Eighteen leading channel partners recognised for driving digital transformation to help organisations deliver business outcomes across every major industry, with the Nintex…

Amazon Leads as Top Channel for Product Research, According to New Data from ChannelAdvisor

Survey Shows that 75% of Australian Consumers Regularly Shop On Multiple Online Marketplaces A survey of over 5,000 global consumers provides brands…

Huawei Hosts the 9th Global Rail Summit in Berlin

BERLIN, Sept. 24, 2022 — In parallel with InnoTrans 2022, Huawei held the 9th Huawei Global Rail Summit, themed "Driving Digitalization in Future Rail, Create New Value Together". The summit…

Huawei Launches FRMCS Solution to Facilitate Digital Transformation of Railway

BERLIN, Sept. 23, 2022 — Huawei officially launched the Future Railway Mobile Communication System (FRMCS) solution at the InnoTrans 2022 and the 9th Huawei Global Rail Summit in Berlin,…

Ant Group listed as a Representative Vendor in the 2022 Gartner® Market Guide for Multiexperience Development Platforms

SINGAPORE, Sept. 23, 2022 — Ant Group has been mentioned as a Representative Vendor in the latest Gartner Market Guide for Multi experience Development Platforms, published in August, 2022. It…

Trip.com Group Limited Reports Unaudited Second Quarter and First Half of 2022 Financial Results

SHANGHAI, Sept. 22, 2022 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…

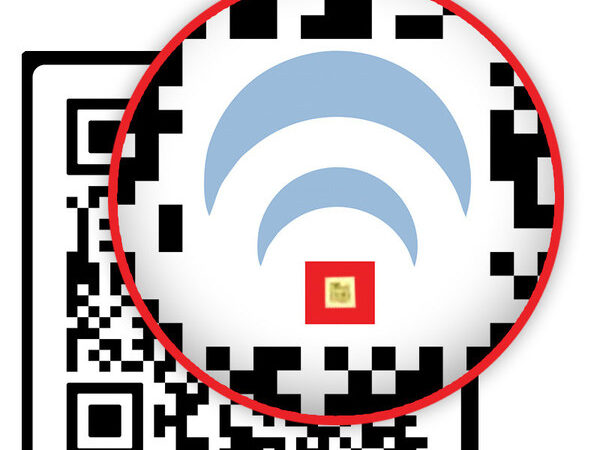

p-Chip Corporation Introduces First-of-its-Kind p-Chip Code Tracker to Revolutionize QR Code Security

CHICAGO, Sept. 16, 2022 — p-Chip Corporation, a company that is revolutionizing the tracking of physical products and materials with its cutting-edge microtransponder technology, today introduced its newest breakthrough,…

SHUTTERSTOCK APPOINTS SEJAL AMIN AS CHIEF TECHNOLOGY OFFICER

NEW YORK, Sept. 13, 2022 — Shutterstock, Inc. (NYSE: SSTK) (the "Company"), a leading global creative platform for transformative brands and media…

Nature’s Miracle, a Leader in the Controlled Environment Agriculture Industry, to be Listed on Nasdaq Through Business Combination with Lakeshore Acquisition II Corp.

Nature’s Miracle is a fast-growing agriculture technology company providing services to growers in Controlled Environment Agriculture ("CEA") settings in North America; Nature’s Miracle provides hardware as well as…

Experlogix Expands Senior Sales Leadership Team with Appointment of Two New VPs

SOUTH JORDAN, Utah and VEENENDAAL, Netherlands, Sept. 7, 2022 — Experlogix, a leading provider of Configure, Price, Quote (CPQ) and Document Automation software, announced today an expansion of its…