LONDON, June 18, 2020 — FIDE Online Arena, the official chess gaming platform, today redefined online chess with the global launch of the new gaming experience and online ratings. Chess players from around the world are now able to compete for the official online ratings and qualify for official titles….

Crypto.com Completes Key Exchange Infrastructure Upgrades

Delivers 10x performance with the new Matching Engine, paving the way for margin and derivative features rollout HONG KONG, June 18, 2020 — Crypto.com today announced it has rolled out significant infrastructure upgrades to its Exchange, including a revamped Matching Engine, OMS (Order…

Easy&Light introduces an upgraded EasyCanvas Pro app with wireless connect function

SEOUL, South Korea, June 17, 2020 /PRNewswire/ — Devguru (CEO Song Ji-ho), Software Development Company, announced that its brand Easy&Light have launched EasyCanvas Pro.

‘EasyCanvas Pro’ is an app that can use an iPad as a drawing tablet. While previous EasyCanvas could only connect via USB cables, this new upgrade allows wireless connections. It also announced it will add more professional functions in the future to increase productivity.

One can easily connect and use the app by downloading the program at Easy&Light website(http://www.easynlight.com/easycanvaspro/) and then connecting the PC and iPad using a USB cable. Moreover, on the same wireless network, they can be connected wirelessly. The biggest benefit of this app is that one can draw using PC software such as Photoshops or Clip Studio by creating a copy of the PC screen on the iPad.

The app supports palm rejection, pen pressure and tilt, easy shortcuts, and wire/wireless connections at the same time. It can convert between the stylus mode and touch mode automatically, allowing users to use the pen to draw while using touch gestures to zoom in/out or rotate simultaneously.

The menu bar can be hidden, recalled, minimized, or moved at will and the shortcuts speed up the work process. Users can also freely customize the shortcut names, icons, or actions. With the current launching promotion, the annual subscription can be purchased for just $4.99 and 14-day free trial is also provided.

Since its establishment in 2002, Devguru has been providing solutions for numerous companies working with machines using different operating platforms.

For more information, please contact: DEVGURU Co., Ltd., Management Support Team, +82 2-3442-7236, Sang Hoon Song, [email protected]

Photo – https://photos.prnasia.com/prnh/20200611/2827453-1?lang=0

P&G and Shopee drive record sales at first-ever experiential online initiative, Show Me My Home, with more than 15x increase in orders

Show Me My Home is a key initiative under the recently signed Joint Business Plan between P&G and Shopee

KUALA LUMPUR, Malaysia, June 12, 2020 /PRNewswire/ — Shopee, the leading e-commerce platform in Southeast Asia and Taiwan, and Procter & Gamble (NYSE:PG), a leading fast-moving consumer goods company, achieved strong performance for their first-ever experiential online initiative, Show Me My Home. The initiative recorded more than 15x increase in orders at peak day[1], and it is a key activation under the recently signed regional Joint Business Plan (JBP) between Shopee and P&G. The JBP marks a joint commitment between Shopee and P&G to improve the online shopping experience for users across the region, and to provide convenient and easy access to quality FMCG products on Shopee.

![Shankar Viswanathan, Vice-President, P&G Malaysia, Singapore, Vietnam and E-Commerce, P&G Asia Pacific, Middle East & Africa (left), and Chris Feng, CEO, Shopee (right), at the official Joint Business Plan signing [Photo taken before circuit breaker] Shankar Viswanathan, Vice-President, P&G Malaysia, Singapore, Vietnam and E-Commerce, P&G Asia Pacific, Middle East & Africa (left), and Chris Feng, CEO, Shopee (right), at the official Joint Business Plan signing [Photo taken before circuit breaker]](https://techent.tv/wp-content/uploads/2020/06/pg-and-shopee-drive-record-sales-at-first-ever-experiential-online-initiative-show-me-my-home-with-more-than-15x-increase-in-orders.jpg)

Shankar Viswanathan, Vice-President, P&G Malaysia, Singapore, Vietnam and E-Commerce, P&G Asia Pacific, Middle East & Africa (left), and Chris Feng, CEO, Shopee (right), at the official Joint Business Plan signing [Photo taken before circuit breaker]

Chris Feng, CEO at Shopee, said, "As we transit into the new normal, e-commerce has taken on greater importance in people’s lives. Consumers are increasingly going online to fulfil their everyday needs, and it is important for businesses to remain agile and adapt quickly. The success of P&G’s online debut of the Show Me My Home initiative on Shopee is proof of that. By merging P&G’s portfolio of leading FMCG brands and retail expertise with Shopee’s wealth of insights on online shoppers’ behaviour and preferences, it allowed us to deliver a novel, experiential online home shopping experience for consumers across the region. This success has inspired us to continue innovating to provide the best for our users, and we are excited to work closely with P&G going forward."

