BEIJING, May 8, 2020 /PRNewswire/ — Phoenix New Media Limited (“Phoenix New Media”, “ifeng” or the “Company”) (NYSE: FENG), a leading new media company in China, today announced that it will report its 2020 first quarter financial results on Monday, May…

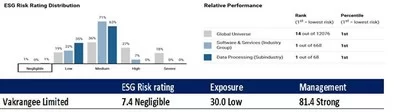

Vakrangee Ranked World’s No.1 Company in the Software and Services Industry Based on Sustainalytics ESG Assessment

Globally Ranked 14th out of the 12,076 companies (Global Universe) Globally Ranked 1st out of 668 Companies in Software & Services (Industry Group) MUMBAI, India, May 8, 2020 /PRNewswire/ — In recognition of its superior Environmental, Social and Governance models, Vakrangee Limited…

L-com Launches Ruggedized USB 3.0 Cable Assemblies with Die-Cast Shells and Thumbscrews

IRVINE, California, May 8, 2020 /PRNewswire/ — L-com, an Infinite Electronics brand and a preferred manufacturer of wired and wireless connectivity products, announced today that it has launched a new series of ruggedized USB 3.0 cables that feature die-cast metal back…

51job, Inc. Reports First Quarter 2020 Financial Results

SHANGHAI, May 8, 2020 /PRNewswire/ — 51job, Inc. (Nasdaq: JOBS) (“51job” or the “Company”), a leading provider of integrated human resource services in China, announced today its unaudited financial results for the first quarter of 2020 ended March 31, 2020. First Quarter 2020 Financial…

Ribbon Announces Management Change

WESTFORD, Mass., May 8, 2020 /PRNewswire/ — Ribbon Communications Inc. (Nasdaq: RBBN), a global provider of real time communications software and network solutions to service providers, enterprises, and critical infrastructure sectors, today announced that the President and CEO of ECI Telecom…

Redtea Mobile Supports the Implementation of Integrated nuSIM for IoT

SINGAPORE, May 7, 2020 /PRNewswire/ — Redtea Mobile, the pioneering connectivity solution provider has today announced that it has developed the trusted application to support the implementation launch of nuSIM solution, the integrated SIM for IoT, which brings clear benefits for…

Get your spyglass out! Educational detective game launches worldwide for curious kids to play at home

The Wollstonecraft Detective Agency: Thrilling adventure for young sleuths teaches coding, history and features famous women in STEM VICTORIA, British Columbia, May 7, 2020 /PRNewswire/ — Best-selling children’s book series The Wollstonecraft Detective Agency is now available as a seriously fun,…

AUTOCRYPT Joins Car Connectivity Consortium (CCC)

SEOUL, South Korea, May 7, 2020 /PRNewswire/ — AUTOCRYPT announced that the company has joined Car Connectivity Consortium (CCC), a cross-industry organization advancing global technologies for smartphone-centric car connectivity solutions, as the first cybersecurity company from the Asia Pacific. The…

CooTek to Announce First Quarter 2020 Unaudited Financial Results on May 15, 2020

SHANGHAI, May 7, 2020 /PRNewswire/ — CooTek (Cayman) Inc. (NYSE: CTK) (“CooTek” or the “Company”), a fast-growing global mobile internet company, today announced that it will report its unaudited financial results for the first quarter 2020 ended March 31, 2020, before…

The outstanding camera phone – TECNO CAMON 15 Premier allows you to experience brilliant photography with big screen, big memory and big battery

HONG KONG, May 6, 2020 /PRNewswire/ — The CAMON 15 series smartphone from TECNO Mobile (www.TECNOMobile.com) has begun its official sale, which means it’s time to dive deeper into this device that many people have heard so much about. Aside from its…