PARIS, Oct. 20, 2020 — At its online sale on 28 May 2020, Phillips sold Banksy’s lot Happy Choppers (2003) for $39,000. That may not seem surprising until you take into account that the work was a screenprint numbered 621 from a series…

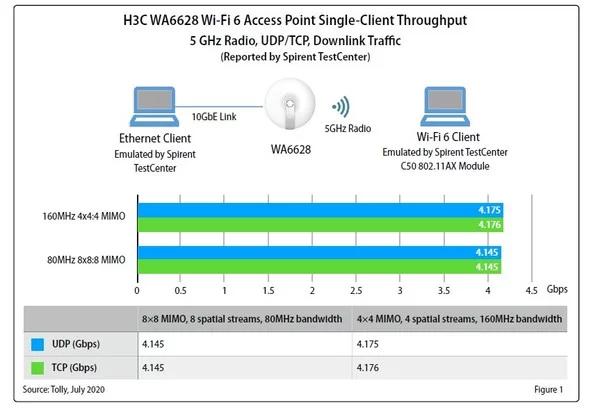

H3C Wi-Fi 6 Access Point Registers Fastest Connection Speed Ever Tested: Tolly Test Report

BEIJING, Oct. 19, 2020 — H3C’s Wi-Fi 6 flagship access point WA6628 delivers single-client wireless throughput up to 4.176Gbps on the 5 GHz radio, representing the fastest Wi-Fi connection speed that has been tested by Tolly Group so far, according to a recent report of the leading global provider of…

Consumers in APAC continue to struggle with bill payments amid COVID-19

The second wave of Experian’s 2020 Global Insights Report highlights the impact of the global pandemic on consumer spending habits and potential implications for financial institutions SINGAPORE, Oct. 19, 2020 — Consumers in Asia Pacific (APAC) have reported difficulties in paying their bills…

BGK agrees with IMF report: “Infrastructure investment is a key priority for the CESEE region to accelerate convergence toward the EU15”

WARSAW, Poland, Oct. 17, 2020 — Infrastructure investment is a key priority for Countries in Central, Eastern, and Southern Europe (CESEE) to accelerate the convergence of the living standards toward the level of the more advance European countries, the EU15 – says the IMF report published on 28th Sep 2020. IMF…

iQIYI iCartoonFace Paper For Cartoon Character Recognition Accepted by Prestigious Multimedia Conference

BEIJING, Oct. 16, 2020 — iQIYI Inc. (NASDAQ: IQ) ("iQIYI" or the "Company"), an innovative market-leading online entertainment service in China, is pleased to announce that its paper on face recognition and detection technology of cartoon characters (the "Paper"), titled Cartoon Face Recognition: A Benchmark Dataset, has been accepted by…

Beijing’s digital economy accounts for over half of GDP in 2019

BEIJING, Oct. 16, 2020 — A report from China SCIO: The digital economy of Beijing accounted for over half of the city’s GDP in 2019, the highest ratio in China, municipal officials announced on Thursday. The total added value of the Chinese capital’s new economy last year, including new industries,…

xQuant Named to 2020 IDC FinTech 100 Rankings

HANGZHOU, China, Oct. 16, 2020 /PR Newswire/ — xQuant, a leading multiple-asset trade processing, portfolio management and risk analytics system and services provider for capital markets and investment management communities in China, announced that it has ranked No. 94 on the 2020 IDC FinTech 100 Rankings, one of the most comprehensive…

Consumer Electronics and Automotive Sectors to Push Adoption Potential for Electrically Conductive Materials

Development of nanomaterials to manufacture electrically conductive materials will unlock new growth opportunities, says Frost & Sullivan SANTA CLARA, California, Oct. 15, 2020 — Frost & Sullivan’s recent analysis, Growth Opportunities for Conductive Materials, finds that increasing demand for high-efficiency electronics and components such as electrical circuits is sparking innovation in…

Second Citizenship from St Kitts and Nevis Opens Doors to British Education in Times of Crisis

LONDON, Oct. 9, 2020 — Despite predictions that the pandemic would cause a decline in international students, the United Kingdom is set for a record increase. Interestingly, enrolments from non-EU international students went up 9 per cent this academic year. According to Jimmy Beale, the founder of The English Education, a…

Infosys Named a Global Leader in Digital Process Automation Services

BENGALURU, India, Oct. 8, 2020 — Infosys (NYSE: INFY), a global leader in next-generation digital services and consulting, announced today that Forrester has named Infosys a global leader in Digital Process Automation (DPA) Services, in its recent report entitled "The Forrester Wave™: Digital Process Automation…