Shoppers enjoyed greater convenience with Show Me My Home

The Show Me My Home initiative was initially an offline concept which was well-received among both consumers and retailers. With a shared vision to serve the region’s increasingly savvy digital consumers at scale, P&G leveraged Shopee’s technology expertise and insights on online shoppers to optimize and scale the experience online. Through this partnership, P&G and Shopee successfully piloted the online version of Show Me My Home, recording more than 15x increase in orders at peak day. The Show Me My Home initiative offered greater convenience as shoppers could easily find what they needed as the microsite simulated the household environment. This novel way of shopping online successfully captured shoppers’ attention with an overall increase in traffic for P&G.

Fostering meaningful connections with Shopee’s in-app engagement features

As people spend more time online, brands are also increasingly finding new ways to interact and engage with their consumers. As part of the Show Me My Home initiative, P&G leveraged Shopee’s engagement features to foster deeper and meaningful connections with their consumers.

- Shopee Live: P&G tapped on Shopee Live to engage consumers with a special series of live streams featuring popular local celebrities. The biggest stars, including Yuna, Iman Azman and Preston Kaw shared with fans and Shopee users their favourite P&G products, as well as provided tips on how to use them.

- Shopee Throw: Users visited Shopee daily to play Shopee Throw, an in-app game where users can win exclusive P&G vouchers and prizes by throwing arrows onto a target on the Shopee app. The game was played over 600,000 times in 5 days, offering added entertainment and value to consumers while they shopped for their favourite P&G brands.

Show Me My Home marks the first of many initiatives under the recent regional JBP between Shopee and P&G. The JBP aims to better serve and capture the hearts of online shoppers in the region by providing a seamless access to P&G’s wide range of leading brands and products. This agreement will see P&G broadening its multi-brand portfolio offerings on Shopee and tapping on Shopee’s big data analytics capability to provide a personalised customer journey via precise marketing. In addition, P&G will leverage Shopee Brands Suite, a comprehensive set of support tools, such as Shopee Live, to help brand partners better reach and connect with consumers.

"At P&G, we are continually trying new ways to personalize and engage our consumers be it offline or online. The encouraging results we have achieved from this campaign proves the partnership with Shopee to be very successful as we managed to engage more meaningfully with our consumers on digital platforms. We look forward to evolving with the customer as we work closely with Shopee to execute future innovations online, serving more regions and value-adding to digital transactions," adds Shankar Viswanathan, Vice President, E-Commerce, Asia Pacific, Middle East and Africa.

With the success of the Show Me My Home initiative, P&G and Shopee will be bringing it back on 15 June 2020, featuring another round of exclusive deals and promotions from popular P&G brands including Olay, Pantene, and Ambi Pur.

To know more, visit https://shopee.com.my/m/pg-mid-year-sale

|

[1] Compared to average day in 2020 |

Appendix

For a full list of P&G products available on Shopee’s Show Me My Home Campaign, please visit this website.

About Procter & Gamble

P&G serves consumers around the world with one of the strongest portfolios of trusted, quality, leadership brands, including Always®, Ambi Pur®, Ariel®, Bounty®, Charmin®, Crest®, Dawn®, Downy®, Fairy®, Febreze®, Gain®, Gillette®, Head & Shoulders®, Lenor®, Olay®, Oral-B®, Pampers®, Pantene®, SK-II®, Tide®, Vicks®, and Whisper®. The P&G community includes operations in approximately 70 countries worldwide. Please visit http://www.pg.com for the latest news and information about P&G and its brands.

