BEIJING, April 26, 2022 — New Oriental Education & Technology Group Inc. (the "Company" or "New Oriental") (NYSE: EDU/ 9901.SEHK), a provider of private educational services in China, today…

Crystal International Steps Up Systems Transformation & Productivity with SAP Solutions

HONG KONG, April 25, 2022 — Crystal International Group, a global leader in apparel manufacturing headquartered in Hong Kong, is leveraging an array of SAP solutions to power its journey…

Databricks Announces Lakehouse Offering for Customers in the Media and Entertainment Industries

The Databricks Lakehouse for Media and Entertainment launches with early support from AWS, Cognizant, Fivetran, Labelbox and Lovelytics SAN FRANCISCO, April 21,…

Stamus Networks Supports NATO Cyber Defense Exercises

The company to provide advanced technology and experts to support the international live-fire exercise TALLINN, Estonia, April 20, 2022 — Stamus Networks, a global provider of high-performance network-based threat detection…

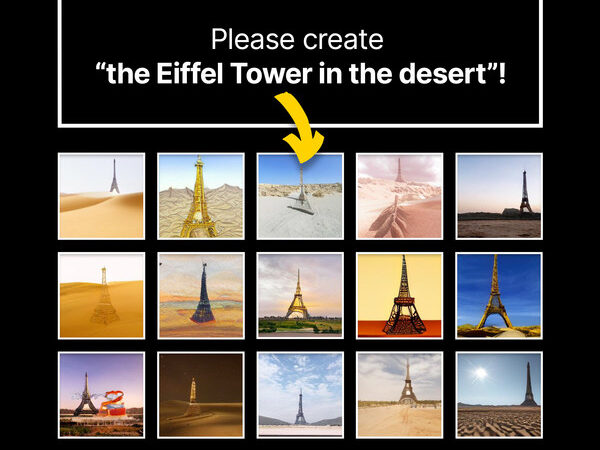

Kakao Brain Unveils Efficient Text-to-Image Generator, RQ-Transformer, on GitHub

Doubled the sampling speed compared to company’s ‘minDALL-E’ model Achieved enhanced quality and faster sampling speed by configuring high-resolution images as low-resolution 3D tensors Technology to be presented…

Open a New Page: XPPen Launched Its Online Rebranding

SHENZHEN, April 16, 2022 — On Apr. 15th, XPPen, a leader in digital painting, launched an online rebranding conference via the metaverse, amid much fanfare among Generation Z. XPPen, which…

FPT Software: How to Turn Dreamers into Doers & Harness the Power of Intrapreneurship

Intrapreneurship is always welcomed by tech giants, where innovations are greatly valued, going way back from when Gmail was born out of Google’s famous 20-percent rule. Mr. Dang Hoa…

Criminal IP New Cybersecurity Search Engine launches first beta test

TORRANCE, Calif., April 11, 2022 — AI Spera announced Criminal IP, a new cybersecurity platform, today. Criminal IP is a total Cyber Threat Intelligence (CTI) search engine intended to identify…

VMware Launches New Regional Digital Hub to Foster Greater Innovation and Inclusive Growth in Asia

Interactive, state-of-the-art technologies are key for enabling businesses to tap VMware’s solutions and global expertise in realizing innovation aspirations in the region SINGAPORE, April 8, 2022 — VMware, Inc….

Phai Labs releases whitepaper on building fairer AI for candidate screening

MELBOURNE, Australia, April 6, 2022 — Phai Labs, the R&D arm of PredictiveHire, has released the whitepaper that informed its FAIRTM Framework, showing how bias in AI can be mitigated…