HONG KONG, Jan. 4, 2021 — CLPS Incorporation (Nasdaq: CLPS) ("CLPS" or "the Company"), today released a letter to shareholders from the Chairman of the Company’s Board of Directors (the "Board"), the full text of which is provided below. All CLPS shareholders are encouraged to read it. Dear Shareholders, On behalf…

Yuanyuan’s Adventure Episode III: Taiwan Reunification

BEIJING, Jan. 4, 2021 — A news report by China.org.cn:   In the Kangxi period of the Qing Dynasty, the Zheng family, which was headed by the descendants of Zheng Chenggong, ruled Taiwan, and contended with the Qing government. Despite several rounds of peace negotiations, no agreement was reached. In order…

uCloudlink and China Mobile UK Fuel Multinational Business Development with Superior Mobile Connectivity Experience

HONG KONG, Jan. 4, 2021 — UCLOUDLINK GROUP INC. ("uCloudlink") (NASDAQ: UCL), the world’s first and leading mobile data traffic sharing marketplace, and China Mobile International (UK) Limited ("China Mobile UK"), a subsidiary of China Mobile International Limited (CMI), continue their six-year strong partnership, providing high-quality network connection support for…

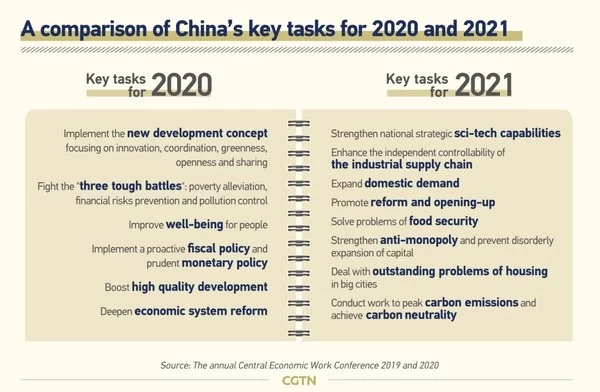

CGTN: After ‘extraordinary’ 2020, what are Xi Jinping’s expectations for 2021?

BEIJING, Jan. 4, 2021 — 2021, a year that marks the beginning of China’s new five-year plan period and the 100th founding anniversary of the Communist Party of China (CPC), is knocking at the door. jwplayer.key=”3Fznr2BGJZtpwZmA+81lm048ks6+0NjLXyDdsO2YkfE=” jwplayer(‘myplayer1’).setup({file: ‘https://mma.prnasia.com/media2/1393641/Chinese_President_Xi_Jinping_gives_2021_New_Year_address.mp4?p=medium600’, image: ‘http://www.prnasia.com/video_capture/3235634_AE35634_1.jpg’, autostart:’false’, aspectratio: ’16:9′, stretching…

UnionBank acclaimed by Frost & Sullivan for leveraging innovative digital capabilities to deliver exceptional customer experiences

Bank takes customer experience to next level by harnessing the power of 5G, in line with the launch of its smart branch SINGAPORE, Jan. 1, 2021 — Based on its recent analysis of the Philippines’ customer experience solutions in the banking industry, Frost & Sullivan honored UnionBank of the Philippines (UnionBank)…

Hoymiles Launches S-Miles Cloud, New Powerful Real-time Solar Power Station Monitoring Platform on Mobile App and Browser

HANGZHOU, China, Dec. 31, 2020 — Hoymiles Power Electronics Inc. ("Hoymiles"), a leading microinverter manufacturer, has recently unveiled the all-new S-Miles Cloud Platform for real-time visualized monitoring of solar power generating equipment. Key field equipment can be connected to the S-Miles Cloud Platform. With the IoT-supported data collection devices, the…

Inaugural Shanghai Electric Cup ‘Industrial App’ Awards Given to 16 Outstanding Entries, Empowering Digital Innovation for Energy Industry

SHANGHAI, Dec. 31, 2020 — Shanghai Electric (the "Company") (SEHK: 02727, SSE: 601727), the world’s leading manufacturer and supplier of electric power generation equipment, industrial equipment and integration services, has recently concluded a five-month industrial innovation application competition. The inaugural ‘Shanghai Electric Cup’…

Victor Ai awarded Forbes 2020 Top 100 Venture Capitalist in China

BEIJING, Dec. 31, 2020 — Recently, Forbes released the 2020 Top 100 Venture Capitalist list in China, the definitive ranking of the top investors of this year. Victor Ai is awarded one of the top 100 venture capitalists of this year in China. He is recognized for his excellent leadership…

Renren Announces Unaudited First Half 2020 Financial Results

BEIJING, Dec. 31, 2020 — Renren Inc. (NYSE: RENN) ("Renren" or the "Company"), which operates a premium used auto business in China through its subsidiary Kaixin Auto Holdings (NASDAQ: KXIN) ("Kaixin") as well as several U.S.-based SaaS businesses, today announced its unaudited financial results for the six months ended June…

‘People’ chosen as Chinese character of the year

BEIJING, Dec. 30, 2020 — A news report by China.org.cn on China’s Chinese character of the year:   In a recently published list of buzzwords in China, "min", meaning "people," was chosen as the Chinese character of 2020, while "poverty alleviation" was crowned as the Chinese word of…