SHANGHAI, Aug. 20, 2021 — Dada Group (Nasdaq: DADA), China’s leading local on-demand delivery and retail platform, and Charoen Pokphand Group (CP Group)’s Retail Business Division, today announced a partnership to provide omni-channel on-demand delivery services for CP Group’s CP Lotus, a leading supermarket chain, and CP Fresh Mart, a community-based…

HH Global acquires Adare International

Merge completion of global marketing services providers, HH Global and Adare International LONDON and CHICAGO, Aug. 18, 2021 — HH Global is pleased to announce the completion of the acquisition of Adare International (including Purple Agency), from the private equity firm Endless LLP, following the signing of an agreement on Monday 21 June…

SKF to service Berlin underground carriages in long-term agreement

Service agreement for U-Bahn trains includes original part supply and service for at least 606 carriages – and will last for a 32-year period minimum GOTHENBURG, Sweden, Aug. 17, 2021 — SKF has signed a long-term agreement with Stadler Rail to equip and service rolling stock for the Berlin underground…

Senmiao Technology Reports Fiscal 2022 First Quarter Financial Results

CHENGDU, China, Aug. 17, 2021 — Senmiao Technology Limited ("Senmiao") (NASDAQ: AIHS), a provider of automobile transaction and related services targeting the online ride-hailing industry in China as well as an operator of its own online ride-hailing platform, today announced financial results for its fiscal 2022 first quarter ended June 30,…

Intelligent Systems | Tech Helps GAC Jump to 176th on the Fortune 500

GUANGZHOU, China, Aug. 13, 2021 — For almost 25 years, GAC has strengthened independent innovation on the basis of joint ventures and cooperation, as well as through extensively funding of the GAC R&D Centers. This investment in technology has yielded great results: as of August 2, 2021, GAC had jumped…

Key Foundry Reinforces Design Support for Fabless Customers

SEOUL, South Korea, Aug. 11, 2021 — Key Foundry, the only pure-play foundry in Korea, announced today that it has developed a customer-friendly semiconductor design support tool named PDK Version E (Process Design Kit, enhanced version), and begun its offering to fabless companies….

Macronix and Foxconn Sign Asset Transaction Agreement for 6-inch Wafer Fab

HSINCHU, Aug. 6, 2021 — Macronix International Co., Ltd. ("Macronix") (TWSE: 2337), a leading integrated device designer and manufacturer in Non-Volatile Memory (NVM), and Hon Hai Technology Group ("Foxconn") (TWSE: 2317), the world’s largest electronics manufacturer and service provider, today announced the signing of an Asset Transaction Agreement for the sales…

Shipsy brings Deb Deep Sengupta as their Board Advisor

– Deep brings more than two decades of technical experience with a specialization in driving enterprise-wide transformations – His onboarding will help the company execute key strategies and business decisions to march ahead with its expansion plans GURUGRAM, India, Aug. 6, 2021 — Shipsy, a leading SaaS-based intelligent supply chain and…

Luokung Subsidiary eMapGo Wins Gaogong Intelligent Car Golden Globe Award

BEIJING, Aug. 5, 2021 — Luokung Technology Corp. (NASDAQ: LKCO) ("Luokung" or the "Company"), a leading spatial-temporal intelligent big data services company and provider of interactive location-based services ("LBS") and high-definition maps ("HD Maps") in China, today announced that its operating subsidiary eMapGo Technology (Beijing) Co., Ltd. ("EMG"), a leading…

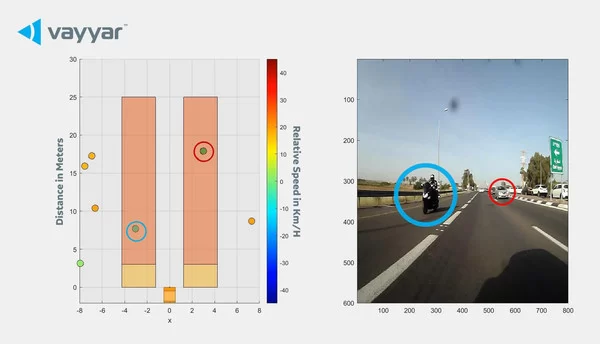

Piaggio Fast Forward Develops New Sensor Technology for Consumer and Enterprise Robots and for Motorcycle and Scooter Safety (ARAS)

TEL AVIV, Israel, Aug. 5, 2021 — Piaggio Fast Forward Develops New Sensor Technology for Consumer and Enterprise Robots and for Motorcycle and Scooter Safety (ARAS) Highlights: Piaggio Fast Forward (PFF) reveals trailblazing sensor technology for consumer and business robots as well as…