Partnership creates opportunity to access professional business development capabilities at scale SINGAPORE, July 19, 2021 — Verticurl (A WPP Company) and Startup-O are pleased to announce they have entered into a strategic partnership combining Verticurl’s leading Marketing Technology Services capabilities with Startup-O’s global online platform for discovering, investing and scaling…

Registration for HICOOL 2021 Global Entrepreneurship Competition concluded, over 4,000 global projects are in head-to-head Competition

BEIJING, July 2, 2021 — Recently, the registration for HICOOL 2021 Global Entrepreneurship Competition has concluded. After two months of project solicitation, the total number of projects registered has reached 4,018, a year-on-year increase of 98.32% compared with 2,026 of last year. A total of 5,077 applicants from 5 major…

FTAG Group Acquires Stake in Live Streaming Startup BeLive Technology

SINGAPORE, June 25, 2021 — FTAG Group announced today that it has acquired a significant stake in Singapore-based live streaming startup BeLive Technology. The strategic move, made via the company’s investment arm FTAG Ventures, will enhance FTAG’s own media capabilities while expanding its technology portfolio. It also makes them one…

Osome Raises a $16M Series A to Expand its AI-based Accounting Platform to Global Markets

SINGAPORE, June 18, 2021 — Osome, a super-app that digitizes accounting and compliance services for SMEs, has raised $16M in a Series A funding from a group of investors including Target Global, AltaIR Capital, Phystech Ventures, S16VC, and Peng T. Ong, an angel investor. The capital enables Osome to expand…

Circle Completes $440 Million Financing to Drive Growth and Market Expansion

BOSTON, May 29, 2021 — Circle, a global financial technology firm that provides payments and treasury infrastructure for internet businesses, today announced it has raised $440 million in financing from leading institutional and strategic investors. The financing, among the top 10 in private…

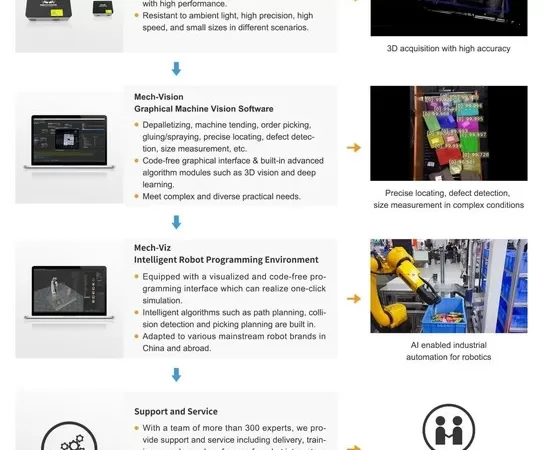

AI Robotics Startup Mech-Mind Completes Series C Funding Led by Tech Giant Meituan

With total funding of over USD100 million, Mech-Mind is pioneering the next frontier of manufacturing through a combination of artificial intelligence and industrial robotics BEIJING, May 19, 2021 — Fast-growing Chinese AI industrial robotics startup, Mech-Mind Robotics ("Mech-Mind") has recently completed Series C funding led by tech giant Meituan. This latest…

MarTech Startup Affable.ai Raises USD 2M to Boost the Adoption of its Influencer Marketing Platform

Investors: Prime Venture Partners, Decacorn Capital, SGInnovate BENGALURU, India and SINGAPORE, May 18, 2021 — Singapore-based Martech startup, Affable.ai has raised USD Two Million from Prime Venture Partners, Decacorn Capital & SGInnovate. Affable’s AI-driven, Self-service SaaS platform helps brands and agencies run high impact influencer…

WeLab completes initial close of Series C-1 funding, led by Allianz X for US$75 million and announces strategic partnership

WeLab’s focus on technology and innovation in building a pan-Asian digital financial services platform complements Allianz’s expansion strategy with technology-focused partners in the region Allianz and WeLab have established a strategic partnership with plans to develop and distribute investment and insurance solutions WeLab Bank and Allianz Global…

Data analytics software company Phocas positions for rapid growth in the U.S. and UK with AU$45 million (US$34 million) capital raise

SYDNEY, Jan. 29, 2021 — Australian global data analytics software business Phocas Software announces a AU$45 million (US$34 million) capital raise to accelerate its growth in America and the United Kingdom, expand into new industries and develop its core products. Ellerston Capital led the capital raise with a AU$35 million (US$27…

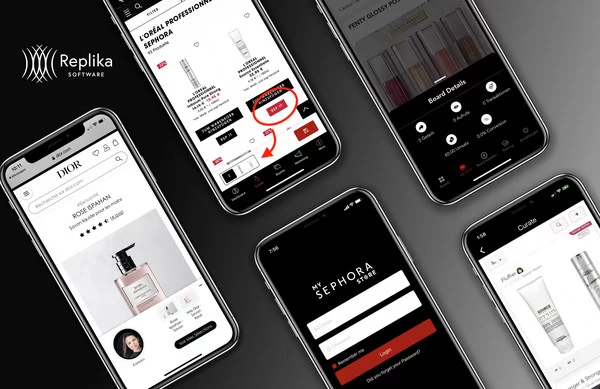

Replika Software Secures Series A Financing from LVMH Luxury Ventures and L’Oréal BOLD Ventures to Power the Future of Social Selling

NEW YORK, Jan. 27, 2021 — Replika Software, the turnkey social selling solution enabling brands to empower their networks of social sellers to inspire and sell online, has completed its Series A financing round with LVMH Luxury Ventures and L’Oréal BOLD, both investment arms of their parent companies. The funding…