BEIJING, Jul 30, 2020 — The world-renowned Chinese pianist Lang Lang performed publicly for the first time in six months on Kuaishou, a livestreaming platform. Lang hosted the one-hour broadcast, which attracted over 3 million viewers and fans. Entertaining the crowd with a mix of songs, stories and games,…

How CommonLook’s Expertise Helps Google With PDF Accessibility

ARLINGTON, Virginia, July 30, 2020 — Two years ago, Google reached out to CommonLook because of our expertise in PDF accessibility. "At the time, we recognized the potential impact on PDF accessibility due to the massive number of Chrome users around the world."…

Siemon Supports Single-Pair Ethernet with TERA® Cabling

WATERTOWN, Connecticut, July 30, 2020 — Siemon, a leading global network infrastructure specialist, is pleased to announce that its TERA cabling system supports 10BASE-T1L single-pair Ethernet (SPE), providing an easily-deployed, Standards-based infrastructure that simplifies cable management, reduces costs, and enables more efficient use of pathway space. As explained in a new…

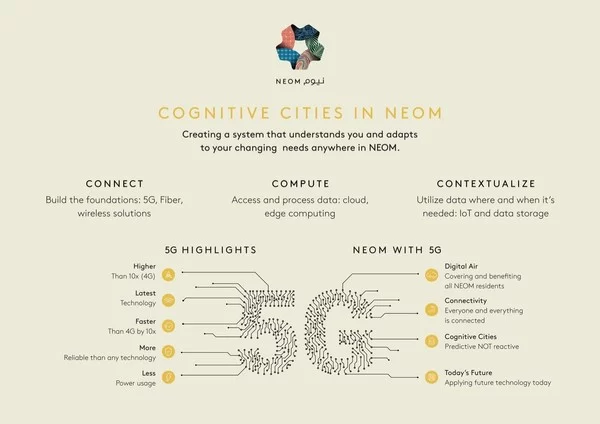

NEOM launches infrastructure work for the world’s leading cognitive cities in an agreement with stc

– NEOM’s next generation cognitive cities will support its cutting-edge urban environments, improving the lives of residents and businesses far beyond the capabilities of today’s smart cities – stc will deliver an advanced 5G and IoT network to support the development of NEOM NEOM, Saudi Arabia, July 28, 2020 — NEOM…

Leading software development agency Titansoft selects PeopleStrong to power their HR Tech

SINGAPORE, July 28, 2020 — PeopleStrong announced today that it has secured an agreement to power the HR technology for leading software development agency – Titansoft. PeopleStrong will implement Alt Recruit (next-generation recruitment system), Alt Worklife (leading HRMS Software which provides a Hire to…

Supermicro Unveils New Generation Top-Loading Storage Systems for High-Capacity Cloud-Scale Deployments

Customers Can Leverage Multiple Expansion Options with Flexible 60-bay and 90-bay Systems Available in Single-Node, Dual-Node, SBB, or JBOD Configurations SAN JOSE, Calif., July 27, 2020 — Super Micro Computer, Inc. (SMCI), a global leader in enterprise computing, storage, networking solutions, and green computing technology, announced an extension of its market-proven ultra-dense…

Sohu.com to Report Second Quarter 2020 Financial Results on August 10, 2020

BEIJING, July 27, 2020 — Sohu.com Limited (NASDAQ: SOHU), China’s leading online media, video, search and gaming business group, will report its second quarter 2020 unaudited financial results on Monday, August 10, 2020, before U.S. market hours. Sohu’s management team will host a conference call…

AP Memory Joins NXP Partner Program

TAIPEI, July 27, 2020 — AP Memory Technology Corporation (AP Memory, TWSE: 6531), a leading supplier of innovative DRAM products, has joined the NXP Connect Partner Program. AP Memory is a memory IC design company focusing on low to mid density DRAM solutions, providing a full range of IoT RAM (low pin count QSPI/OPI…

Heroic-Faith raised NT$ 1.2 Billion for COVID-19 Unprecedented Need of Remote Patient Monitoring

TAIPEI, Taiwan, July 25, 2020 — Heroic-Faith uses deep learning and other forms of AI to develop algorithms that assist in the identification of normal and adventitious lung sounds, such as inhalation, exhalation, wheeze, stridor and crackles. The technology is also able to respond to excessive respiratory rate, slow respiratory…

Go-Yunnan launches on Twitter, Facebook and YouTube

KUNMING, China, July 24, 2020 — On July 20, 2020, Go-Yunnan formally established a presence on the world’s three key social networks, Twitter, Facebook and YouTube, finalizing the integration of a number of services and features and providing a venue where anyone interested in visiting or touring Yunnan can gain…