Combination of #1 Sales Enablement platform with the leading enterprise Sales Readiness platform creates a complete system to ensure customer-facing teams are "buyer ready" in the all-digital world WALTHAM, Mass., Aug. 23, 2021 — Bigtincan (ASX:BTH), the global leader in sales enablement automation, announced…

CLPS Incorporation Announces the Completion of Capital Increase Agreement Transaction in MSCT to Ramp Up Cooperation in Global Financial Technology Services Market with MCT

HONG KONG, Aug. 20, 2021 — CLPS Incorporation (Nasdaq: CLPS) ("CLPS" or "the Company"), today announced that it has completed the previously announced Capital Increase Agreement (the "Agreement") transaction with Minshang Creative Technology Holdings Limited ("MCT", 01632.HK). CLPS, through its wholly-owned subsidiary, Growth Ring Ltd., and MCT now hold 53.33% and 46.67%…

Bambuser CEO and CFO comment on the Interim Report for Q2 2021

STOCKHOLM, Aug. 20, 2021 — Maryam Ghahremani, CEO and Sara Lundell CFO of Bambuser, will comment on the interim report from the second quarter of 2021. The interview will be broadcast today at 15:00 CEST, 9 AM EDT, held in English and last for approx 15 minutes. Link to the broadcast: https://bambuser.com/ir/q2-2021…

Bambuser’s Nomination Committee proposes that Sonia Gardner and Jørgen Madsen Lindemann be elected as new board members – Alexander Mcintyre has announced his intention to resign from the board

STOCKHOLM, Aug. 20, 2021 — To further strengthen the board of directors competence the Nomination Committee of Bambuser proposes that Sonia Gardner and Jørgen Madsen Lindemann, respectively, be elected as new board members of Bambuser. At the same time, Alexander Mcintyre has announced that he intends to resign from the…

Cloopen Group Holding Limited (NYSE: RAAS) Announces Financial Results for Second Quarter 2021

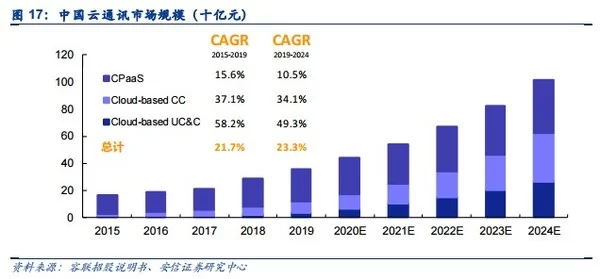

BEIJING, Aug. 19, 2021 — The thriving stay-at-home economy that emerged in 2020 unleashed the potential of the cloud-based communications market. Rising alongside the ongoing improvement of the communications infrastructure, the market is entering a golden age. The cloud-based communications market in China will continue to grow rapidly in the…

VVDN Technologies Joins NVIDIA Partner Network to Expand Opportunities for Advanced AI-Enabled Camera & Vision Applications

SAN JOSE, California, Aug. 18, 2021 — VVDN Technologies, a premier electronic product engineering and manufacturing company, announced that it has joined the NVIDIA Partner Network (NPN) as a provider of AI-enabled computer vision solutions powered by the NVIDIA Jetson edge AI platform….

Tecnotree Reports Strong Financial Result for H1 of 2021

HELSINKI, Aug. 16, 2021 — Tecnotree, the global Digital Business Support Systems (BSS) provider, announced its 2021 second quarter and half-year results. With the growth in all the parameters, the company reported an increase of 16% in net sales and a remarkable growth of 60% in the net profit for…

China Finance Online Announces Receipt of Nasdaq Delisting Notice

BEIJING, Aug. 14, 2021 — China Finance Online Co. Limited ("China Finance Online", or the "Company", "we", "us" or "our") (NASDAQ GS: JRJC), a leading web-based financial services company that provides Chinese individual investors with fintech-powered online access to securities trading services, wealth management products, securities investment advisory services, as…

Fifth Wall Acquisition Corp. I Reminds Stockholders to Vote “FOR” Business Combination with SmartRent at Special Meeting of Stockholders

Upon Closing, the Combined Company Will Trade on the NYSE under "SMRT" Ticker Symbol LOS ANGELES, Aug. 13, 2021 — Fifth Wall Acquisition Corp. I (the "Company" or "FWAA"), a special purpose acquisition company, today reminded stockholders to vote "FOR" the business combination with SmartRent.com, Inc. ("SmartRent") at the special meeting…

Key Foundry Reinforces Design Support for Fabless Customers

SEOUL, South Korea, Aug. 11, 2021 — Key Foundry, the only pure-play foundry in Korea, announced today that it has developed a customer-friendly semiconductor design support tool named PDK Version E (Process Design Kit, enhanced version), and begun its offering to fabless companies….