SHANGHAI, Jan. 12, 2022 — On January 11, 2022, Eoslift announced to change its corporate branding to Enotek in Shanghai, China. Enotek will help customers build efficient supply chain systems with intelligent…

project44 Receives $420 Million Investment led by Thoma Bravo, TPG and Goldman Sachs Valuing Business at $2.2 Billion Pre-Money

– With $100+ million in ARR, 1,000+ team members, 1,000+ customers, 1+ billion packages tracked annually and the top performer in analyst reports,…

HHI Group and ABS to collaborate on real-life trials of autonomous ship technologies

LAS VEGAS, Jan. 9, 2022 — Avikus, Hyundai Heavy Industries (HHI) Group’s subsidiary specializing in autonomous navigation technologies for ships, partners with the American Bureau of Shipping (ABS) to collaborate on…

ThunderSoft Announces New Smart Cockpit Solution Based on Qualcomm SA8295 at CES 2022

LAS VEGAS, Jan.7, 2022 — ThunderSoft, the world’s leading intelligent operating system product and technology provider released an all-new smart cockpit solution based on Qualcomm’s hardware platform SA8295 at the…

ThunderSoft SmartParking Enables Parking Simpler, Safer and more Efficient

BEIJING, Jan. 7, 2022 — ThunderSoft, the world leading intelligent operating system products and solutions provider, introduced its advanced parking technologies and solutions, ThunderSoft SmartParking, at CES 2022. What makes ThunderSoft…

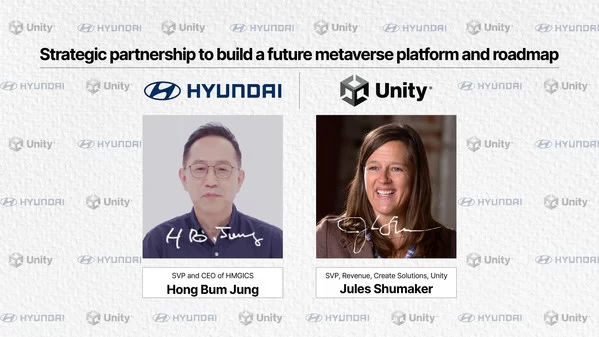

Hyundai Motor and Unity Partner to Build Meta-Factory Accelerating Intelligent Manufacturing Innovation

Partnership to support Hyundai’s vision of becoming a smart mobility solutions provider for an entirely new digital ecosystem Metaverse-based digital-twin factory to optimize plant operation and allow virtual…

Edible fungus industry stimulates rural revitalization in Guiyang

BEIJING, Jan. 5, 2022 — A news report from China Daily on Guiyang. Success of agricultural sector sees output and profits of Guizhou province rise substantially. As a key edible…

KT SAT unveils its new brand of maritime satellite communication targeting South East Asia market

SEOUL, South Korea, Jan. 5, 2022 — KT SAT(www.ktsat.com), the leading provider of satellite communication service in South Korea unveils its new maritime brand "XWAVE" that stands for the company’s…

Renren Announces Unaudited First Half 2021 Financial Results

PHOENIX, Dec. 30, 2021 — Renren Inc. (NYSE: RENN) ("Renren" or the "Company"), which operates two US-based SaaS businesses, Chime Technologies Inc. ("Chime") and Trucker Path Inc. ("Trucker Path"), today announced…

Waymo and Zeekr to collaborate on all-electric, fully autonomous ride-hailing vehicle

HANGZHOU, China and SAN FRANCISCO, Calif., Dec. 29, 2021 — Geely Holding Group’s (Geely) premium electric brand, Zeekr, will collaborate with Waymo on the development of a new pure electric…