This article was written from a sit-down interview withYuval Ziv, President of Nuvei Corporation.

The world we know is ever-changing. With the advent of digital technologies and rapidly adapting legislation, it’s become even more challenging for businesses to grow across borders. Where it once was a matter of having an international website, it’s now a question of localisation and adaptation. This reality rings true even when handling international payments and transactions. However, companies like Nuvei provide a unique proposition of a single, modular interface to manage most, if not all, of the challenges of digitalisation when it comes to payments.

Paypal, VISA, iPay88, Stripe and even Apple Pay are some of the world’s most popular payment methods right now. However, when it comes to accepting these payment methods for businesses, it can be a long, tedious process. What’s more, there is also the added complication of regulatory compliance and knowing the lay of the land.

These hurdles don’t just delay global rollout and expansion. They, can, at times, be the factors that cause businesses and companies to lose momentum. In other words, they can be the straws that break the camel’s back. That said, a business’s aspirations should never be limited by uphill battles. Collaboration and onboarding of the right solutions will always be at the heart of any foolproof strategy. However, too many partners can also create more problems.

A Single Turnkey for Most Hurdles

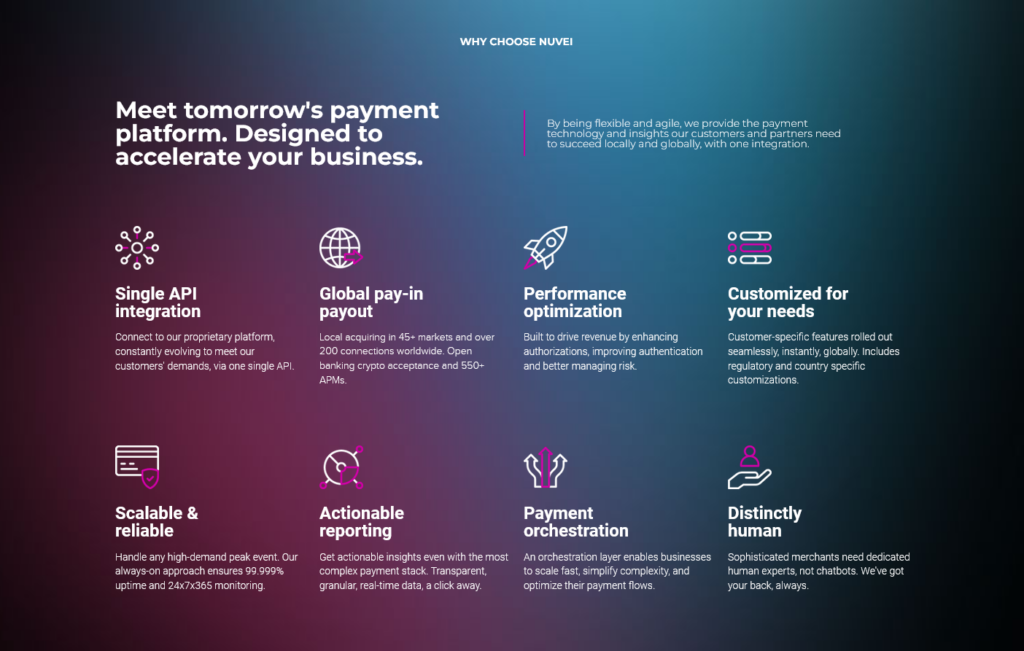

The need for a single turnkey solution is more than just apparent; it’s imperative. That’s where Nuvei has chosen to develop its single API which brings together everything businesses need when it comes to payment solutions. The API is continually being developed by their in-house team of developers as the company continues to grow even through acquisitions.

In fact, Nuvei has most recently acquired Paymentez, Mazooma and Simplex. These acquisitions expand the reach and scope of services offered by Nuvei. The added features and services that they bring will be integrated seamlessly into the existing Nuvei API. Businesses that have deployed the API will then get an update which will give them access to these new markets and services. The company’s internal development team allows them to have the agility needed to bring new products to market as well as the freedom to adapt near instantaneously. What’s more, its core platform remains unchanged and flexible throughout.

