The Samsung Galaxy A(w-Suh-m) series is full of awesome goodies from the front of the Super AMOLED screen all the way to the camera array on the back. The A series has always been about variety; ranging from the Samsung Galaxy A01 all the way up to the Samsung Galaxy A80. We’re taking a look at the Samsung Galaxy A71 – the latest and greatest Galaxy A series phone at the time of writing in Malaysia. Above the Galaxy A71, we are met with Samsung’s next tier consisting of the Samsung Galaxy Note 10 Lite and the Galaxy S10 Lite. The Note 10 lite is MYR500 (USD$118) more while right under is the A51 which is MYR500 cheaper than the A71. This beckons the question, how awesome is this phone, really?

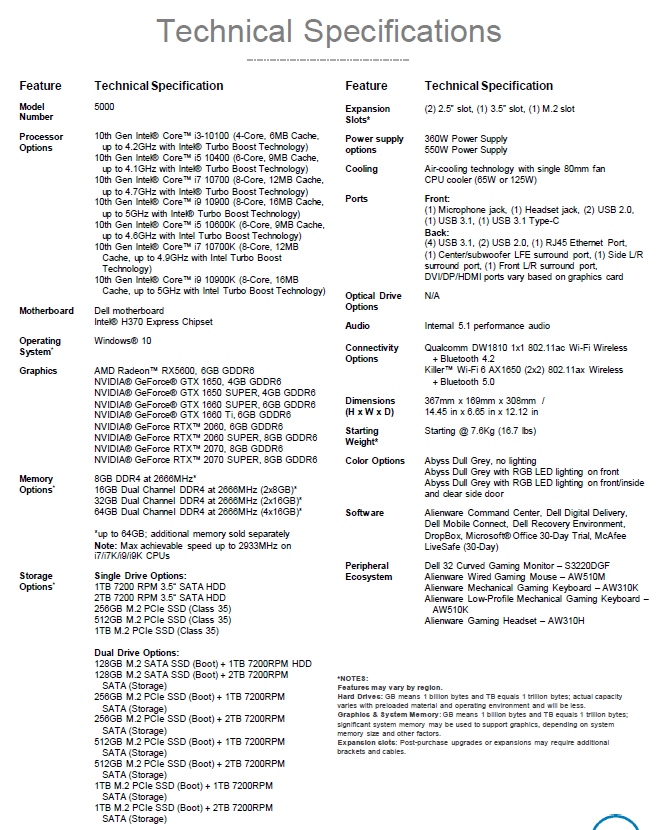

Hardware and Performance

Let’s start off with the hardware. Just because it is a mid-tier phone does not mean it does not have the goods. The phone comes with a Qualcomm Snapdragon 730 Octa-core processor that handles heavy apps and games like a breeze. This is paired with either 6GB or 8GB of RAM to let you run all the applications you need. Last but not least 128GB of internal storage which seems decent but let’s not forget like most Samsung, it can host a micro SD card to expand its storage. This is bolstered by a pretty respectable camera setup that would suffice for most users.

As the Galaxy A71 is a mid tier phone, I did not have much expectations of the phone. Maybe some freezing and lag after heavy load applications such as games but the use of the Snapdragon 730 really packs a punch for the performance of the phone. It felt as if I was using a phone with a top of the line processor, giving me the ability to jump back and forth between apps without much hiccups.

Call Quality and Connectivity

Phone calls on the A71 works just as well like every other phone on the market. Giving you clear sound quality from its earpiece and speakers while picking up every sound around you from a teeny tiny mic in the phone. These days many youngsters do not call one another anymore unless its an emergency and couples prefer video calls to see each other. With a better selfie camera the receiving end of the video calls of the A71 user gets a much clearer video quality.

However, the antenna on this phone does not pick up signal as good compared to other phones. In an area with expected weak connectivity the phone could barley register any signal leaving you stranded with no connectivity at all. Videos calls would lag as you cannot load what’s coming from the other end and regular phone calls would be half muffled and cut off.

