TAIPEI, Aug. 8, 2022 — Leveraging its strength in cloud infrastructure, leading server contract manufacturer Inventec (2356) continues to invest in developing 5G smart factory applications with O-RAN technology…

Suzhou promotes green, smooth industrial and supply chains with digital economy

SUZHOU, China, Aug. 3, 2022 — ASEAN Plus Three (10+3) Forum on Industrial Chain and Supply Chain Cooperation kicked off in Suzhou on Friday, its sub-forum on digital economy under the spotlight….

Over 80 out of top 100 supermarkets in China 2021 are accessible on JDDJ and Shop Now

About 50 supermarkets out of the top 100 are connected to Dada Group’s Haibo system. China’s brick-and-mortar retailers’ online sales up 40% yoy in 2021, reflecting huge opportunities…

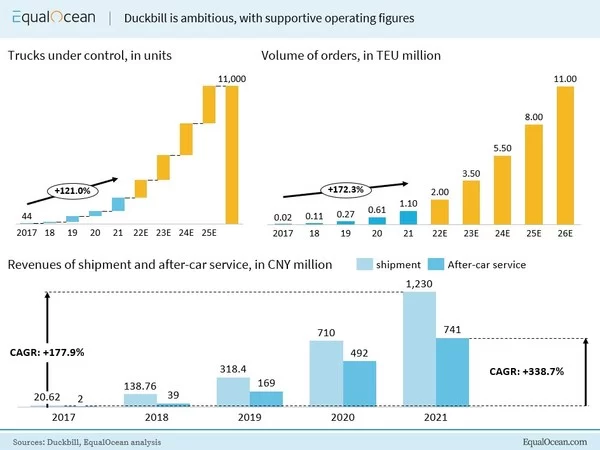

China’s Digitized Container Duckbill Speeds Up, Faster and Smarter

Backed by a new round of capital, Duckbill aims high to be a dominant player in the domestic container trucking market BEIJING, July 23, 2022 — Chinese digital container logistic…

Nippon Express (China) Becomes First Japanese Logistics Company to Establish Office in China’s Hainan Province

TOKYO, July 21, 2022 — Nippon Express (China) Co., Ltd. (hereinafter "NX China"), a group company of Nippon Express Holdings, Inc., has become the first Japanese logistics company to…

IQAX named among top 10 digital twin solution providers in APAC

IQAX is proud to announce its inclusion in CIOoutlook’s top 10 digital twin solution providers 2022 in the region. HONG KONG, July 14, 2022 — IQAX Limited, a leading…

IQAX launches IGP&I approved eBL, COSCO SHIPPING Lines and OOCL already onboard

IQAX is proud to announce COSCO SHIPPING Lines and Orient Overseas Container Line ("OOCL") as early adopters of IQAX eBL, which has been given the seal of approval by…

G7 Connect and E6 Technology Announce Completion of Merger

The merger combines IoT technology with software services to empower the road freight transport sector BEIJING, June 11, 2022 — G7 Connect Inc. ("G7"), a fleet management company backed…

BEST Inc. Announces Unaudited First Quarter 2022 Financial Results

HANGZHOU, China, June 9, 2022 — BEST Inc. (NYSE: BEST) ("BEST" or the "Company"), a leading integrated smart supply chain solutions and…

Dada Group’s JDDJ fulfilled the first order in JD618 Grand Promotion, and saw sales surge

SHANGHAI, June 3, 2022 — On May 31, only 10 minutes after the official opening of JD618 Grand Promotion, one consumer who lives in Chaoyang District, Beijing, had received…