The global Ethernet testing market is expected to reach $2 billion by 2025, with North America leading the way SANTA CLARA, Calif., Nov. 25, 2020 — Frost & Sullivan’s recent analysis, High-Speed 200GbE and 400GbE Powering the Global Gigabit Ethernet Testing Market, finds that the growth of connected devices, incorporation of…

ZTE and GSMA Intelligence Release White Paper on Green 5G – 5G Energy Efficiencies, Green is the New Black

SHENZHEN, China, Nov. 25, 2020 — ZTE Corporation (0763.HK / 000063.SZ), a major international provider of telecommunications, enterprise and consumer technology solutions for the Mobile Internet, has released a white paper on its 5G Summit & User Congress on Green 5G, "5G Energy Efficiencies, Green is the New Black", authored by…

China Telecom Honored with “The Best of Asia – Icon on Corporate Governance”

Asia’s Best Awards in CEO, CFO and CSR HONG KONG, Nov. 20, 2020 — China Telecom Corporation Limited ("China Telecom" or "the Company"; HKEx: 00728; NYSE: CHA) was awarded "The Best of Asia – Icon on Corporate Governance" in the "Corporate Governance Asia Recognition Awards 2019", organized by Corporate Governance Asia,…

Globe Telecom sees pervasive 4G/LTE mobile data in PH by 2021

MANILA, Philippines, Nov. 20, 2020 — Aligning with the national plan to boost digital inclusivity and fulfill its commitment to serve its customers, Globe Telecom has been focusing on improving its network infrastructure by expanding its reach through new site builds and network upgrades all over the country. As…

Huawei’s Ken Hu: 5G Creates New Value for Industries and New Growth Opportunities

SHANGHAI, Nov. 13, 2020 — At the 11th Annual Mobile Broadband Forum today, Huawei’s Deputy Chairman Ken Hu spoke with leaders in the telecoms and digital technology sectors about the new value that 5G can bring to different industries around the globe. As 5G is poised to transform the way we…

PTT Team Up with Partners to Launch 5G x UAV SANDBOX to Unlock Thailand’s First Restriction-free Drone Testing Area at Wangchan Valley

BANGKOK, Nov. 12, 2020 — Wangchan Valley invites start-ups, investors, and all interested parties to utilize 5G technology and the first UAV regulatory sandbox in Thailand. Together, both sandboxes will serve as a paradigm shift mechanism to drive Thailand’s innovation ecosystem, since the country’s development is geared towards Industry 4.0. …

VTech Announces 2020/2021 Interim Results

Higher profit on stable revenue and improved gross margin HONG KONG, Nov. 9, 2020 — COVID-19 brought unprecedented challenges to the Group’s operations Group revenue was flat at US$1,123.6 million Gross profit margin improved from 30.7% to 31.8%…

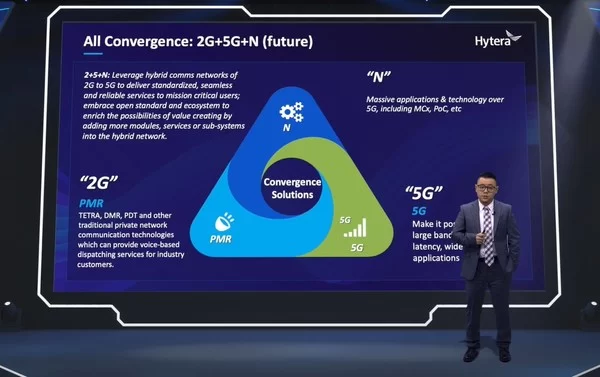

Hytera Envisages the Future of PMR at Critical Communications World Virtual Conference

SHENZHEN, China, Nov. 6, 2020 — Hytera, a global leading Professional Mobile Radio (PMR) solution provider, participated in Critical Communications Week (CCWeek) 2020 as a Brand Leader sponsor to showcase its latest innovations and shared perspectives on the evolution of communications technologies from 2G to 5G. CCWeek, a five-day virtual exhibition…

Dubber “Best of Breed” UCR & Voice Intelligence Cloud selected for IBM Cloud for Telecommunications Services

Integrated Cloud offering to unlock efficiency and new services across Service Provider Networks globally Addresses critical customer challenges in compliance, customer experience and security at scale MELBOURNE, Australia, Nov. 6, 2020 — Dubber Corporation Limited (ASX: DUB) (Dubber), has been…

Chunghwa Telecom Reports Un-Audited Consolidated Operating Results for the Third Quarter of 2020

TAIPEI, Oct. 30, 2020 — Chunghwa Telecom Co., Ltd. (TAIEX: 2412, NYSE: CHT) ("Chunghwa" or "the Company") today reported its un-audited operating results for the third quarter of 2020. All figures were prepared in accordance with Taiwan-International Financial Reporting Standards ("T-IFRSs") on a consolidated basis. (Comparisons throughout the…