Specifications

| Processor | Qualcomm Snapdragon 730 |

| Operating System (OS) | Android 10 One UI 2.0 |

| Display | Super AMOLED+ capacitive touchscreen 16M colours 6.7 inches 87.2% screen to body ratio |

| Memory | 6GB RAM, 128GB Storage 8GB RAM, 128GB Storage |

| Rear Camera | 64-megapixel wide camera, f/1.8, 26mm, PDAF 12-megapixel ultrawide, f/2.2, 12mm 5-megapixel macro, f/2.4, 25mm 5 -megapixel depth, f/2.2 |

| Front Camera | 32 -megapixel wide, f/2.2, 26mm |

| Connectivity | Wi-Fi 802.11 a/b/g/n/ac, dual-band Wi-Fi Direct Bluetooth 5.0, A2DP, LEA-GPS, GLONASS, GALILEO, BDS NFC USB Type-C (v1.0) |

| Audio | Single loud speaker 3.5 mm jack |

| Battery | 4,500 mAh battery 25W fast charging |

| Miscellaneous | Fingerprint (under display, optical) Accelerometer Gyro Sensor Proximity Sensor Compass |

Camera

The Samsung Galaxy A71 comes with a quad-camera set up that has a 64-megapixel main sensor! This is complemented by three other cameras: a 12-megapixel ultrawide sensor, a 5-megapixel macro lens, and lastly a 5-megapixel depth sensor. This setup raises a few questions particularly since Samsung has already stepped up its camera game by having a 48-megapixel sensor in the S10 Lite. This is contrasted to the 12-megapixel main sensor in the S20. Take those and contrast it to the fact that Samsung has equipped the A71 with the 64-megapixel sensor. Now that is Aw-Suh-m approved. Upfront, the Galaxy A71 comes with a single, 32-megapixel camera up similar to many other Samsung phones.

However, let’s not get ahead of ourselves when it comes to the pixels in the camera. The camera looks like it captures pictures really well at the first glance but after deeper inspection. The only reason the pictures looks good is due to its colour contrast where it makes the colours pop. If you zoom into the pictures the textures seem like it is blended and mixed together. The camera also pics up a lot of noise giving the pictures a very grainy look. This is quite disappointing as there are phone with smaller megapixel sensor which can perform better.

It also has a Live Focus mode where it focuses on the object and blurs out the background. It works well as long as the object in focus is large enough for the software to figure out between the object and background. The objects also have to be 1 to 1.5 meters away from the phone. You can also adjust the intensity of the background blur to give it a more realistic effect. Another cool effect is the super slow-motion option. This is cool, but it is very hard to use as the video clip that is recorded is not fully slow motion but only a few seconds between the clips.

Display

The Samsung Galaxy A71 comes with a Super AMOLED+ display. As with all Super AMOLED+ displays, the picture quality is crisp and sharp. However, my biggest gripe with the display is that the display is way too bright and using it in dark environments can be straining to the eyes even on the lowest brightness settings – and if you’re like me, you tend to be blinded when you’re on the phone in bed or turning it on first thing in the morning.

The screen is 6.7 inches with an 87.2% screen-to-body ratio and 393 pixels per inch. The bezels do not seem to be as thin or sensitive as my hands did not manage to accidentally touch or trigger it while still maintaining the look of having really thin bezels. The display is protected by Corning Gorilla Glass 3. This allowed the phone to hold up pretty well in my pocket which is usually cramped with my keys, keeping me worry free of accidentally scratching the screen. It does come with a thin plastic protector that has been taking all the beating from the keys.

The irregular 20:9 aspect ratio on the Galaxy A71 makes watching videos is a weird mix. Most videos on YouTube are still at the aspect ratio of 16:9, thus users will get big black bars on the top and bottom the videos. Whereas most movies on the other hand would fit perfectly in the display as most cinematic aspect ratio is at 21:9, giving users a really immersive cinematic experience.

