SEOUL, South Korea, Sept. 11, 2023 — CelcomDigi Berhad (CelcomDigi) and VIRNECT (438700: KOSDAQ), a Korea-based technology company that specializes in the development and commercialization of industrial extended reality…

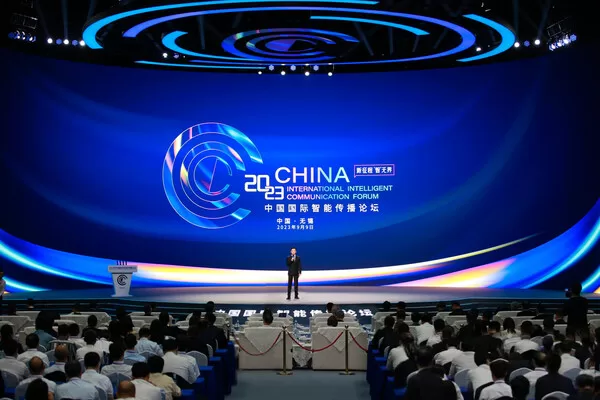

China International Intelligent Communication Forum 2023 Builds up International Consensus and Facilitates Media Innovation

WUXI, China, Sept. 9, 2023 — The China International Intelligent Communication Forum 2023, hosted by China Media Group and the Jiangsu Provincial People’s Government, took place in Wuxi, Jiangsu…

CGTN: Regional economic integration promotes China-ASEAN common prosperity

BEIJING, Sept. 8, 2023 — Themed "ASEAN Matters: Epicentrum of Growth," the 43rd Association of Southeast Asian Nations (ASEAN) Summit concluded on Friday in Jakarta, Indonesia, with a series…

Dow Jones and Cision Unveil Exclusive Global Content Partnership for the PR and Corporate Communications Market

New Agreement Empowers Reputation Management and Strategic Communication Agendas Worldwide CHICAGO and NEW YORK, Sept. 7, 2023 — Cision, the leading provider…

Trip.com Group Limited Reports Unaudited Second Quarter and First Half of 2023 Financial Results

SHANGHAI, Sept. 5, 2023 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…

“With Saudi, Go Global” Huawei Cloud Launches Services in Saudi Arabia

RIYADH, Saudi Arabia, Sept. 4, 2023 — Huawei Cloud announced the launch of the Huawei Cloud Riyadh Region today at the Huawei Cloud Summit Saudi Arabia 2023. This Region…

TECNO Unveils “PHANTOM Ultimate” Concept Phone Redefining Rollable Screen Innovation

HONG KONG, Sept. 1, 2023 — PHANTOM, TECNO’s premium technology sub-brand, released a concept video for its latest rollable smartphone concept, PHANTOM Ultimate. Following the previous PHANTOM Vision V…

Yonyou Releases White Paper on Globalization of Digital Operations for Chinese Enterprises, Empowering Global Expansion and Digital Transformation

HONG KONG, Aug. 31, 2023 — On August 19, 2023, Yonyou Network Technology unveiled the White Paper on Globalization of Digital Operations for Chinese Enterprises at the forum entitled ‘Chinese…

Starbox Group Holdings Ltd. Announces First Half of Fiscal Year 2023 Financial Results

Revenue and Net Profit Increased to $4.0 Million and $1.4 Million Respectively (Basic Earnings of $0.03 Per Share) with Technology-Driven Services Revenue…

Quhuo to Report Unaudited Financial Results for First Half of 2023 on August 31, 2023

BEIJING, Aug. 28, 2023 — Quhuo Limited (NASDAQ: QH) ("Quhuo," the "Company," "we" or "our"), a leading gig economy platform focusing on life services in China, today announced that it…