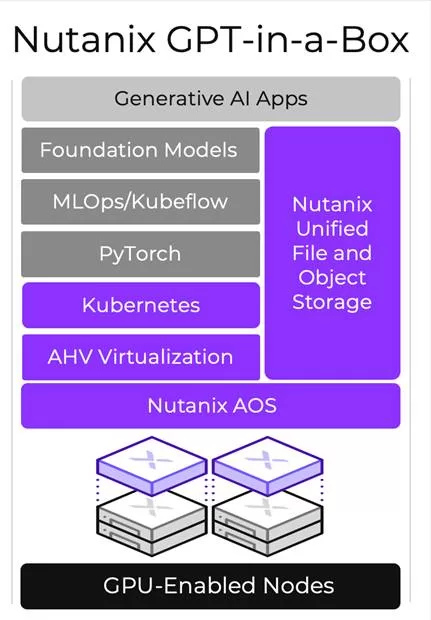

Mr. Lee Choon Wooi, Chairman and Chief Executive Officer of Starbox, commented, “We are excited about the results we have accomplished for the first half of fiscal year 2023, where we saw robust growth across almost every key financial metric. Our revenue and net income grew for the first half of fiscal year 2023, demonstrating the fruition of our earlier investments in technology and successful execution of our strategic initiatives, namely new technology-driven services revenue via licensing and/or sale of our technologies. Moving forward, we expect to channel our efforts into continuous technological innovation as we believe technology such as artificial intelligence will be one of our key drivers for revenue growth for the foreseeable future. We plan to keep investing in our artificial intelligence-generated content (AIGC) engine, which we believe will revolutionize how people visualize ideas and provide invaluable tools for businesses across industries. We aim to disrupt the industry with our applications of AI technologies, thereby solidifying our market position, and generating long-term value for our shareholders.”

First Half of Fiscal Year 2023 Financial Highlights

- Total revenue was $4.0 million for the six months ended March 31, 2023, an increase of 36.1% from $2.9 million for the same period of last year.

- Income from operations was $2.0 million for the six months ended March 31, 2023, an increase of 3.1% from $1.9 million for the same period of last year.

- Net income was $1.4 million for the six months ended March 31, 2023, an increase of 8.6% from $1.3 million for the same period of last year.

First Half of Fiscal Year 2023 Operational Highlights

- Number of advertisers was 22 during the six months ended March 31, 2023, compared to 42 during the six months ended March 31, 2022.

- Number of members on the GETBATS website and mobile app was 2,518,023 as of March 31, 2023, compared to 2,513,658 as of September 30, 2022.

- Number of merchants on the GETBATS website and mobile app was 832 as of March 31, 2023, compared to 820 as of September 30, 2022.

- Number of transactions facilitated through GETBATS website and mobile app was 161,306 during the six months ended March 31, 2023, compared to 188,718 during the six months ended March 31, 2022.

First Half 2023 Financial Results

Revenue

Total revenue was $4.0 million for the six months ended March 31, 2023, an increase of 36.1% from $2.9 million for the same period of last year. The increase in revenue was primarily due to increases in the revenue from our newly established software licensing service segment.

- Revenue from digital advertising service was $2.2 million for the six months ended March 31, 2023, which decreased by 23.7% from $2.9 million for the same period of last year. The decrease was due to decreases in the number of advertisers for our services in the six months ended March 31, 2023.

- Revenue from software licensing was $1.7 million for the six months ended March 31, 2023. The Company did not have revenue from software licensing for the same period of last year. On March 24, 2023, the Company’s wholly owned subsidiary, Starbox Technologies Sdn. Bhd., entered into a software licensing agreement with Brandavision Sdn Bhd, a Malaysia company (“Brandavision”). The Company will develop a comprehensive data management system for Brandavision, grant them the access to its vast database, help train the staff of Brandavision with respect to its use and provide continuous technical support.

- Revenue from cash rebate services was $10,621 for the six months ended March 31, 2023, which increased by 91.3% from $5,552 for the same period of last year. The increase was primarily due to an increase in the average cash rebate commission rate earned by the Company for the six months ended March 31, 2023 as compared to the six months ended March 31, 2022.