Gaming

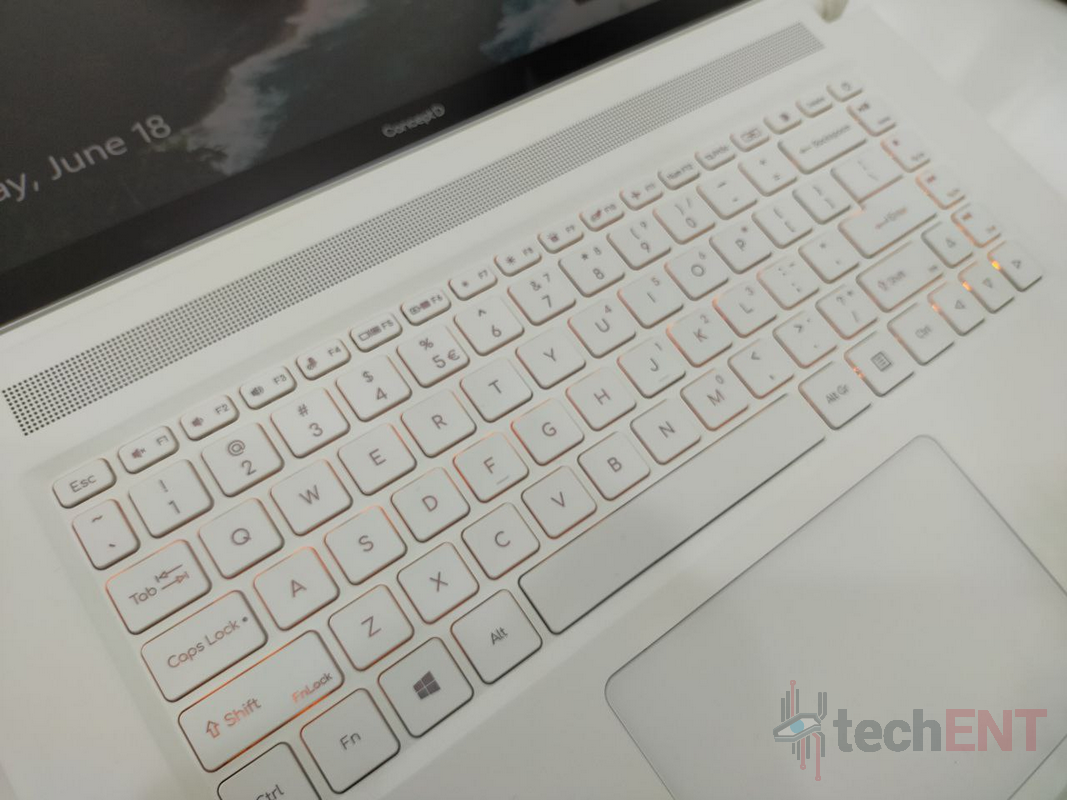

Gaming experience was smooth and I did not have many hiccups. Together with A71’s large screen estate, the controls do not get in the way which gives you a slight advantage. Software side, it automatically places games into full screen, or it blacks out the notification bar. I’m a little annoyed that I cannot choose if I want the game to take up the entire screen or have the notification bar blacked out as it is automatically decided by the system itself. That said, I, personally, prefer the notification bar blacked out as the camera punch hole doesn’t interrupt the display providing a more immersive experience.

If you are gaming with the phone’s speakers it should not be a problem as it is loud and clear. But during gaming, your hand placement might accidentally block the speaker with your index finger and muffle out the sound. So keep that in mind or use headphones with the 3.5mm jack for the best gaming experience. Yeap, that’s right! The phone comes with a 3.5mm headphone jack. Praise the jack lords! Headphone users rejoice! You can now have the most useful accessory back when you’re gaming! However, the wires can get in the way of holding your phone, it is still in an acceptable position as it does not strain your fingers to game.

Security and Privacy

To keep your phone safe and secure and have the convenience of unlocking the phone easily, there are two biometric ways to unlock the phone. There is face recognition and fingerprint. The face recognition works really well, it unlocks within seconds after waking the phone.

But for the under-display fingerprint sensor, It is not as good as a physical mounted fingerprint sensor. The under display fingerprint sensor does not detect the fingerprints as fast. I found myself having to make multiple tries before it can finally be unlocked which makes you more dependent on facial recognition.

