BREA, Calif., Jan. 13, 2023 — ViewSonic Corp, a leading global provider of visual solutions, worked with the Gaia Hotel Bandung in Indonesia…

Guizhou Satellite TV released a video: Kazakh sisters experience Bouyei culture in an immersive way

GUIYANG, China, Dec. 16, 2022 — Xingyi finds itself in the southwest region of Guizhou Province, China, has always been a commercial…

ROLLER celebrates gaining Great Place to Work® certification

Ten years into its business operations, ROLLER has achieved a 98% employee satisfaction rating from Great Place to Work® — the global authority on workplace culture. MELBOURNE, Australia, Dec….

China Matters releases a short video “11 Reasons Why I’ve Fallen in Love with Beijing” to tell an American vlogger’s view

BEIJING, Nov. 23, 2022 — From rich culture and history to convenient and enriched lifestyle, Beijing is an attractive place in the view…

Trip.com Group and Qatar Tourism Sign a Memorandum of Understanding to Promote Qatar as Leading Family-Friendly Tourism Destination

Qatar Tourism and Trip.com Group – one of the world’s leading travel service providers – sign Memorandum of Understanding to promote…

China Matters’ Feature: How was an ancient Chinese village transformed by art?

BEIJING, Nov. 8, 2022 — Gejia village, located in a remote mountainous area of Ningbo, east China’s Zhejiang Province, has a history…

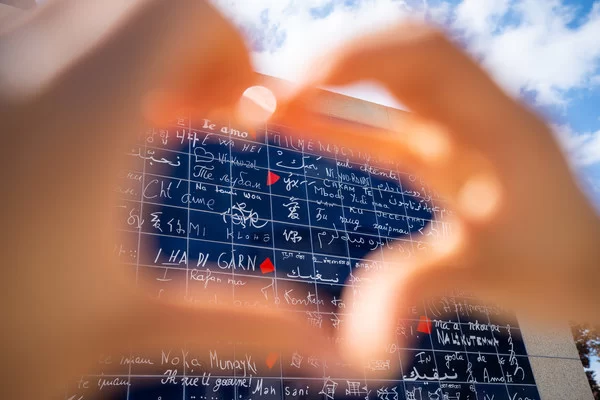

First Suzhou Jinji Lake China-France Culture and Art Week opens

Le mur des je t’aime’s only replica in Asia inaugurated in Suzhou China SUZHOU, China, Oct. 29, 2022 — The only replica of Le mur des je t’aime in Asia…

Tuniu Announces Receipt of Minimum Bid Price Notice from Nasdaq

NANJING, China, Sept. 23, 2022 — Tuniu Corporation (Nasdaq: TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced that it has received written notification…

Trip.com Group Limited Reports Unaudited Second Quarter and First Half of 2022 Financial Results

SHANGHAI, Sept. 22, 2022 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…

PRICE COMPARISON TRAVEL APP WAYAWAY LAUNCHES OFFSETTING INITIATIVE

Recently launched travel price comparison appWayAway announces A Green Way to Travel initiative. All contributions by WayAway users are doubled by…