- Revenue from payment solution services was $4,303 for the six months ended March 31, 2023, which decreased by 20.0% from $5,379 for the same period of last year.

Operating Cost

Operating costs were $2.0 million for the six months ended March 31, 2023, which increased by 99.0% from $1.0 million for the same period of last year. The increase was primarily due to the following reasons:

- Salary and employee benefit expenses were $318,750 for the six months ended March 31, 2023, which increased by $122,846 from $195,904 for the same period of last year, primarily due to an increase in the number of employees from 17 for the six months ended March 31, 2022 to 25 for the six months ended March 31, 2023, in order to handle the increase in business activities associated with the Company’s digital advertising services, cash rebate services, and the newly expanded business in software licensing services.

- Marketing and promotional expenses were $209,564 for the six months ended March 31, 2023, which increased by $104,756 from $104,808 for the same period of last year, as a result of our increased marketing efforts to develop new merchants and advertisers for our services.

- License costs were $30,000 for the six months ended March 31, 2023, which increased by $4,941 from $25,059 for the same period of last year.

- Website and facility maintenance expenses were $147,345 for the six months ended March 31, 2023, which increased by $97,620 from $49,725 for the same period of last year, primarily because the Company incurred more costs to optimize and upgrade its IT system related to rebate calculation and AI calculation engine.

- Utility and office expenses were $251,563 million for the six months ended March 31, 2023, which increased by $194,784 from $56,779 for the same period of last year, primarily due to increased office insurance expenses and increased office supply expenses resulting from an increased number of staff.

- Depreciation and amortization expenses were $193,662 for the six months ended March 31, 2023, which increased by $149,515, from $44,147 for the same period of last year, mainly due to increased amortization of intangible assets.

- Business travel and entertainment expenses were $71,479 for the six months ended March 31, 2023, which increased by $53,957 from $17,522 for the same period of last year, due to the Company’s increased efforts to expand its business operations into local and neighboring countries.

- Others were $344,633 for the six months ended March 31, 2023, which increased by $304,175 from $40,458 for the same period of last year, primally due to (i) increased trademark expenses by $69,990 and (ii) increased bonus by $176,635.

Provision for Income Taxes

Provision for income taxes was $0.6 million for the six months ended March 31, 2023, which decreased by 5.4% from $0.7 million for the same period of last year.

Net Income

Net income was $1.4 million for the six months ended March 31, 2023, which increased by $0.1 million from $1.3 million for the same period of last year.

Basic Earnings per Share

Basic earnings per share was $0.03 for the six months ended March 31, 2023, compared to basic and diluted earnings per share of $0.03 for the same period of last year.

Balance Sheet

As of March 31, 2023, the Company had cash of $0.9 million, compared to $17.8 million as of September 30, 2022.

Cash Flow

Net cash used in operating activities was $12.1 million for the six months ended March 31, 2023, compared to net cash provided by operating activities of $1.5 million for the same period of last year.

Net cash used in investing activities was $17.9 million for the six months ended March 31, 2023, compared to $0.6 million for the same period of last year.

Net cash provided by financing activities was $11.8 million for the six months ended March 31, 2023, compared to net cash used in financing activities of $0.8 million for the same period of last year.

About Starbox Group Holdings Ltd.

Headquartered in Malaysia, Starbox Group Holdings Ltd. is a technology-driven, rapidly growing company with innovation as its focus. Starbox is aiming to be a comprehensive AI solutions provider within Southeast Asia and also engages in building a cash rebate, digital advertising, and payment solution business ecosystem targeting micro, small, and medium enterprises that lack the bandwidth to develop an in-house data management system for effective marketing. The Company connects retail merchants with retail shoppers to facilitate transactions through cash rebates offered by retail merchants on its GETBATS website and mobile app. The Company provides digital advertising services to advertisers through its SEEBATS website and mobile app, GETBATS website and mobile app and social media. The Company also provides payment solution services to merchants. For more information, please visit the Company’s website: https://ir.starboxholdings.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “approximates,” “assesses,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the U.S. Securities and Exchange Commission.