Battery

Waking up in the morning with only 20% battery life would cause one to panic but with the 25W fast charging of the A71, it can charge the phone to full capacity slightly over an hour. The phone packs a pretty big battery with 4,500mAh that is ready to last you the entire day. However, being a mid-tier phone, it does not come with wireless charging capabilities and it charges with USB Type-C 2.0.

It actually surprised me how well the battery sustained throughout the day as I would scroll through social media aimlessly and launch games just to collect daily rewards. Even with all those activities by the end of the day I would still have around 25% to 30% of battery life, where I would just leave it throughout the night and when I wake up, it still has enough battery life to do other activities before really needing to charge it.

Software

The Galaxy A71 runs on Android 10 using Samsung’s OneUI 2.0. With the skin, it has various features that the bare android does not have. Even though OneUI 2.0 is heavily skinned, it brings along with it various conveniences such as our all time favourite dark theme, a more intuitive user interface in the camera app, Knox and even device care. There are also various tiny little details that you can configure on the phone to make it suit to your liking.

It does not seem to have an impact on the phone’s performance. The phone still runs smoothly and launches applications without any issue. With a third party skin the battery usually performs worse but Samsung has optimised OneUI 2.0 so well the battery performance barely takes a hit.

Design

Last but not least, the design of the phone. Almost all of Samsung’s phones look alike this time around with Samsung’s new design language; Now with its now-signature bulky rectangular camera casing that is sticking out of the top right of its back. This has to be the single annoyance of any Samsung device but it has an easy fix that is to put on a case on the phone. Even the polyurethane (PU) case that comes in the box makes the camera bump more seamless and flush with the casing which makes it easier to fit into your pockets without it getting snagged onto anything.

The A71 carries the same basic frame and back casing but it has its own unique flair and design to keep it different from the rest of the Samsung series. There is a slash and two strokes across the phone as its design pattern. The back does refract light to give you the effect of light breaking down, allowing you to see all of the shades of red, green, and blue hues on the back.

The phone is on the larger side but it still fits into your hands comfortably and, if you’re like me, one handed usage shouldn’t be a problem; although, people with smaller hands may have a slight issue. One design decision that I have a gripe with is the placement of the 3.5mm headphone jack. While I’m grateful for its inclusion, the headphone jack is placed on the bottom of the phone where the charging port is also located. You can’t use the earphones while keeping the phone upright. This also applies to using the phone while charging particularly if you’re in a video call. You’ll have to tip in on its head for things to work.

Affordability

Now comes the price, the phone is priced at RM1,799 which I believe is a very reasonable price for a mid range phone but a shocking price for what it is packing. With all three of its Aw-Suh-m-ness, from its Super AMOLED+ screen that gives you clear and vibrant colours, a 64MP main camera that captures every detail to the inch, and battery life that will last you throughout the day leaving you worry free of battery anxiety. All these specs would have easily placed the A71 in a tier above with a hefty price tag. Plus a bonus with Samsung’s OneUI 2.0 software that enables customisation that makes that phone truly personal. All these goodies for only RM1,799?! Not only is it worth every penny, but it’s an absolute steal, especially when it’s a Samsung!

Final Thoughts

Personally, I think it’s a phone that you should definitely get. For its specification and its price tag this is perfect for someone who is constantly on the phone who needs battery power that can survive the endless scrolling or gaming throughout the day. This is a perfect daily driver for you if you . As mentioned above, the Galaxy A71’s specifications and performance definitely matches its price tag, and dare I say it would still be worth even if it was higher. But, if you are someone who prioritizes the camera and picture quality, then the Note10 Lite and S10 Lite would be a better choice for you. It may come with a lower megapixel sensor but the picture processing is so much better with less noise, better colour and texture right off the bat.

![Intelligent Binhai Operation and Management Center [Photo from Binhai New Area] Intelligent Binhai Operation and Management Center [Photo from Binhai New Area]](https://techent.tv/wp-content/uploads/2020/06/investment-in-new-infrastructure-projects-rises-in-binhai.jpg)