The Real Power for Real People dissemination campaign has impacted millions of consumers and showed the "real power" of nuts and dried fruits and its connection to "attitudinal immunity". REUS, Spain, April 22, 2021 — Launched on October 27, 2020, the Real Power for Real People messaging focused on the…

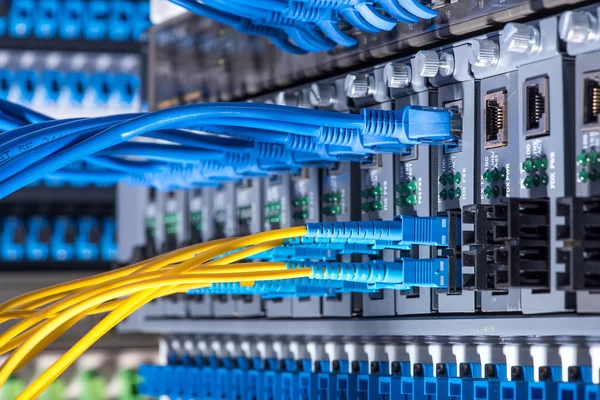

US Companies Invest in Switched Ethernet Services to Connect to Cloud-based Applications, Says Frost & Sullivan

Enterprises are evaluating the benefits of fixed versus usage-based network services to align with pay-as-you-go cloud-based services SANTA CLARA, Calif., April 22, 2021 — Frost & Sullivan’s recent analysis finds that continued demand for bandwidth and cloud connectivity needs are sustaining Ethernet demand in the United States business markets. Market maturity,…

DevOps Institute Announces the ‘Upskilling 2021: Enterprise DevOps Skills Report’

With new data gathered from over 2,000 IT professionals worldwide, the report shows the continued adoption of DevOps must be supported through a learning organization and the continuous development of multi-faceted, skilled DevOps professionals BOCA RATON, Fla., April 21, 2021 — DevOps Institute, a…

CFOs in Global Survey Reveal Pandemic Has Fundamentally Altered How They Hire and Manage Their Workforce

– Sixty-five percent of Asia-Pacific respondents indicated that they expect to exceed goals and expectations for 2021, compared to 46% for UK and 47% for North America – Almost all (94%) of respondents from Asia Pacific have a growth strategy involving expansion into countries where they do not currently operate…

Crypto.com Visa Card Spending Grew 55% Per User in 2020, Online Spending Up 117%

For the first time, Crypto.com shares transaction data for its Visa Card, showing strong growth in overall user spending, especially for online purchases and cross-border transactions HONG KONG, April 1, 2021 — Today, Crypto.com released its Consumer Spending Insights Report for 2020, which details spending…

Chinese cities feature prominently in global Top 50 Smart City Government rankings

Seven Chinese cities emerge among the top 50 smart city governments worldwide SINGAPORE, March 31, 2021 — Seven Chinese cities – Shanghai, Beijing, Chengdu, Shenzhen, Hangzhou, Guangzhou, and Chongqing – clinched spots in the second edition of the Top 50 Smart City Government rankings released by Eden Strategy Institute. …

Global Semiconductor Materials Market Sets New High of $55.3 Billion With 5% Expansion in 2020, SEMI Reports

MILPITAS, Calif., March 22, 2021 — The global semiconductor materials market grew 4.9% in 2020 to $55.3 billion in revenue, surpassing the previous market high of $52.9 billion set in 2018, SEMI, the global industry association representing the electronics manufacturing and design supply chain,…

FICO Survey: 54% of Indonesians Prefer to Use Digital Channels to Engage with their Bank During Financial Hardship

Appeal of in-person branch banking fading fast post pandemic JAKARTA, Indonesia, March 18, 2021 — Preferred banking customer touchpoints across Asia Pacific – December 2020 Highlights: 54 percent of Indonesian consumers prefer to use digital channels to…

AI and Cloud to Empower the European Telehealth Market Securing Efficient Access to Essential Healthcare Services

By 2026, the European telehealth market is estimated to witness more than a four-and-a-half-fold growth, garnering $20.7 billion revenue, finds Frost & Sullivan SANTA CLARA, Calif., March 17, 2021 — Frost & Sullivan’s recent analysis, Innovative Business Models Powering the Telehealth Market in Europe, finds that the severe impact of COVID-19…

Global Security Industry to be Powered by Rising Need for Niche Security Solutions and Rapid Advancements in Technology

The demand for surveillance technologies such as security cameras and advanced electro-optics, video analytics, RADAR, and LIDARs to intensify, reveals Frost & Sullivan SANTA CLARA, Calif., March 17, 2021 — Frost & Sullivan’s recent analysis, Digitization and Advanced Analytics Power the Global Security Industry, finds that threats posed by the proliferation…