BEIJING, Nov. 13, 2020 — After 30 years of development and opening-up, Pudong in east China’s Shanghai Municipality has been given two new roles in the country’s overall development in the next three decades.   The area should strive to become a pioneer of reform and opening-up at…

CooTek to Participate in November Investor Conferences

SHANGHAI, Nov. 13, 2020 — CooTek (Cayman) Inc. (NYSE: CTK) ("CooTek" or the "Company"), a fast-growing global mobile internet company, today announced that the Company will present and meet with institutional investors at the following virtual investor conferences. For more information on CooTek presentations, please visit investor relations website https://ir.cootek.com….

Visaic Acquires Video Platform Provider YARE Media

The combined companies will offer a scalable cloud-based content delivery and fan engagement solution SAN DIEGO, Nov. 12, 2020 — Visaic, Inc., a provider of cloud-based content delivery solutions today announced the acquisition of successful Vancouver-based streaming platform company YARE Media. Together the companies will offer a scalable cloud-based content…

TIDAL Adds Millions of Master Quality Tracks, Offering Extensive Catalog of Highest Quality Streaming Audio

MQA Users have Doubled Since 2019 on TIDAL TIDAL HiFi Users Now Stream 40% More Tracks in Master Quality than Last Year NEW YORK, Nov. 12, 2020 — Today, global music and entertainment streaming platform, TIDAL, added millions of tracks in MQA from Warner Music Group to its Masters catalog….

Phoenix New Media to Announce Third Quarter 2020 Financial Results on Tuesday, November 17, 2020

BEIJING, Nov. 11, 2020 — Phoenix New Media Limited ("Phoenix New Media", "ifeng" or the "Company") (NYSE: FENG), a leading new media company in China, today announced that it will report its third quarter 2020 financial results on Tuesday, November 17, 2020 after the market closes. The earnings release will…

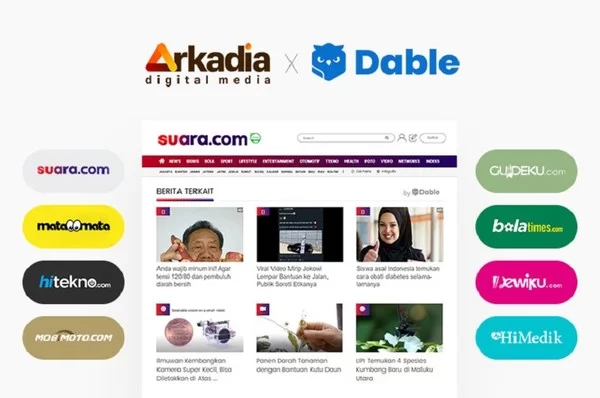

Dable Partners with Arkadia Digital Media to provide Personalized Content Recommendation

JAKARTA, Indonesia, Nov. 11, 2020 — Dable, Asia’s No.1 content discovery platform, has announced a partnership with PT Arkadia Digital Media Tbk.(Arkadia Digital Media), an independent and integrated digital media group on 11th November. Dable Partners with Arkadia Digital Media to provide Personalized Content Recommendation…

Yalla Group Limited Announces Unaudited Third Quarter 2020 Financial Results

DUBAI, UAE, Nov. 10, 2020 — Yalla Group Limited ("Yalla" or the "Company") (NYSE: YALA), the leading voice-centric social networking and entertainment platform in the Middle East and North Africa (MENA), today announced its unaudited financial results for the three months ended September 30, 2020. Third Quarter Ended September 30,…

Morning exercises to Dunhuang Dance: What are the students dancing for?

BEIJING, Nov. 6, 2020 — A news report by China.org.cn on China’s radio calisthenics innovation:   A video of students in school uniforms "dancing" on the playground has recently gone viral. This impressive scene takes place in a middle school in Dunhuang, northwest China’s Gansu province. During their…

iQIYI to Report Third Quarter 2020 Financial Results on November 16, 2020

BEIJING, Nov. 6, 2020 — iQIYI, Inc. (NASDAQ: IQ) ("iQIYI" or the "Company"), an innovative market-leading online entertainment service in China, today announced that it will report its financial results for the third quarter ended September 30, 2020 after the U.S. market closes on November 16, 2020. iQIYI’s management will…

ATIF Holdings Limited Announces Closing of USD$4.0 Million Registered Direct Offering

SHENZHEN, China, Nov. 6, 2020 — ATIF Holdings Limited (Nasdaq: ATIF, the "Company"), a company providing business consulting and multimedia services in Asia, today announced that it has successfully closed the previously announced registered direct offering of 4,347,826 of its ordinary shares at a purchase price of USD$0.92 per share. The…