SANTA CLARA, Calif., Dec. 31, 2020 — World-leading general-purpose robotics company Flexiv Ltd. has closed an over 100m USD Series B round with major investors including Meituan, Meta Capital, New Hope Group, Longwood, YF Capital, Gaorong Capital, GSR Ventures and Plug and Play, marking the largest single-round fundraising ever in the…

LESS_ continues to grow and prepares for the next round of financing

WROCŁAW, Poland, Dec. 30, 2020 — 700,000 users across the world have joined the LESS_, an internet platform for selling second-hand clothes and accessories that operates from Poland. The app was launched in June 2019 and six months later it obtained EUR 4 million in the seed round. Now, LESS_ is…

Ed-Tech Cakap to Start Strong in 2021 After Raising US$3 Million in Series A+ Funding

JAKARTA, Indonesia , Dec. 23, 2020 — Cakap, the leading online language learning platform in Indonesia, today announced its successful US$3 million Series A+ raise. The round was led by Heritas Capital with participation from Strategic Year Holdings and other prominent Investors. Existing investors including Investidea Ventures and Prasetia Dwidharma also…

ClassIn raises $265 million in Series C funding, led by Hillhouse Ventures

BEIJING, Dec. 22, 2020 — Global EdTech giant ClassIn, creator of online interactive classroom ClassIn, has announced its Series C funding of $265 million. ClassIn screenshot The new round of financing, led by Hillhouse Ventures, followed by Tencent, SIG, Ince Capital and Gaocheng Capital, comes just months after…

Tive Secures $12 Million Series A Capital Funding

Backed by RRE Ventures and Two Sigma Ventures, Tive offers real-time, in-transit location and condition insights to every part of the supply chain BOSTON, Dec. 16, 2020 — Tive, Inc., a leading provider of global supply chain visibility insights, announced today that it secured a $12 million Series A funding…

Wiz Emerges from Stealth with $100 Million Series A Financing and a Mission to Reinvent Cloud Security

New financing from Index Ventures, Sequoia and Insight Partners comes just nine months after the first line of code; Wiz’s cloud security platform already in use at Fortune 100 customers at scale PALO ALTO, Calif. and TEL AVIV, Israel, Dec. 10, 2020 — Wiz,…

EVONET Global Pte. Ltd Raises USD30 Million in Series A Round of Financing

SINGAPORE, Dec. 1, 2020 — EVONET Global ("the Company") is excited to announce that it has successfully raised USD 30 million in series A round funding from TIS Inc. (www.tis.co.jp) through CardInfoLink. The proceeds will be used to set up an innovative platform and business for financial services to support interoperability…

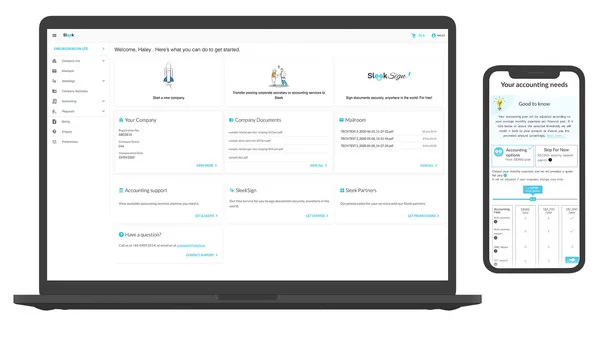

Singapore Fintech startup Sleek secures US $4M from Enterprise Singapore’s SEEDS Capital and business angels

SINGAPORE, Nov. 23, 2020 — Sleek, a fintech startup that is disrupting the traditional corporate services industry, has raised US $4M in a new funding round. Led by SEEDS Capital, the investment arm of Enterprise Singapore, the funding was also joined by MI8 Limited, a Hong-Kong multi-family office, and investor Pierre…

AP Ventures invests USD 10 million into Happay targeting the Chinese market

SHANGHAI, Nov. 16, 2020 — The Australian-based investment company, which is set up to collaborate with and counts Afterpay as its largest shareholder, has completed a USD 10 million investment in Happay, China’s first BNPL (Buy Now Pay Later) platform, taking a 20% stake and valuing Happay at USD 50…

Benson Hill Raises $150 Million in Series D Funding Round to Accelerate the Pace of Food Innovation on a Global Scale

– Financing was co-led by Wheatsheaf and GV with broad participation from strategic and environmental, social and governance (ESG) focused investors across the food and agriculture value chain. – Benson Hill will use the funds to scale its commercial operations and its platform food…