It is this agile and adaptable approach that makes a viable single turnkey solution. With a continually evolving marketplace and changing legislative environment, partners need to be able to help alleviate some of the burdens of business without becoming a burden themselves.

Payments are just the beginning

Let’s just face the hard truth, dealing with payments across markets can be a headache. Aside from legislative and technological hurdles, the biggest choice a company can make is which payment platform they choose to support. This reality changes from country to country and perhaps even from region to region within a country. There is no single answer that can accurately predict the proliferation of a payment gateway or service.

That said, a business partner which can provide you with these insights would be invaluable. A business partner that can provide you with insights, as well as access to all the possible payment platforms, is pivotal. Nuvei is poised to be able to do this with access to numerous payment gateways as well as provide you with the insights needed to grow your business effectively. Of course, we’re talking about payment platforms here.

Take for instance, in Malaysia, we have Touch ‘N Go Wallet, Boost, GrabPay and ShopeePay. Each of these platforms is able to not only process digital payments but also bring a large number of potential customers. Choosing between them, if you really need to, could be the difference between success and failure. Without looking at any insights, you think that accepting TnG’s eWallet would be a safer bet when it comes to payment methods. However, factors such as time in the market as well as adoption could be different. In this case, both GrabPay and TnG’s eWallet are front runners perception-wise. That said, we can never 100% that the other methods may not be greater than what’s reported. Getting a dashboard where this information is available would allow businesses to make informed decisions.

“Every market, every user has their payment method… if we enable a merchant to collect or accept payments by only the minority or some of the payment methods, you will cause a merchant to lose users.”

Yuval Ziv, President at Nuvei Corporation

Nuvei’s platform not only allows businesses to see these vital insights but also gives them the freedom to adopt and choose between the payment methods available in the country and region. The flexibility and freedom for businesses to not only accept but also implement their preferred service through a single helps them grow on their terms with access to impactful insights.

Dealing with More than Just Implementation But Remaining Flexible

Today’s marketplace is no longer simply about market access or payments either. It’s about growing while mitigating risks and adapting to new realities as they emerge. Conventional solutions tend to always lock businesses into a single, inflexible mode of operations but it goes without saying, that a one-trick pony can be detrimental when it comes to business growth. In addition, streamlining allows business cost reductions that can be channelled elsewhere.

“The first challenge working globally… is understanding the user’s preferences and then enabling all of those payment methods in our checkout experience.”

Yuval Ziv, President at Nuvei Corporation

If that is true for general business practices, what more for payment solutions. Businesses are flung into a landscape where they will need to keep tabs on regulatory changes as will undoubtedly affect them. If the business has services rooted in the gig economy, it has the added complication of pay-outs.

These complex day-to-day activities can’t be avoided even if we try to. Businesses require visibility and peace of mind when they happen. Nuvei doesn’t just provide businesses with access to payment methods, its single, modular API brings along payment orchestration. Using this, merchants and businesses are able to integrate payments received and pay-outs into a single platform where they have eyes on everything. The platform is also able to generate unified reports that will allow businesses to get a complete picture of their business health.

In addition to this, Nuvei is constantly updating its business insights and practices. They have teams that are constantly monitoring markets for updates in legislation and impactful insights. The company not only updates their API with these new developments but also reacts to ensure that its client’s businesses remain unaffected. In fact, they also act to help mitigate and manage risk when changes happen and also when required by the client.

Peace of Mind in an Ever-evolving Landscape

There’s nothing better than having peace of mind when it comes to a business’s day-to-day activities. That’s essentially what Nuvei is promising with their Payment platform. However, the company has its eyes on the future as they continue to grow. With the emergence of digital banking and open banking worldwide as well as the continued influence of cryptocurrencies and the blockchain, the company is committed to ensuring that its platform remains one of the most flexible and robust.

Their platform already supports payments via cryptocurrencies and supports clients in the NFT space. In fact, the company sees the emergence of cryptocurrencies and the blockchain as opportunities. Implementation of blockchain and tokenization to increase the security of the platform could be in its future. However, for now, the company remains committed to providing a turnkey solution for customers when it comes to payment management, acceptance and orchestration.