About Shopee

Shopee is the leading e-commerce platform in Southeast Asia and Taiwan. It was launched in 7 markets in 2015 to connect consumers, sellers, and businesses in the region. Shopee offers an easy, secure, and engaging experience that is enjoyed by millions of people daily. It offers a wide product assortment, supported by integrated payments and logistics, as well as popular entertainment features tailored for each market. Shopee is also a key contributor to the region’s digital economy with a firm commitment to helping brands and entrepreneurs succeed in e-commerce.

Shopee is a part of Sea Limited (NYSE:SE), a leading global consumer internet company. In addition to Shopee, Sea’s other core businesses include its digital entertainment arm, Garena, and digital financial services arm, SeaMoney. Sea’s mission is to better the lives of consumers and small businesses with technology.

Photo – https://photos.prnasia.com/prnh/20200610/2826392-1?lang=0

Related Links :

https://pg.com/

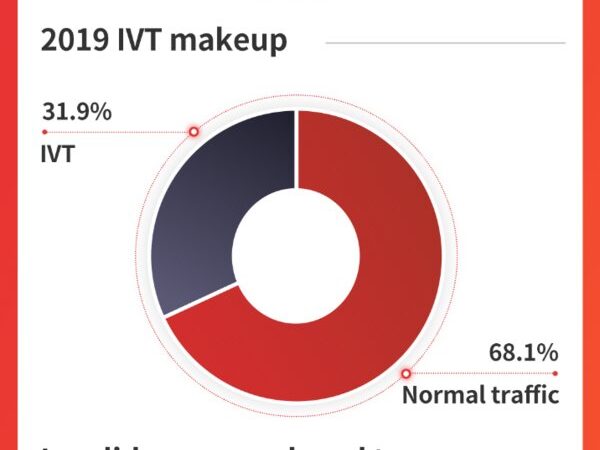

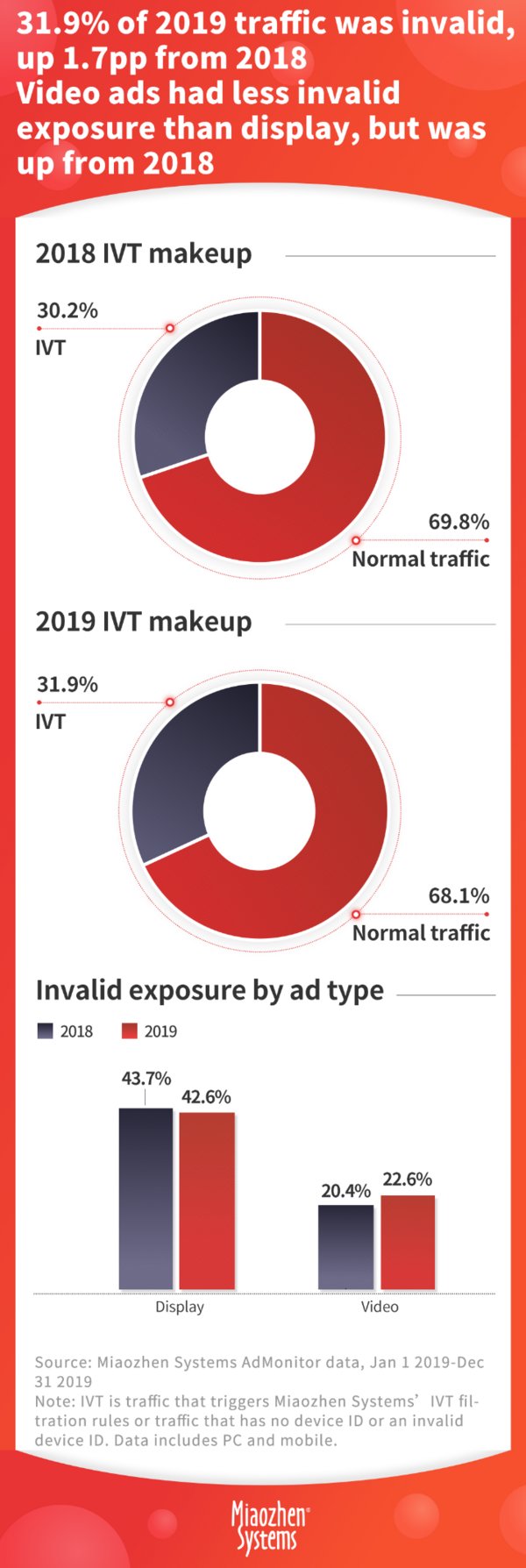

Miaozhen Systems: 31.9% of digital ad traffic was invalid in China 2019, costing the industry 28 billion RMB

BEIJING, June 12, 2020 /PRNewswire/ — A new report by Miaozhen Systems, China’s leading omni measurement and business intelligence analytics solutions provider, has found that 31.9% of all online advertising traffic in China was invalid in 2019, costing the China brand marketing industry an estimated 28 billion RMB.

