Products and solutions for multi-scenario applications help expand global business portfolio BANGKOK, Sept. 10, 2022 — On September 7, 2022, the Bangkok Refrigeration, Heating, Ventilation and Air Conditioning (RHVAC)…

Antelope Enterprise Holdings Announces Annual Meeting of Shareholders

JINJIANG, China, Aug. 5, 2022 — Antelope Enterprise Holdings Limited (NASDAQ Capital Market: AEHL) ("Antelope Enterprise" or the "Company"), a leading Chinese manufacturer of ceramic tiles used in residential and…

Vieworks Wins FDA Approval for Its Newest VIVIX-S F series

ANYANG, South Korea, Aug. 5, 2022 — Vieworks, a leading digital X-ray imaging solution provider based in South Korea, noted that its newest VIVIX-S F series has been authorized…

Trajan to acquire leading chromatography consumables and tools business building critical mass in the gas chromatography portfolio

Highlights Trajan to acquire Chromatography Research Supplies, Inc. (CRS), a leading global manufacturer of high-quality analytical consumables Provides Trajan with enhanced…

Rockwell Automation Announces the First Platinum System Integrator Partner, SAGE Automation, to its PartnerNetwork(TM)

Top-level Rockwell Automation Platinum Partnership helps industry address current issues and prevents future ones MELBOURNE, Australia, May 19, 2022 — Rockwell…

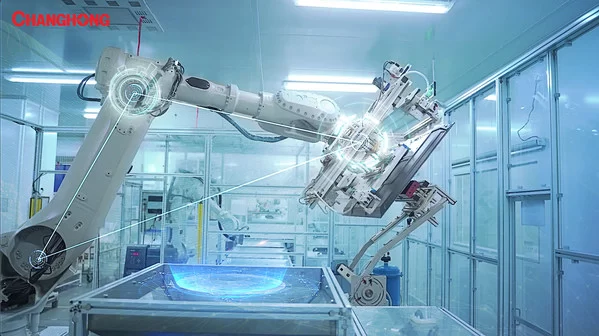

Changhong Ranked Among China’s Top 50 Intelligent Manufacturing Enterprises

Its advanced 5G+Industrial Internet intelligent production line was a key factor in driving the inclusion in the coveted list MIANYANG, China, May 13, 2022 — Changhong, a top…

ACE Green Recycling to build North America’s largest green battery recycling park in Texas

Proprietary emissions-free battery recycling technology to be deployed to recycle both lead-acid and lithium-ion batteries BELLEVUE, Wash., May 10, 2022 — Recycling technology company, ACE Green Recycling (ACE) is announcing its plans…

Roan Holdings Group Co., Ltd. Reports 2021 Financial Year Results

BEIJING and HANGZHOU, China, April 23, 2022 — Roan Holdings Group Co., Ltd. ("Roan" or the "Company") (OTC Pink Sheets: RAHGF and RONWF), a comprehensive solution provider for industrial…

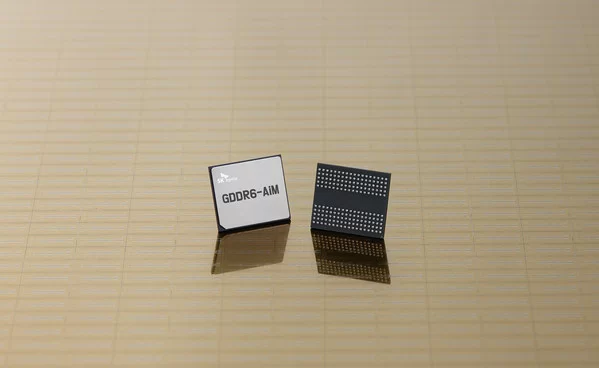

SK hynix Develops PIM, Next-Generation AI Accelerator

SEOUL, South Korea, Feb. 16, 2022 — SK hynix (or "the Company", www.skhynix.com) announced on February 16 that it has developed PIM*, a next-generation memory chip with computing capabilities. …

Picosun part of extensive quantum technology development project

HELSINKI, Jan. 18, 2022 — Picosun takes part as an industrial partner in QuTI, a recently launched extensive research project aiming to develop new components, manufacturing and testing solutions that…