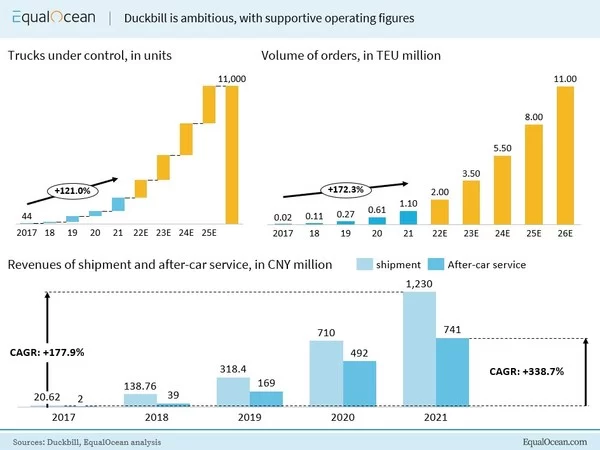

Backed by a new round of capital, Duckbill aims high to be a dominant player in the domestic container trucking market BEIJING, July 23, 2022 — Chinese digital container logistic…

Nippon Express (China) Becomes First Japanese Logistics Company to Establish Office in China’s Hainan Province

TOKYO, July 21, 2022 — Nippon Express (China) Co., Ltd. (hereinafter "NX China"), a group company of Nippon Express Holdings, Inc., has become the first Japanese logistics company to…

Senmiao Technology Announces Ride-Hailing Platform Operating Metrics for June 2022

CHENGDU, China, July 20, 2022 — Senmiao Technology Limited ("Senmiao" or the "Company") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China, as…

World’s first desert-circling railway brings vitality to Xinjiang

BEIJING, July 15, 2022 — A news report by China.org.cn on Xinjiang:   Amid an endless desert, a train runs along an elevated section of track as sand…

Senmiao Technology Reports Fiscal 2022 Year-end Financial Results

CHENGDU, China, July 15, 2022 — Senmiao Technology Limited ("Senmiao" or the "Company") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China, as…

IQAX named among top 10 digital twin solution providers in APAC

IQAX is proud to announce its inclusion in CIOoutlook’s top 10 digital twin solution providers 2022 in the region. HONG KONG, July 14, 2022 — IQAX Limited, a leading…

NaaS Technology and Jingcheng Leasing Jointly Developing a New Charging Infrastructure Ecosystem

The strategic cooperation will provide one-stop financial solutions for the construction of charging stations BEIJING, July 11, 2022 — NaaS Technology Inc. (NASDAQ: NAAS, "NaaS" or "the Company") announced that…

‘AI Data Company’ AIMMO Positions to Serve US and European Markets

AIMMO showcases advanced AI, GTaaS, DaaS, and smart labeling services at the world’s largest AI and data expo AIMMO attracts attention from many OEMs and tier…

Macronix OctaBus™ Flash Memory Selected for Renesas VC4 Automotive Computing Development Platform

Macronix OctaBus MX25UW51245G NOR Flash Provides Boot Memory to Renesas R-CAR S4 SoC-based VC4 Vehicle Computer Reference Designs TAIPEI, July 7, 2022 — Macronix International Co., Ltd. (TSE: 2337), a…

Sharing Economy Entered into MOU with Quantron AG to Plan for Joint Venture in the development of New Zero Emission Vehicles

HONG KONG, June 28, 2022 — Sharing Economy International Inc. ("SEII") (OTCQB: SEII), announced today that the company has signed an memorandum of understanding with Quantron AG ("Quantron"), planning to…