The report, "China Digital Advertising Invalid Traffic Report in 2019", is the first of its kind to examine invalid traffic in new advertising formats and media. In addition to PC and mobile ads, this report analyzed the state of invalid data in NEW TV ads, offline and outdoor ads, online consumer leads, social media ads, KOL marketing, and more. With data collected from 65,000 campaigns by 2,000 brands across 1,200 platforms, it is the most accurate and comprehensive report on this subject to date.

Key findings for 2019 are summarized below:

- Invalid traffic (IVT) made up 31.9% of all digital advertising traffic in China, up 1.7pp from 2018;

- 39.9% of vertical media traffic was invalid; IT verticals had the highest IVT rate at 49%, up 14pp from 2018;

- Across industries, internet and communications saw the greatest IVT increase (up 6.3pp from 2018) and suffered the highest IVT rate;

- 10% of NEW TV ad traffic was invalid; agencies contributed the most invalid exposure;

- 26% of all online consumer sales leads were invalid, with major implications for auto and other industries that rely on online lead collection;

- 4.2% of outdoor advertising was invalid or not displayed;

- 48% of social media advertising traffic was invalid. On average, 57.5% of KOL fans were invalid, with baby & mom KOLs having the highest rate of invalid fans (65.1%).

Since 2013, Miaozhen has been dedicated to the healthy development of the China digital marketing ecosystem. Besides contributing to national digital marketing industry standards, Miaozhen offers innovative, cutting-edge IVT filtration and influencer evaluation solutions to help make the industry more transparent and trustworthy. Clients who used Miaozhen’s intelligent IVT filtration solution SmartVerify had an average IVT rate of 4.7%, far lower than the 2019 average of 31.9%, and saved an estimated total of 4.5 billion RMB that would have been lost to invalid traffic.

To learn more about Miaozhen Systems, please visit www.miaozhen.com.

Photo – https://photos.prnasia.com/prnh/20200611/2827530-1?lang=0

Related Links :

http://www.miaozhen.com

New Report With 33 Expert Tips on Circular IT Management

STOCKHOLM, June 9, 2020 /PRNewswire/ — The new report from TCO Development, the organization behind the global sustainability certification for IT products TCO Certified, explains how everyone who buys and uses IT products can implement circular and more sustainable practices.

"Circular solutions are already available. We now need to use them," says Clare Hobby, Global Purchaser Engagement Director at TCO Development.

The report, Impacts and Insights: Circular IT Management in Practice, sets out how the circular economy helps solve many of the most pressing sustainability challenges linked to IT products. Today’s linear consumption causes substantial carbon dioxide emissions. Natural resources are being rapidly exhausted and vast amounts of hazardous e-waste piles up, with more than 50 million metric tonnes being discarded every year, of which only 20% is being responsibly taken care of. The circular economy can help us reduce the pressure we’re putting on the planet.

As a pioneer of circular procurement, Aalborg municipality has seen the effects of acting with greater circularity.

"The amount of CO2 we can save by keeping IT products longer surprised me. Using laptops for another three years will save emissions equivalent to heating and powering all municipality buildings for a year," says Birgitte Krebs Schleemann, project manager for sustainability procurement at Aalborg municipality.

The circular transition is a paradigm shift that will require both big and small changes. In the report, experts in the frontline of circularity and IT share 33 concrete tips.

"We want to go beyond theory — this report provides practical help for those who want to take the next step," says Clare Hobby.

Some of the tips:

- Use your IT-products longer — it’s the single most important thing you can do to save natural resources and cut greenhouse gas emissions.

- Work to gradually implement circular practices, such as take-back programs.

