LAS VEGAS, July 31, 2021 — Sparrow Co., Ltd, the leader in application security testing, announced on July 29 its participation in "Black Hat USA 2021." Sparrow hosts its virtual booth to introduce its new solutions between August 4 and 5. This year, Black Hat, one of the world’s largest…

ZENVIA Inc. Announces Closing of Concurrent Private Placement with Twilio Inc.

SÃO PAULO, July 30, 2021 — ZENVIA Inc. ("ZENVIA") (NASDAQ: ZENV), announced yesterday the closing of its previously disclosed concurrent private placement of 3,846,153 of its Class A common shares to Twilio Inc. in a private transaction ("Concurrent Private Placement") at an offering price of US$13.00 per Class A common…

iWeb Inc, OTC Markets QB, IWBB, announced it will acquire Tingo Mobile Plc. from Tingo International Holdings, Inc, in a deal valuing the Tingo Mobile Plc at $3.7 Billion USD

LOS ANGELES, July 30, 2021 — Transaction was negotiated for IWEB by their Business Development Partners Global Fintech Trading Limited Led by Craig Marshak an experienced Fintech Specialist investment banker who formerly ran a Nomura bank Venture Technology fund in London with considerable success in online gaming, Software and Cybersecurity investments….

Doo Financial’s First Display On Times Square Nasdaq Tower, Establishing A Fully Disclosed Brokerage Relationship With Interactive Brokers

HONG KONG, July 30, 2021 — Doo Financial, an online broker affiliated with Doo Group, has recently established a fully disclosed brokerage relationship with Interactive Brokers, and celebrated with a debut on the Nasdaq in Times Square, New York. Doo Financial has recently established…

Production Officially Starts at USI’s Vietnam Plant

SHANGHAI, July 30, 2021 — USI’s Vietnam plant is located in Dinh Vu, Haian District, Haiphong City, Vietnam, covering a total area of 65,000 square meters. The construction process will be finished in two phases. Recently the System in Package (SiP) modules for wearable products have received the production…

Huion Announces Three 23.8inch Pen Displays, Including the Kamvas Pro 24(4K)

SHENZHEN, China, July 30, 2021 — Huion announces three big screen pen displays today, Kamvas 24, Kamvas 24 Plus, and Kamvas Pro 24(4K). Two from its Kamvas series and one from its Kamvas Pro series. Featured with upgraded performances, these pen displays are…

Dynamic Threat Landscape Urges European Organizations to Turn to Managed & Professional Security Services

Financial services will remain the largest contributor to the European MSS/PSS market until 2024, finds Frost & Sullivan SANTA CLARA, Calif., July 30, 2021 — Increasing cyber-threats coupled with a shortage of cybersecurity professionals in Europe is compelling organizations to turn toward managed and professional security services (MSS/PSS) companies. Frost &…

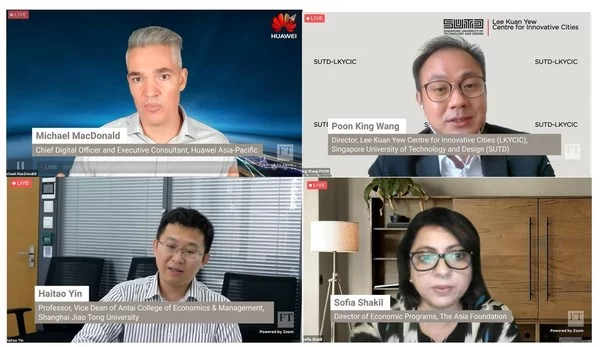

Experts call for increasing rural area digital connectivity to alleviate poverty

SINGAPORE, July 28, 2021 — To close the digital divide and drive economic recovery during the pandemic, cross sectors collaboration are needed to lower the costs of rural area connectivity and improve digital literacy. This was the crux of the presentations by experts at the a webinar on "Strategies for…

Supermicro Debuts New Top-Loading and Simply Double Storage Systems with 3rd Generation Intel Xeon Processors, PCI-E 4.0 with NVMe Cache for High-Capacity Cloud-Scale Storage

Comprehensive Family of 60-bay and 90-bay 4U Storage Models Supporting Single-Node, Dual-Node, Storage Bridge Bay, or JBOD Configurations in a Highly Serviceable Architecture SAN JOSE, Calif., July 27, 2021 — Super Micro Computer, Inc. (Nasdaq: SMCI), a global leader in enterprise computing, storage,…

Shop Anywhere with “Single-Pay” and “3-Pay” Using New Paidy App

TOKYO, July 27, 2021 — -Complete Entire Purchase within App, from Discovery to Payment for Smooth Shopping Experience- Paidy Inc., Japan’s leading "Buy Now, Pay Later" provider, has announced the release of its new app that allows consumers to browse and discover the items they want across thousands of online…