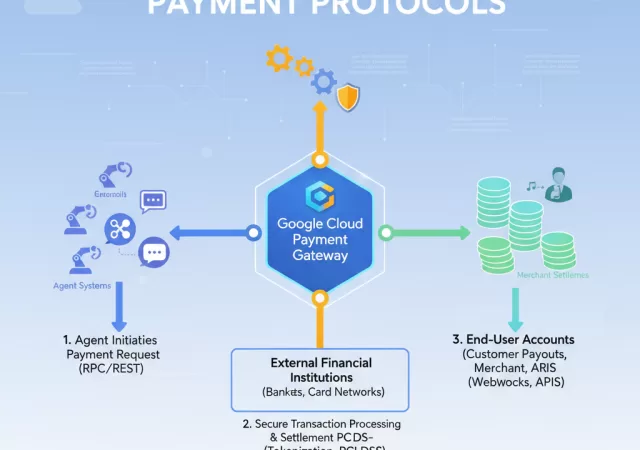

Google Cloud collaborates with over 60 organisations to develop the Agent Payments Protocol in anticipation for “agentic commerce”.

Google Launches Google Wallet in Malaysia

Google Wallet is officially available in Malaysia! You’ll be able to pay for your purchases without reaching fo your wallet.

Why Payments Are the Key to the Gaming Industry in Asia Pacific

As more games look to monetise beyond just the initial purchase, it’s becoming more crucial for developers to look at how payments are being done in gaming.

Enabling Global Expansion Through An Agile & Adaptable Payment System

Expanding businesses overseas and into new markets can be a challenge for any business. However, Nuvei looks to change that with a unique payment system.