- Think circular when you’re purchasing IT products. Use circular criteria.

- Give your IT products a second life by reselling them.

- Acknowledge that circularity is a team effort and no one can do it alone. Both internal and external cooperation is key!

About TCO Certified

TCO Certified is the world-leading sustainability certification for IT products. Our comprehensive criteria are designed to drive social and environmental responsibility throughout the product life cycle. Covering 11 product categories, compliance is independently verified, both pre and post certification.

Contact

Cassandra Julin

+46(0)702866861

[email protected]

Press room

Related Links :

https://tcocertified.com/

Chinese Sports Technology Brand Keep and Fitness Brand Zumba(R) to Hold Strategic Collaboration Conference Online

BEIJING, June 8, 2020 /PRNewswire/ — On May 30, sports technology brand Keep and world’s leading brand Zumba® Fitness held a unique online global press conference, at which the two firms announced the roll out of a program in China that is expected to inject new vitality and energy into the summer of 2020.

At the event, Keep announced the launch of a series of genuine Zumba® courses, a world-leading fitness brand. This marks Keep’s deep commitment to the introduction of copyrighted content, as well as an expansion in the variety of its courses and in the portfolio of licensed fitness content.

Keep invited 5 heavyweight Bilibili video uploaders to participate in the conference as Zumba® experience officers and dance with internationally renowned Zumba® instructors. This interaction continues to support the spread of these types of fitness programs and gain a legitimate foothold in China. The collaboration between the two firms gives China’s young adults an opportunity to know and experience Zumba® and enables further collaboration on and exchanges of sports cultures.

At the sharing session themed "At Keep, exercise what you like" that was part of the press conference, Zhao Xi, general manager of the Keep marketing center, related Keep’s thinking over the last few years in terms of further exploration into the world of sports and fitness. "The original intention of Keep is to enable more people to experience science-based exercise and enjoy a healthy lifestyle anytime and anywhere," said Zhao. Keep is committed to examining more possibilities on breaking down the boundaries that inhibit people from taking that first step towards engaging in a healthy exercise routine and making it possible for every person to find the content that resonates with their expectations.

During the five years since Keep’s founding, the firm has accumulated over 200 million sports-loving users. The platform has introduced a variety of courses that meet the diversified needs of different groups when it comes to sports and exercise, such as the Tai Chi series courses in cooperation with Taiji Zen, ballet courses in partnership with the Russian Hermitage Ballet, and plot run courses in cooperation with Marvel. Keep is not only focusing on the amount of content that it plans to make available, but also on the diversity of the content offerings.

This formal and strategic collaboration with the international fitness brand Zumba® supported the launch of its newest HIIT program, Strong Nation™. A music-led, high-intensity training exercise class that combines bodyweight, muscle conditioning, cardio, and plyometric training moves. Routines are created first and then music is reverse-engineered to match every move perfectly, for a unique workout experience. This new concept, which emphasizes music, is the main motivator, allowing participants to burn more calories while toning abs, legs, arms, and glutes.

Compared with traditional training routines, Zumba® moves beyond the limitations of basic aerobics, turning something that feels repetitive into an exciting and stimulating event. Zumba’s huge number of fans lose weight effortlessly while dancing joyfully. CEO Alberto Perlman claims that, "Zumba now has millions of class participants worldwide." Knowing that nothing compares to a live class experience, Zumba® acknowledges that trying classes at home is often the beginning of the Zumba® journey so that is why working with Keep has been a great collaboration. We (Zumba®) are happy to collaborate with companies around the world that align with this journey, and that’s why we are so excited to be working with Keep."

The collaboration allows Keep’s users to engage in their exercise routine mentored by licensed Zumba® Instructors from Keepland, as well as experience 14 of Zumba’s official programs via the Keep app anytime and anywhere. Keep and Zumba® will continue to work together to keep users engaged in both of their programs: Zumba® and Strong Nation™

With a deep understanding of user expectations, Keep is committed to creating an excellent fitness experience by providing users with increasingly improved fitness solutions enhanced by the brand’s insights into user habits and preferences as well as its competitive content and enhanced products.

