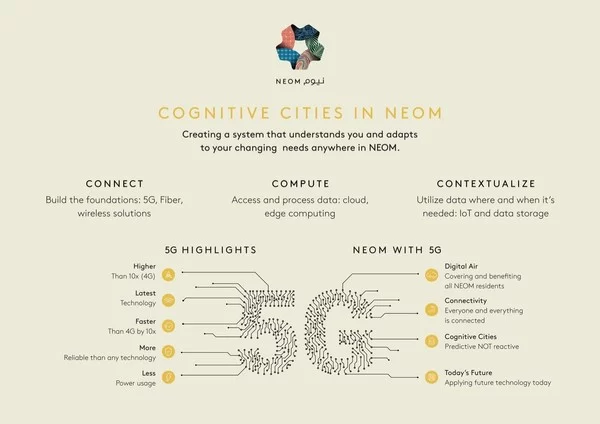

– NEOM’s next generation cognitive cities will support its cutting-edge urban environments, improving the lives of residents and businesses far beyond the capabilities of today’s smart cities – stc will deliver an advanced 5G and IoT network to support the development of NEOM NEOM, Saudi Arabia, July 28, 2020 — NEOM…

Supermicro and Scality Collaborate to Simplify Deployment of Enterprise Software Defined Storage

Supermicro Delivers an Optimized Software-Defined Storage Solution for Large Scale On-Premises Management of Unstructured Data in Partnership with Leading Software Company SAN JOSE, California, July 28, 2020 — Super Micro Computer, Inc. (SMCI), a global leader in enterprise computing, storage, networking solutions, and green computing technology, announced today a new solution…

Yellowfin Bolsters Partnership with Exasol to Offer Customers Unrivalled Analytics Performance

MELBOURNE, Australia, July 28, 2020 — Yellowfin, a world-leading and innovative analytics vendor, today announced one-stop purchase capability for its flagship analytics and business intelligence (BI) platform with Exasol the analytics database. Together, the two companies deliver unrivalled performance for better data-driven decision-making. Find out more here https://www.yellowfinbi.com/campaign/exasol …

Leading software development agency Titansoft selects PeopleStrong to power their HR Tech

SINGAPORE, July 28, 2020 — PeopleStrong announced today that it has secured an agreement to power the HR technology for leading software development agency – Titansoft. PeopleStrong will implement Alt Recruit (next-generation recruitment system), Alt Worklife (leading HRMS Software which provides a Hire to…

Global Healthcare Interoperability Market to Witness Nearly Two-fold Growth by 2024

Data interoperability and data analytics are key contributors to global market revenue for healthcare interoperability, says Frost & Sullivan SANTA CLARA, California, July 27, 2020 — Frost & Sullivan’s recent analysis, Global Healthcare Interoperability Market, Forecast to 2024, contends that interoperability has become a critical consideration for all health IT…

111, Inc. Launched Lung Cancer Patient Care Program “Cloud Enabled Lung Cancer Care by Great Doctors” for Full Life-cycle Management of Tumor

SHANGHAI, July 27, 2020 — Aiming to provide better health management services to lung cancer patients, "Cloud Enabled Lung Cancer Care by Great Doctors" was officially launched in Shanghai on July 25, 2020. The lung cancer patient care program (the "Program"), spearheaded by China Primary Health Care Foundation and co-hosted…

Arrowroot Capital Completes Sale of its Interest in SocialChorus, the Global Leader in Workforce & Employee Communications, to Sumeru Equity Partners

SANTA MONICA, California, July 25, 2020 — Arrowroot Capital Management, LLC ("Arrowroot"), a global growth equity firm in Santa Monica California, today announced the sale of its interest in portfolio company SocialChorus, Inc. ("SocialChorus"), the leader in end-to-end employee communications and engagement software solutions, to Sumeru Equity Partners L.P. ("Sumeru")….

Baidu App Announces Launch of Naming Selection Campaign for China’s First Mars Rover

Baidu App is the host for the rover’s name selection process, as well as for innovative multimedia content about the Tianwen-1 Mars mission BEIJING, July 24, 2020 — Baidu App, the flagship mobile platform of Baidu Inc. (NASDAQ: BIDU), today kicked off the official naming selection process for China’s first…

China Finance Online Reports 2020 First Quarter Unaudited Financial Results

BEIJING, July 24, 2020 — China Finance Online Co. Limited ("China Finance Online", or the "Company", "we", "us" or "our") (NASDAQ GS: JRJC), a leading web-based financial services company that provides Chinese retail investors with fintech-powered online access to securities trading services, wealth management products, securities investment advisory services, as well…

AGM Group Holdings Inc. Regains Compliance with Nasdaq Listing Requirement

BEIJING, July 24, 2020 — AGM Group Holdings Inc. ("AGMH" or the "Company") (NASDAQ: AGMH), an application software company providing accounting and ERP software, fintech software, and trading education software and website service, today announced that on July 23, 2020, the Company received a letter from the Listing Qualifications Department…