JINJIANG, China, Aug. 5, 2022 — Antelope Enterprise Holdings Limited (NASDAQ Capital Market: AEHL) ("Antelope Enterprise" or the "Company"), a leading Chinese manufacturer of ceramic tiles used in residential and…

Vieworks Wins FDA Approval for Its Newest VIVIX-S F series

ANYANG, South Korea, Aug. 5, 2022 — Vieworks, a leading digital X-ray imaging solution provider based in South Korea, noted that its newest VIVIX-S F series has been authorized…

Bechtel launches second round of STEM Returners program

Career-break engineers helping to shape team performance BRISBANE, Australia, June 17, 2022 — Bechtel announced today launch of second intake of STEM…

Recon Receives NASDAQ Notification Regarding Minimum Bid Requirements

BEIJING, June 4, 2022 — Recon Technology, Ltd (NASDAQ: RCON) ("Recon" or the "Company") today announced that on June 1, 2022, it received a letter from The Nasdaq Stock Market…

CAMX Power LLC Announces Transfer of GEMX® Cathode License from Johnson Matthey to EV Metals Group

LEXINGTON, Mass., May 27, 2022 — CAMX Power LLC (CAMX) announces it consented to Johnson Matthey Plc (JM) transferring its GEMX® and…

Rockwell Automation Announces the First Platinum System Integrator Partner, SAGE Automation, to its PartnerNetwork(TM)

Top-level Rockwell Automation Platinum Partnership helps industry address current issues and prevents future ones MELBOURNE, Australia, May 19, 2022 — Rockwell…

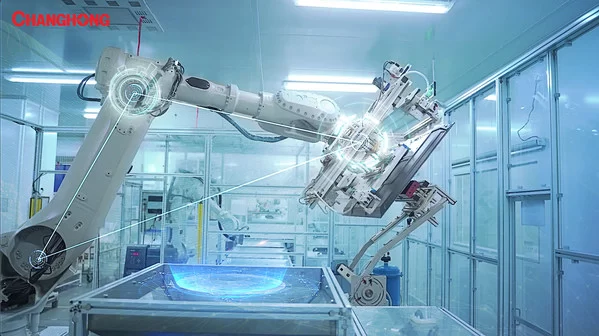

Changhong Ranked Among China’s Top 50 Intelligent Manufacturing Enterprises

Its advanced 5G+Industrial Internet intelligent production line was a key factor in driving the inclusion in the coveted list MIANYANG, China, May 13, 2022 — Changhong, a top…

ACE Green Recycling to build North America’s largest green battery recycling park in Texas

Proprietary emissions-free battery recycling technology to be deployed to recycle both lead-acid and lithium-ion batteries BELLEVUE, Wash., May 10, 2022 — Recycling technology company, ACE Green Recycling (ACE) is announcing its plans…

Roan Holdings Group Co., Ltd. Reports 2021 Financial Year Results

BEIJING and HANGZHOU, China, April 23, 2022 — Roan Holdings Group Co., Ltd. ("Roan" or the "Company") (OTC Pink Sheets: RAHGF and RONWF), a comprehensive solution provider for industrial…

Picosun part of extensive quantum technology development project

HELSINKI, Jan. 18, 2022 — Picosun takes part as an industrial partner in QuTI, a recently launched extensive research project aiming to develop new components, manufacturing and testing solutions that…