Keep will continue implementing its strategy of providing users with outstanding fitness solutions via the app backed by professional and customized content with a focus on meeting user expectations. Keep also plans to explore more lifestyle scenarios for fitness professionals and enthusiasts and build a complete closed-loop sport technology ecosystem, while collaborating with more content partners to improve the health of people around the world by increasing the adoption of its open and professional content.

Photo – https://photos.prnasia.com/prnh/20200608/2823552-1-a?lang=0

Photo – https://photos.prnasia.com/prnh/20200608/2823552-1-b?lang=0

Related Links :

http://keep.com

Real Time Engagement API Provider Agora Announces Filing for IPO under the ticker symbol “API”

|

SANTA CLARA, Calif., June 8, 2020 /PRNewswire/ — Agora, Inc. today announced that it has filed a registration statement on Form F-1 with the Securities and Exchange Commission relating to the proposed initial public offering of its Class A common stock.

Per the F-1 filing, Agora maintains dual headquarters in Shanghai, China and Santa Clara, California, as well as presence in other countries.

The number of shares to be offered and the price range for the proposed offering have not yet been determined. Agora has applied to list its Class A common stock on the Nasdaq Global Select Market under the ticker symbol "API". Morgan Stanley and BofA Securities are acting as the lead bookrunning managers for the proposed offering.

The proposed offering will be made only by means of a prospectus. A copy of the preliminary prospectus is publicly available on the EDGAR website.

A registration statement relating to the proposed sale of these securities has been filed with the Securities and Exchange Commission but has not yet become effective. These securities may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective. This release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Agora

Agora is the leading video, voice and live interactive streaming platform. Our mission is to make real-time engagement ubiquitous, allowing everyone to interact with anyone, anytime and anywhere. Our video, voice and live interactive video SDKs help developers deliver rich in-app experience—including embedded voice and video chat, real-time recording, interactive live streaming, and real-time messaging—for users across gaming, social, education, entertainment, and enterprise apps.

Find out more at www.agora.io.

Media Contact:

Meghan Gardner

[email protected]

971-246-7896

Suzanne Nguyen

[email protected]

408-879-5885

Related Links :

http://www.agora.io

NetEase Announces Pricing of Global Offering

HANGZHOU, China, June 7, 2020 /PRNewswire/ — NetEase, Inc. (NASDAQ: NTES) ("NetEase" or "the Company") today announced the pricing of the Global Offering of 171,480,000 new ordinary shares (the "Offer Shares" or "Shares") which comprises an International Offering and a Hong Kong Public Offering. The final offer price for both the International Offering and the Hong Kong Public Offering (the "Offer Price") has been set at HK$123 per Share. Based on the ratio of 25 ordinary shares per Nasdaq-listed American depositary share ("ADS"), the Offer Price translates to approximately US$397 per ADS. The Company has set the abovementioned offer price by taking into consideration, among other factors, the closing price of the ADSs on June 4, 2020 (the latest trading day before pricing). Subject to approval from The Stock Exchange of Hong Kong Limited (the "SEHK"), the Shares are expected to begin trading on the Main Board of the SEHK on June 11, 2020 under the stock code "9999." The Global Offering is expected to close on the same day, subject to customary closing conditions.

The gross proceeds to the Company from the Global Offering, before deducting underwriting fees and the offering expenses, are expected to be approximately HK$21,092 million. In addition, the Company has granted the international underwriters an over-allotment option, exercisable from June 5, 2020 until 30 days thereafter, to require the Company to issue up to an additional 25,722,000 new Shares at the Offer Price.

The Company plans to use the net proceeds from the Offering for globalization strategies and opportunities, fueling continued pursuit of innovation, and general corporate purposes.

CICC, Credit Suisse and J.P. Morgan (in alphabetical order) are the joint sponsors and joint global coordinators for the proposed Offering.

The International Offering is being made only by means of a prospectus supplement and the accompanying prospectus included in an automatic shelf registration statement on Form F-3 filed with the U.S. Securities and Exchange Commission (the "SEC") on May 29, 2020, which automatically became effective upon filing. The registration statement on Form F-3 and the preliminary prospectus supplement dated June 1, 2010 are available at the SEC website at: http://www.sec.gov. The final prospectus supplement will be filed with the SEC and will be available on the SEC’s website at: http://www.sec.gov. When available, copies of the final prospectus supplement and the accompanying prospectus relating to the offering may also be obtained from China International Capital Corporation Hong Kong Securities Limited, Email: [email protected], Credit Suisse (Hong Kong) Limited, Email: [email protected], or J.P. Morgan Securities (Asia Pacific) Limited, Email: [email protected].

