The merger combines IoT technology with software services to empower the road freight transport sector BEIJING, June 11, 2022 — G7 Connect Inc. ("G7"), a fleet management company backed…

SONGTRADR EXPANDS ITS B2B MUSIC TECHNOLOGY SOLUTIONS – ACQUIRES LEADING ADVANCED AI SEARCH COMPANY, MUSICUBE

The Hamburg-based AI technology company enables measurable ROI-driven licensing that optimizes the creative performance of content LOS ANGELES, June 8, 2022…

European business communications provider Dstny acquires Tactful AI to accelerate its position in the Customer Experience Platform market.

The acquisition takes Dstny to the next level in customer engagement, enabling companies to employ Artificial Intelligence and data in their customer experience operations with minimum effort. BRUSSELS, May…

Top Global Sales Training Company Richardson Sales Performance Announces Acquisition of DoubleDigit Sales, leading Canadian Sales Training Provider

PHILADELPHIA, May 13, 2022 — Richardson Sales Performance, a leading global sales training organization, is pleased to announce they have acquired DoubleDigit…

Happiness Development to Acquire Hekangyuan, One of the Largest Healthcare Product Distributors in Fuzhou Area in China

NANPING, China, March 7, 2022 — Happiness Development Group Limited ("HAPP" or the "Company"), (NASDAQ: HAPP) an emerging and diversified company engaging in the business of production of nutraceutical and dietary supplements,…

BizLink Announces Completion of Merger with LEONI Industrial Solutions Business Group

Fremont, Calif., Jan. 21, 2022 — BizLink, a global leader in interconnect solutions, today announces that the sale of the LEONI Industrial Solutions business…

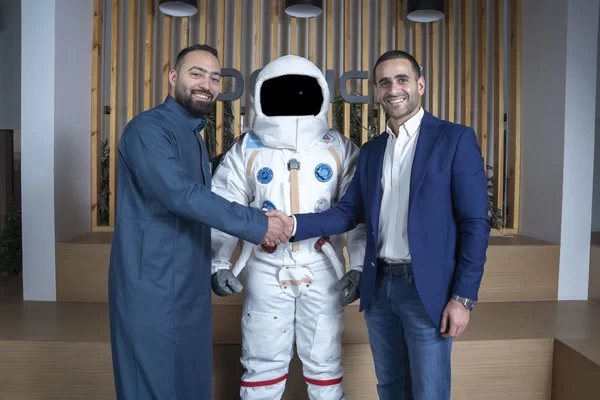

Foodics Acquires POSRocket And Becomes The Dominant Restaurant-Tech Provider In MENA

Strategic Landmark first acquisition for Foodics to consolidate the market Deal positions Foodics as the dominant Restaurant-tech provider in MENA POSRocket is the second largest restaurant Cloud…

YES (Yield Engineering Systems, Inc.) Acquires SPEC (Semiconductor Process Equipment Corp.)

Adds Wet Processing to its Expanding Portfolio of Surface & Material Enhancement Solutions FREMONT, Calif., Dec. 22, 2021 — YES (Yield Engineering Systems, Inc.), a leading manufacturer of process equipment for…

Delta to Acquire Universal Instruments – a Leader in Precision Automation Solutions for Electronics Manufacturing -to Further its Smart Manufacturing Capabilities

TAIPEI, Dec. 18, 2021 — Delta Electronics, Inc. (later referred to as "Delta"), a global leading provider of smart energy-saving solutions, today announced the agreement to acquire, through its subsidiary Delta…

Foot Locker, Inc. Completes Acquisition of atmos

Digitally Led, Culturally Connected Business Immediately Expands Foot Locker’s Global Footprint, Provides Foothold in Rapidly Growing Asia-Pac and Extends Premium, Top-Tier Product Offering …