oVice, a Japan-based virtual office platform, announces a 45 billion yen (around $32.5 million) Series B funding round led by multiple investors. The company plans on creating solutions that…

HR automation platform Omni HR raises USD 2.4mn pre-seed funding from Alpha JWC Ventures & Picus Capital to digitize employee management in SE Asia

SINGAPORE, July 25, 2022 — HR automation platform, Omni HR today announced it has recently closed USD 2.4 million in an oversubscribed pre-seed…

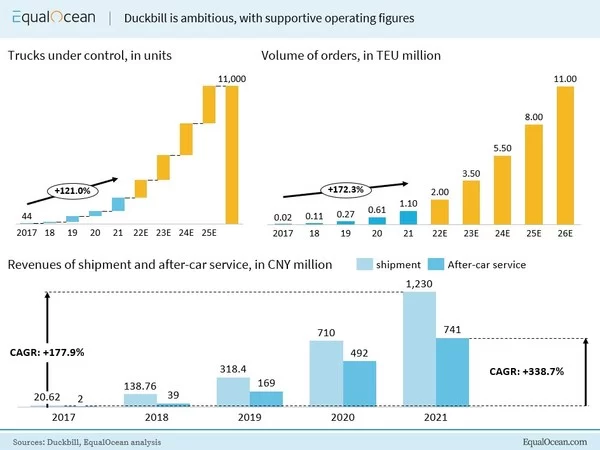

China’s Digitized Container Duckbill Speeds Up, Faster and Smarter

Backed by a new round of capital, Duckbill aims high to be a dominant player in the domestic container trucking market BEIJING, July 23, 2022 — Chinese digital container logistic…

Precision Immersion Cooling Specialist, Iceotope Technologies, Secures £30m Funding from Global Syndicate Led by Impact Investor ABC Impact

Singapore impact private equity firm, ABC Impact, is investing in Iceotope to drive the reduction of carbon emissions from data centres…

BRV China-backed Service Robot Company Wissen Technology Completes US$10 Million Pre-A+ Series Financing

BEIJING, July 5, 2022 — Wissen Technology (Shenzhen) Co., Ltd (Wissen Technology), a leading service robot innovator, raised close to US$10 million in a Pre-A+ Series financing led by…

LeadSquared secures $153mn from WestBridge Capital; Turns Unicorn

ATLANTA, June 24, 2022 — Sales automation platform, LeadSquared recently announced that it has secured an investment of USD $153mn in the Series C funding round from WestBridge Capital. LeadSquared founders Sudhakar Gorti, Nilesh…

Trajan to acquire leading chromatography consumables and tools business building critical mass in the gas chromatography portfolio

Highlights Trajan to acquire Chromatography Research Supplies, Inc. (CRS), a leading global manufacturer of high-quality analytical consumables Provides Trajan with enhanced…

AUTOCRYPT closes Series B with $25.5 million to expand V2X and in-vehicle systems security for intelligent transport

SEOUL, South Korea, May 26, 2022 — AUTOCRYPT, a leading secure mobility and V2X communications company, has raised a $25.5 million Series B round, with post-money valuation of $120…

People Moves at Golden Gate Ventures

Dea Sujardi takes on Senior Advisor role; Kelly Ang takes on Investor Relations responsibilities SINGAPORE, April 29, 2022 — Golden Gate Ventures, one of Singapore’s first VC funds, founded by…

Japan’s first laser nuclear fusion company, EX-Fusion raises 130 million JPY in pre-seed round, paving way for the development of critical components needed for commercialization of nuclear fusion

Funds will be used to develop technologies that enable continuous injection of target material and auto tracking and alignment of the laser…