This press release shall not constitute an offer to sell or the solicitation of an offer or an invitation to buy any securities, nor shall there be any offer or sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction. This press release does not constitute a prospectus (including as defined under the laws of Hong Kong) and potential investors should read the prospectus of the Company for detailed information about the Company and the proposed offering, before deciding whether or not to invest in the Company. This press release has not been reviewed or approved by the SEHK or the Securities and Futures Commission of Hong Kong.

The price of the Shares of the Company may be stabilized in accordance with the Securities and Futures (Price Stabilization) Rules. The details of the intended stabilization and how it will be regulated under the Securities and Futures Ordinance (Chapter 571 of the laws of Hong Kong) have been contained in the prospectus of the Company dated June 2, 2020.

About NetEase, Inc.

As a leading internet technology company based in China, NetEase, Inc. (NASDAQ: NTES) is dedicated to providing premium online services centered around innovative and diverse content, community, communication and commerce. NetEase develops and operates some of China’s most popular mobile and PC-client games. In more recent years, NetEase has expanded into international markets including Japan and North America. In addition to its self-developed game content, NetEase partners with other leading game developers, such as Blizzard Entertainment and Mojang AB (a Microsoft subsidiary), to operate globally renowned games in China. NetEase’s other innovative service offerings include the intelligent learning services of its majority-controlled subsidiary, Youdao (NYSE: DAO); music streaming through its leading NetEase Cloud Music business; and its private label e-commerce platform, Yanxuan. For more information, please visit: http://ir.netease.com/.

Safe Harbor Statement

This press release contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "potential," "continue," "ongoing," "targets," "guidance" and similar statements. Statements that are not historical facts, including statements about the offering and listing, the use of proceeds and the Company’s strategies and goals, are or contain forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement. There can be no guarantee that the offering and listing will be completed as planned, or that the expected benefits from the offering and listing will be achieved. You should consider the risk factors included in the registration statement (including any documents incorporated by reference), prospectus and prospectus supplements that have been or will be filed with the SEC and the prospectus registered in Hong Kong. All information provided in this press release is as of the date of this press release and are based on assumptions that the Company believes to be reasonable as of this date, and the Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Contact for Investors:

Margaret Shi

NetEase, Inc.

[email protected]

Tel: (+86) 571-8985-3378

Brandi Piacente

Investor Relations

[email protected]

Tel: (+1) 212-481-2050

Contact for Media:

Li Ruohan

NetEase, Inc.

[email protected]

Tel: (+86) 571-8985-2668

Alby Wan

Hill+Knowlton Strategies Asia

[email protected]

Tel: (+852) 2894-6267

Related Links :

http://ir.netease.com/

Tencent WeSure CEO Alan Lau: COVID-19 spurs insurance demand in China

SHENZHEN, China, June 5, 2020 /PRNewswire/ — The COVID-19 pandemic has unexpectedly raised the sense of urgency in insurance purchase in China, paving the way for industry players to embrace notably ‘half-ready’ users through curated portfolio and user cultivation backed by technology, according to Alan Lau, CEO of Tencent WeSure.

Educating the largely under-insured population, building trust among users, and employing technology for accurate pricing are thus the three thrusts to gain an edge in China’s vast yet less penetrated insurance market, Lau addressed a high-profile webinar on innovative insurance practices in China on Tuesday.

The event held online this year due to the novel coronavirus was organized by The Digital Insurer, a trade group focused on accelerating the digital transformation of insurance. Lau was joined by industry peers from ZA Tech Global, Ping An Cloud Accelerator, as well as consultancy Oliver Wyman via a virtual panel discussion, where panelists elaborated on a wide range of topics from China’s ecosystem-driven insurance landscape to the role of technology.

"People often say that insurance is important but not urgent. But the pandemic did create quite a large group of what I would call ‘half-ready’ users, whose risk appetite or sensitivity to risk have grown but aren’t quite ready to buy," Lau said, citing the doubling of WeSure’s quarter-on-quarter revenue during the height of the outbreak in China.