For more information, please contact:

Starbox Group Holdings Ltd.

Investor Relations

Department Email:

ir@starboxholdings.com

Ascent Investors Relations LLC

Tina Xiao

Phone: +1 917-609-0333

Email: tina.xiao@ascent-ir.com

|

STARBOX GROUP HOLDINGS LTD AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

As of

March 31, 2023

|

|

|

As of

September 30,

2022

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and equivalents

|

|

$

|

864,392

|

|

|

$

|

17,778,895

|

|

|

Accounts receivable, net

|

|

|

4,986,688

|

|

|

|

2,032,717

|

|

|

Prepaid income tax

|

|

|

552,094

|

|

|

|

–

|

|

|

Prepayments

|

|

|

14,448,012

|

|

|

|

4,269,611

|

|

|

Due from related parties

|

|

|

1,682

|

|

|

|

1,473

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

20,852,868

|

|

|

|

24,082,696

|

|

|

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

21,941

|

|

|

|

13,380

|

|

|

Intangible assets, net

|

|

|

18,824,416

|

|

|

|

903,768

|

|

|

Right-of-use assets, net

|

|

|

36,511

|

|

|

|

42,574

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

18,882,868

|

|

|

|

959,722

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

39,735,736

|

|

|

$

|

25,042,418

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Taxes payable

|

|

$

|

395,772

|

|

|

$

|

1,404,128

|

|

|

Deferred revenue

|

|

|

368,066

|

|

|

|

–

|

|

|

Accrued liabilities and other current liabilities

|

|

|

348,627

|

|

|

|

541,050

|

|

|

Operating lease liabilities, current

|

|

|

17,052

|

|

|

|

15,833

|

|

|

Due to related parties

|

|

|

1,409

|

|

|

|

7,361

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

1,130,926

|

|

|

|

1,968,372

|

|

|

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Deferred tax liabilities, net

|

|

|

318,603

|

|

|

|

–

|

|

|

Operating lease liabilities, non-current

|

|

|

19,459

|

|

|

|

26,741

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

338,062

|

|

|

|

26,741

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

1,468,988

|

|

|

|

1,995,113

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENT AND CONTINGENCY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Preferred shares, par value $0.001125, 5,000,000 shares

authorized, no shares issued and outstanding

|

|

|

–

|

|

|

|

–

|

|

|

Ordinary shares, par value $0.001125, 883,000,000 shares

authorized, 54,375,000 shares and 45,375,000 shares issued and

outstanding as of March 31, 2023 and September 30, 2022,

respectively

|

|

|

61,172

|

|

|

|

51,047

|

|

|

Additional paid in capital

|

|

|

30,674,988

|

|

|

|

18,918,303

|

|

|

Accumulated other comprehensive income (loss)

|

|

|

1,481,084

|

|

|

|

(607,052)

|

|

|

Retained earnings

|

|

|

6,049,504

|

|

|

|

4,685,007

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders’ equity

|

|

|

38,266,748

|

|

|

|

23,047,305

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

$

|

39,735,736

|

|

|

$

|

25,042,418

|

|

|

STARBOX GROUP HOLDINGS LTD AND SUBSIDIARIES

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

|

|

COMPREHENSIVE INCOME

|

|

|

|

SIX MONTHS ENDED MARCH 31,

|

|

|

|

2023

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

Operating revenue

|

|

|

|

|

|

|

|

|

|

Revenue from cash rebate services

|

|

$

|

10,621

|

|

|

$

|

5,552

|

|

|

Revenue from digital advertising services

|

|

|

2,220,794

|

|

|

|

2,911,482

|

|

|

Revenue from payment solution services

|

|

|

4,303

|

|

|

|

5,379

|

|

|

Revenue from software licensing

|

|

|

1,740,472

|

|

|

|

–

|

|

|

Total operating revenue

|

|

|

3,976,190

|

|

|

|

2,922,413

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expenses

|

|

|

1,996,892

|

|

|

|

1,003,373

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

1,996,892

|

|

|

|

1,003,373

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

1,979,298

|

|

|

|

1,919,040

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

7,757

|

|

|

|

–

|

|

|

Other income, net

|

|

|

5,163

|

|

|

|

203

|

|

|

Total other income, net

|

|

|

12,920

|

|

|

|

203

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax

|

|

|

1,992,218

|

|

|

|

1,919,243

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expenses

|

|

|

627,721

|

|

|

|

663,224

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

1,364,497

|

|

|

$

|

1,256,019

|

|

|

|

|

|

|

|

|

|

|

|

Other Comprehensive income

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss)

