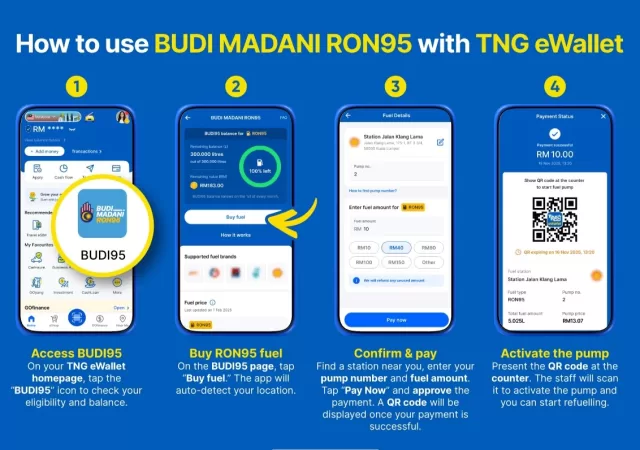

Discover how TNG eWallet streamlines access to BUDI95, making fuel subsidy management effortless for eligible Malaysians.

ASEAN Nations Can Now Register for Touch ‘n Go eWallet

Touch ‘n Go eWallet is opening up to ASEAN countries, allowing travellers to register and pay like a local with the eWallet.

HUAWEI WATCH GT 6 Series Brings Up to 21-Day Endurance and Pro-Level Power Tracking to Malaysia

HUAWEI Watch GT6 ups the ante with 21-day endurance and pro-level sports tracking with more features and local apps like Touch n’ Go eWallet and MyBorderPass.

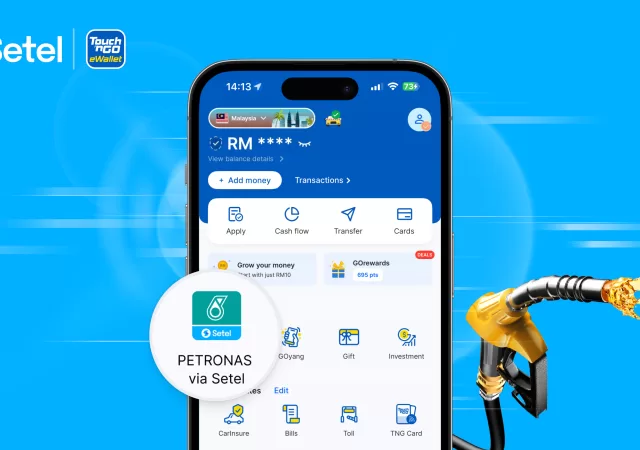

Setel Saje At Petronas with Your TNG eWallet

Paying for fuel is a weekly routine for most of us, and now, that routine is getting a whole lot simpler. In a move focused on everyday convenience, Setel Ventures Sdn Bhd (Setel) has announced a strategic partnership with TNG…

Touch ‘n Go Unveils New Limited Edition Hot Wheels Card

Touch ‘n Go announces a new addition to its limited edition Hot Wheels NFC enabled cards.

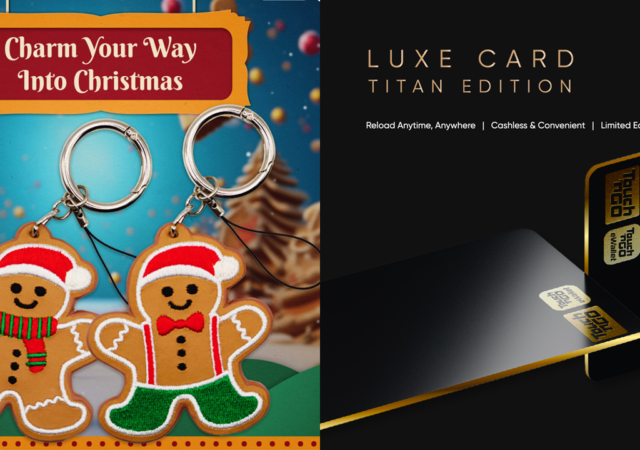

Touch ‘n Go Introduces a Charm for Christmas and a LUXE Card

Still on the hunt for that perfect festive gift? Look no further! Touch ‘n Go has just dropped two new items for your year-end holiday gifting: the Christmas Edition Charm and Touch ‘n Go LUXE Card – Titan Edition. Adding…

Touch ‘n Go eWallet Rewards Users with GOrewards

Touch ‘n Go eWallet unveils a new way for users to earn more with every ringgit spent with GOrewards.

Your Commute Can’t Get Any Cuter Than with Touch ‘n Go’s The Furry Series: Rabbit Charm

Introducing Touch ‘n Go’s Furry Series: Rabbit Charm, the accessory that seamlessly combines convenience, style, and a tribute to the cherished bond between humans and their pets.

It’s Now Easier to Invest in ASNB with GOinvest on Touch ‘n Go E-wallet

Investing in ASNB unit trusts get even more accessible with Touch n’ Go eWallet with GOinvest.

Rev Up Your Drive with Touch ‘n Go’s DUKE of the Road Campaign

If you’re tired of fumbling with your Touch ‘n Go card at the toll or waiting in long queues, Touch ‘n Go is revving things up with their DUKE of the Road Campaign roadshow. This is an opportunity you won’t…