GUANGZHOU, China, Nov. 16, 2022 — Vipshop Holdings Limited (NYSE: VIPS), a leading online discount retailer for brands in China ("Vipshop" or the "Company"), today announced that it will hold…

Chinese Hot-Water Bags Sweep Europe Merchants from Yiwugo Get Busy with Orders

YIWU, China, Oct. 1, 2022 — Yiwu is the world’s capital of commodities, Yiwugo.com is the official website of the Yiwu Commodity Market, which is the largest commodity wholesale…

Trip.com Group Limited Reports Unaudited Second Quarter and First Half of 2022 Financial Results

SHANGHAI, Sept. 22, 2022 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…

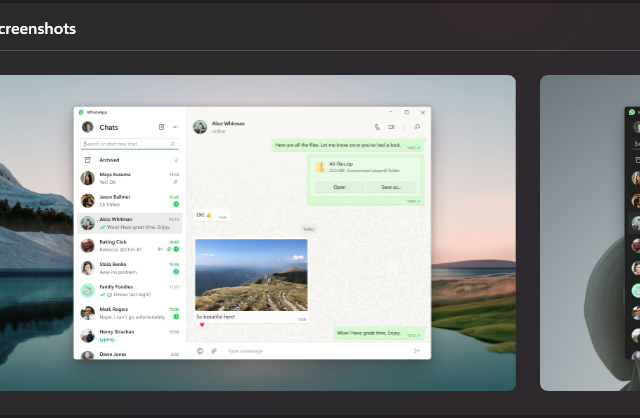

WhatsApp Has a Native Windows App, Finally

WhatsApp has launched its new destkop app. When we say new, the WhatsApp Desktop App is now native to Windows. Mac version coming soon.

Baidu to Report Second Quarter 2022 Financial Results on August 30, 2022

BEIJING, Aug. 5, 2022 — Baidu, Inc. (Nasdaq: BIDU; HKEX: 9888) ("Baidu" or the "Company"), a leading AI company with strong Internet foundation, today announced that it will report its…

Trip.com Group Announces Changes in Board Composition

SHANGHAI, July 1, 2022 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…

NetDragon’s Promethean Reaches Strategic Cooperation with Merlyn Mind to Drive Classroom Productivity and Innovative Teaching

HONG KONG, June 29, 2022 — NetDragon Websoft Holdings Limited ("NetDragon" or "the Company", Hong Kong Stock Code: 777), a global leader…

NetEase Reveals Latest Game Innovations at 2022 Annual Product Launch Event

Diablo® Immortal ™ to Hit Chinese Market on June 23, With Over 15 Million Players Already Pre-Registered in China Updates on Hot Titles Including Harry Potter: Magic Awakened and…

Tuniu to Report Third Quarter 2021 Financial Results on November 19, 2021

NANJING, China, Nov. 12, 2021 — Tuniu Corporation (NASDAQ:TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced that it plans to release its unaudited…

China Finance Online Announces Changes to the Board of Directors

BEIJING, Aug. 27, 2021 — China Finance Online Co. Limited ("China Finance Online," or the "Company," "we," "us" or "our") (Nasdaq GS: JRJC), a leading web-based financial services company that provides Chinese individual investors with fintech-powered online access to securities trading services, wealth management products, securities investment advisory services, as…