The study provides insights into Singaporean workers’ attitudes towards digital transformation and company support. SINGAPORE, Aug. 31, 2023 — Reeracoen, a leading…

PH Emerges as One of the Rising Hyperscale Destinations in Asia, According to S&P Global Market Intelligence

MANILA, Philippines, Aug. 11, 2023 — As the race for data dominance intensifies in the Asia Pacific Region, the Philippines’ Department of Information and Communication Technology (DICT) projects a remarkable…

Global Industrial Control & Factory Automation Market to Surpass USD 259.84 Bn By 2031| Growth Market Reports

PUNE, India, July 3, 2023 — According to a recent market study by Growth Market Reports, titled, "Global Industrial Control & Factory…

Huawei Launches Multiple Portfolio Solutions and Releases 2023 Future Intelligent Campus White Paper for Asia Pacific

SHENZHEN, China, May 17, 2023 — At the Technical Innovation Summit during Huawei Asia Pacific Partners Conference 2023, Huawei launched a number of new upgraded Portfolio Solutions and released…

Sangfor Technologies Ranks Among the World’s Largest Hyperconverged Infrastructure System (HCIS) Vendors in Gartner® Market Share Report

A World-Leading HCIS Vendor HONG KONG, April 21, 2023 — Sangfor Technologies (Hereafter Sangfor) today announced that it has been listed among the world’s largest vendors of Integrated Systems (IS)…

Which category takes best performance on TikTok? Key Findings From Shoplus 2022 TikTok Trends Report

HONG KONG, Feb. 21, 2023 — Report: "Her Economy" is on the rise, Beauty and Personal Care, Womenswear and Lingerie accounted for 44% in TikTok e-commerce As the most…

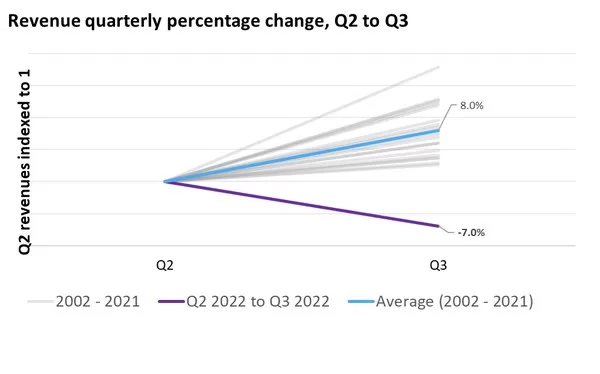

Omdia: Semiconductor market declines into uncharted (seasonal) territory

LONDON, Nov. 22, 2022 — The semiconductor market has had an exceptional run of sequential revenue growth during the COVID-pandemic period that began in early 2020 according to Omdia’s…

New Bite Investments Report Reveals High Expectations for Digital Growth in the Private Capital Industry

New study finds that the pandemic encouraged large firms to enhance technological capacity and smaller firms to capitalize on a first-mover advantage…

Greater China to Dominate the Asia-Pacific Enterprise Video Conferencing Market by 2027, Finds Frost & Sullivan

The surge in demand in Greater China during the COVID-19 lockdowns helped offset a decline and boost the overall revenues SAN ANTONIO, Jan. 10, 2022 — The COVID-19 crisis has changed…

Kalkine Pty Limited to Launch its ‘Cryptocurrency Research’

SYDNEY, Nov. 29, 2021 — Kalkine Pty Limited is pleased to announce the launch of its ‘Cryptocurrency Research’ to provide insights in the…