HONG KONG, Oct. 23, 2020 — CNN International Commercial (CNNIC) and Hyundai Motor Company (Hyundai) are partnering on a cross-platform campaign that explores how innovation will change the way we will live in the future. In this exclusive global partnership, CNN will deliver a creative mix of advertising, branded content…

CaDi introduces Lycofertilic™ – high potency, targeted supplements with algae DHA Omega-3 to provide anti-ageing support for the ovarian reserve and to prepare for egg retrieval and IVF

LONDON, Oct. 23, 2020 — Cambridge Diagnostic Imaging (CaDi) is launching a new generation of targeted daily supplements, LycofertilicTM for fertility support and LycofertilicTM Prime to prepare for egg retrieval and IVF. The ovarian reserve and egg quality of women declines with age. This depletion is exacerbated by stress, imbalanced…

Silicon Motion Launches PCIe 4.0 NVMe 1.4 Controller Solutions for Client SSDs

New controller solutions offer best-in-class Power and Performance up to 7,400/6,800 MB/s Sequential Read/Write Speeds TAIPEI and MILPITAS, Calif., Oct. 23, 2020 — Silicon Motion Technology Corporation (NasdaqGS: SIMO) ("Silicon Motion"), a global leader in designing and marketing NAND flash controllers for solid-state…

Supermicro 2U Ultra-E Short-Depth Server — Now with NEBS Level 3-Certification — Delivers Data Center Computational Power to the Telecom Edge

Expanding Server Portfolio Gives Telecom Customers Multiple System Configurations: Intensive Workload Processing, NEBS Compliance, Free-Air Cooling, AC/DC Power SAN JOSE, California, Oct. 22, 2020 — Super Micro Computer, Inc. (Nasdaq: SMCI), a global leader in enterprise computing, storage, networking solutions, and green computing technology, continues to deliver market-leading data center…

Entrust Launches Next Generation Secure Cloud-Based Direct to Card ID Desktop Issuance Solution

The next generation Entrust Sigma instant ID solution is built for today’s cloud environments, leveraging encryption, trusted HSM technology and secure boot to issue highly secure physical and mobile identities SINGAPORE, Oct. 21, 2020 — Entrust, a leading provider of trusted identities, payments and…

Dubber Unveils Unified Call Recording and Voice AI Solution for Microsoft Teams

Automatically record and transform every conversation on Microsoft Teams into rich voice data for compliance, CX, evidence and performance improvement Eliminate the cost, complexity and risks of legacy call recording and unlock the benefits of voice data at scale Dubber unveils global channel program for Microsoft Channel…

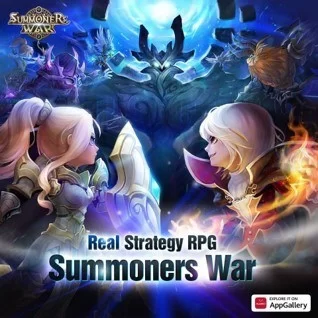

Renowned fantasy RPG, Summoners War, launches with new gameplay and features on AppGallery

The game will offer AppGallery users the chance to battle alongside 100 million Summoners across the globe, competing to retrieve the famous Mana Crystals LONDON, Oct. 21, 2020 — Summoners War, a much-loved RPG game with over 100 million downloads worldwide, has arrived on AppGallery, bringing with…

‘AIZEN’ AI banking-as-a-Service, Empowering data platform to launch lending services

SINGAPORE, Oct. 20, 2020 — The financial services industry has seen drastic technology-led changes over the past few years. While some of the big tech giants have launched their own Fintech verticals, there are many brands that are also increasingly looking to offer financial services to their customers. These companies…

Retail Tech Startup Tiliter Raises $7.5M for Cashierless AI Shopping Technology

Tiliter to increase global footprint as Investec invests through its IEC Australia Fund I SYDNEY, Oct. 20, 2020 — Investor demand for innovative emerging companies remains strong with Australian AI tech startup Tiliter completing a $7.5 million capital raise, led by Investec Emerging Companies (IEC). Eleanor Venture, a tech investment…

Data Analytics Customers Value Choice and Simplicity; Teradata’s New Flexible Cloud Pricing Provides Both

Innovative cloud pricing models include Blended Pricing – for the lowest cost at scale – and Consumption Pricing – for a true pay-as-you-go, usage-based offer SINGAPORE, Oct. 20, 2020 — Recognizing that data analytics workloads, usage patterns, and utilization rates can vary widely across an organization, Teradata (NYSE: TDC), the cloud…