BEIJING, Jan. 5, 2022 — A news report from China Daily on Guiyang. Success of agricultural sector sees output and profits of Guizhou province rise substantially. As a key edible…

KT SAT unveils its new brand of maritime satellite communication targeting South East Asia market

SEOUL, South Korea, Jan. 5, 2022 — KT SAT(www.ktsat.com), the leading provider of satellite communication service in South Korea unveils its new maritime brand "XWAVE" that stands for the company’s…

CCTV+: China Media Group president delivers New Year message to global audience

BEIJING, Jan. 2, 2022 — China Media Group (CMG) President Shen Haixiong addressed the global audience on the first day of 2022, with the focus on the reflection of the CMG’s…

SK Telecom Showcases Green ICT at CES 2022

LAS VEGAS, Jan. 2, 2022 — SK Telecom (NYSE: SKM, hereinafter referred to as "SKT") today announced that it will participate in CES 2022, which will be held in Las Vegas…

SoyNet to introduce AI accelerator at CES 2022

SEOUL, South Korea, Jan. 1, 2022 — SoyNet (CEO Yong-hoKim, Jung-wooPark) will introduce an AI execution accelerator at the "CES 2022" which will be held in Las Vegas on January…

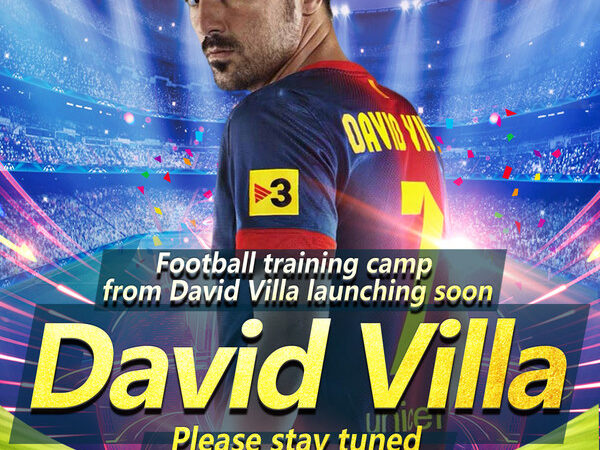

Color Star Technology Co., Ltd. (NASDAQ: CSCW) to Officially Launch Online Course Taught by Football Star David Villa Sanchez on January 1, 2022

NEW YORK, Dec. 31, 2021 –Color Star Technology Co., Ltd. (NASDAQ: CSCW) (hereinafter referred to as "Color Star" or the "Company"), an entertainment technology company with a global network that…

Chunghwa Telecom announces new organizational structure effective in 2022

Business groups and technology groups will collaborate to elevate company to the next level TAIPEI, Dec. 30, 2021 — In response to market competition, rapid technological advancement and the ongoing…

Renren Announces Unaudited First Half 2021 Financial Results

PHOENIX, Dec. 30, 2021 — Renren Inc. (NYSE: RENN) ("Renren" or the "Company"), which operates two US-based SaaS businesses, Chime Technologies Inc. ("Chime") and Trucker Path Inc. ("Trucker Path"), today announced…

CHTF2021 Opens in Shenzhen China

SHENZHEN, China, Dec. 29, 2021 — The 23rd China High-Tech Fair (CHTF2021) opened in Shenzhen, China on December 27, 2021. China Hi-Tech Fair 2021–China’s No. 1 Technology show opens…

Waymo and Zeekr to collaborate on all-electric, fully autonomous ride-hailing vehicle

HANGZHOU, China and SAN FRANCISCO, Calif., Dec. 29, 2021 — Geely Holding Group’s (Geely) premium electric brand, Zeekr, will collaborate with Waymo on the development of a new pure electric…