The outbreak confirms the notion that a major public health event could, to some extent, stimulate demand for insurance. With the lockdown of Wuhan on Jan 23 at the height of the outbreak, demand for insurance saw rapid explosion as newly confirmed COVID-19 cases skyrocketed. With the development of the contagion, the number of total newly-added policy holders, the number of visits to WeSure’s mini program site-a critical indicator gauging prospective insurance needs, as well as annualized health insurance premium have all expanded, meanwhile registering substantial jump compared with same period in 2019.

He referred to a latest research Tencent WeSure conducted in tandem with Shanghai-based Fudan University, which unveiled a string of demographic changes among insurance buyers as a result of the pandemic. For instance, women have become more risk conscious, with the ratio of the number of men and women purchasing insurance on WeSure slashing from 2:1 to 1:1.

The highest jump in user numbers was witnessed among those in their 30s, a population segment perceived to bear the most family responsibilities. Also, by geographical breakdown, residents from the likes of Beijing and Guangdong, who have relatively stronger memories of SARS in 2003, experienced a noticeable pickup in insurance demand.

"So there’s a lot of work for us to do to cultivate and educate these users that have suddenly arrived in very big numbers," he noted, adding it’s by no means an easy feat given the complicatedness of insurance products even for the most educated population.

To make insurance buying less of a headache, Tencent WeSure has landed on two approaches: First is the adoption of a pre-selection pattern, wherein the platform hand-picks insurance products and tailors offerings based on individual needs. This ‘curated portfolio’ helps streamline the decision-making process, as opposed to the more common insurance marketplace model filled with a dazzling array of offerings that could easily deter prospective buyers.

The other more important gameplay is to employ the power of social "Word of Mouth" to both attract and retain customers. This is best exemplified by the fact that one-third of WeSure’s sales are generated from social referral, three times higher than industry average.

Lau said WeSure has always upheld viral marketing as a ‘very core aspect’ of the business, touting its indispensable role in this trust-based industry. "There’s no better connection and social relationship than what already exists…and no better way to sell when you hear it from your friend’s recommendations."

Apart from driving sales, the social aspect also weighs in on the post-purchase end, when making insurance claims could be a lengthy and troublesome process. Using a combination of artificial intelligence and human intervention, WeSure assigns each customer with a virtual ‘claim concierge’ that would follow through the entire process.

Such investment is paying off: Lau said 79% of claims handled via WeSure are processed within one day, whereas loss ratio is 30 to 80 percent lower than industry average.

The company has also embarked on new ways of customer engagement and education, riding on the knowledge-sharing and livestreaming boom for new sources of revenue. For instance, livestreaming has managed to turn clicks into revenue, with some 36,000 policies being snapped up from one online broadcast session on May 20. Lau said WeSure will expand the livestreaming footprint across major Chinese social media sites, imparting knowledge on real estate, fund and insurance through vivid, interactive story-telling.

Bill Song, CEO of ZA Tech Global, echoed Lau’s view, saying the comprehensive internet ecosystem, the technology to scale, and the regulatory leeway offered by the authorities hold key to success in China’s booming insurance market.

According to Leonard Li, a partner at Oliver Wyman, the four major growth drivers in Asia’s insurance market are the large protection gap, technological readiness, favorable ecosystems that provide one-stop shop to lifestyle needs, and thriving fintech investment activities.

Launched in 2017, WeSure currently boasts over 80 million active users. Four in ten customers would choose to repurchase from the company, a remarkable achievement fueled by algorithm and data-backed recommendations that serve to enhance product relevance for users.

About Tencent WeSure

Tencent WeSure Insurance Ltd. is Tencent’s insurance platform. Leveraging Tencent’s strengths of data-driven and social connection, Tencent WeSure works with well-known insurance companies to provide users with high-quality insurance services. Users can make insurance purchases, inquiries and claims directly on the firm’s vastly popular instant messaging and lifestyle platform, Tencent WeChat and QQ. For more information, please visit Tencent WeSure’s LinkedIn page.

For further information, please contact:

Alexandra Li

Email: [email protected]

Tel: +86-755-2909-9966