Alliance Bank brings its virtual credit card with dynamic card number to Google Wallet and Samsung Wallet – a first in Malaysia.

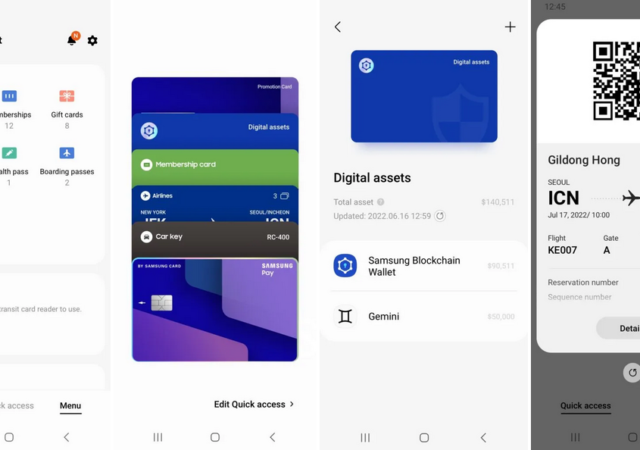

Samsung Wallet Here to Replace SamsungPay Ahead of Google Wallet

Samsung launches a new service where passwords, cards and Samsung Pay reside in the new Samsung Wallet.