|

|

|

2,088,136

|

|

|

|

(9,188)

|

|

|

|

|

|

|

|

|

|

|

|

Total Comprehensive income

|

|

$

|

3,452,633

|

|

|

$

|

1,246,831

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share – basic

|

|

$

|

0.03

|

|

|

$

|

0.03

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding – basic

|

|

|

53,089,286

|

|

|

|

40,000,000

|

|

|

STARBOX GROUP HOLDINGS LTD AND SUBSIDIARIES

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

FOR SIX MONTHS ENDED MARCH

31,

|

|

|

|

2023

|

|

|

2022

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

1,364,497

|

|

|

$

|

1,256,019

|

|

|

Adjustments to reconcile net income to cash provided by (used in)

operating activities:

|

|

|

|

|

|

|

|

|

|

Disposal of fixed assets

|

|

|

2,928

|

|

|

|

–

|

|

|

Depreciation and amortization

|

|

|

253,662

|

|

|

|

69,147

|

|

|

Amortization of right-of-use operating lease assets

|

|

|

9,111

|

|

|

|

42,974

|

|

|

Change in deferred tax

|

|

|

313,963

|

|

|

|

–

|

|

|

Changes in operating assets / liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(2,809,804)

|

|

|

|

(1,326,333)

|

|

|

Prepaid income tax

|

|

|

(544,054)

|

|

|

|

–

|

|

|

Prepaid expenses and other current assets

|

|

|

(9,621,687)

|

|

|

|

(63,935)

|

|

|

Deferred revenue

|

|

|

362,706

|

|

|

|

579,355

|

|

|

Taxes payable

|

|

|

(1,063,540)

|

|

|

|

834,895

|

|

|

Operating lease liabilities

|

|

|

(9,111)

|

|

|

|

(42,974)

|

|

|

Accrued expenses and other current liabilities

|

|

|

(407,590)

|

|

|

|

177,101

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

(12,148,919)

|

|

|

|

1,526,249

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Purchase of fixed assets

|

|

|

(13,183)

|

|

|

|

(5,011)

|

|

|

Purchase of intangible assets

|

|

|

(17,864,000)

|

|

|

|

(626,420)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

(17,877,183)

|

|

|

|

(631,431)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Deferred initial public offering costs

|

|

|

–

|

|

|

|

(423,994)

|

|

|

Proceeds from equity financing

|

|

|

11,766,810

|

|

|

|

–

|

|

|

Increase in due from related party

|

|

|

(134)

|

|

|

|

–

|

|

|

Repayment of related party borrowings

|

|

|

(6,232)

|

|

|

|

(398,422)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

11,760,444

|

|

|

|

(822,416)

|

|

|

|

|

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE CHANGES ON CASH

|

|

|

1,351,155

|

|

|

|

(8,955)

|

|

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH & EQUIVALENTS

|

|

|

(16,914,503)

|

|

|

|

63,447

|

|

|

|

|

|

|

|

|

|

|

|

CASH & EQUIVALENTS, BEGINNING OF PERIOD

|

|

|

17,778,895

|

|

|

|

2,295,277

|

|

|

|

|

|

|

|

|

|

|

|

CASH & EQUIVALENTS, END OF PERIOD

|

|

|

864,392

|

|

|

|

2,358,724

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Cash Flow Data:

|

|

|

|

|

|

|

|

|

|

Income tax paid

|

|

$

|

2,011,188

|

|

|

$

|

–

|

|

|

Interest paid

|

|

$

|

–

|

|

|

$

|

–

|

|

Source: Starbox Group Holdings Ltd.