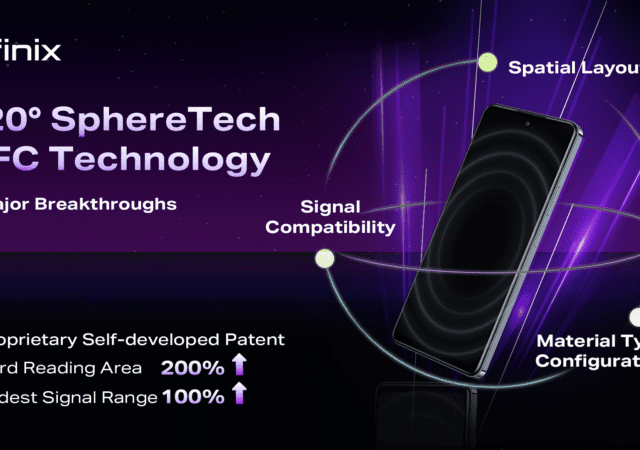

Infinix announces its 720° SphereTech Technology, a new approach to NFC technology that enables easier NFC activation.

European Union Probe Pushes Apple to Open NFC Access to Third Parties

Apple is moving to make the iPhone’s NFC open to third parties after the EU investigates it for anticompetitive practices.